The crypto world is watching closely as the Celia presale deadline closes on 25 December; early buyers are rushing in before the project enters its next major phase: the Celia token launch on big exchanges in Q1 2026.

Along with this, a major big update is this month with strong community demand and smart-contract upgrades. Let's explore all the details here.

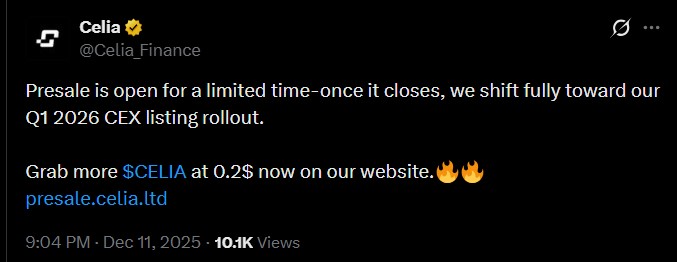

The team officially confirmed on X that the early sale is open for a short time only, and once the deadline hits, the team will shift fully toward their Q1 2026 listing rollout.

The sale went live on 10 December, and the early response is already creating buzz. Check live data:

Presale Price Today: $0.20

Raised: $2,529

Participants: 90

Sold: 12.6K / 500K coins

Total Supply: 800M tokens (decided through a public poll where 72.9% voted in favor)

This early interest shows strong curiosity toward the upcoming token launch and signals how investors react when a new SocialFi project reveals real utility instead of only hype.

To prepare for centralized listing exchanges, the team announced that this week they are completing the last technical steps required for full smart-contract readiness:

Minting the remaining tokens toward the total 800M coins supply

Renouncing ownership for long-term transparency

Fixing all reported security flags and contract issues

These steps matter because they show real development, real audits, and real checks, the things that improve trust in a project before its market debut.

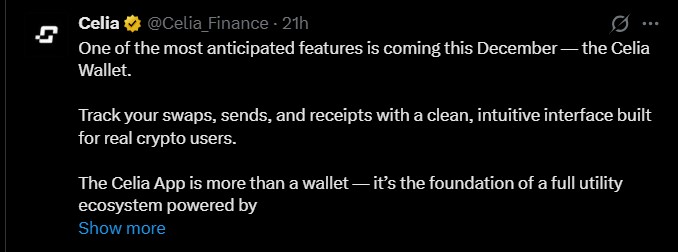

While most early-stage tokens raise funds first and build later, it is taking the opposite route. The team confirmed that a native wallet; embedded inside the App will go live this December.

Features

Safe and simple asset storage

Easy swaps, sends, and receipts

Clean, modern interface

Foundation for a full SocialFi ecosystem

This latest $CELIA coin news strengthens confidence that it is not just another listing, it’s tied to a real product.

The big question in the community has been: When is the finance coin launching on exchanges? As of now, the team has confirmed two exchanges for its 2026 debut:

BigX

MEXC

As per my analysis being a crypto expert, other high-probability exchanges include Binance, Bitget, Bybit, OKX, Bitmart, KCEX, and more. With the Celia Presale Deadline approaching, anticipation for the early debut is rising quickly.

1. Expected Listing Price (Early Q1 2026): Major exchanges typically list new tokens at 20–80% higher than their presale price. With the current price at $0.20, the expected opening range is $0.28 - $0.45

If it sells out before the Celia Presale Deadline, analysts say the token may list closer to $0.50.

2. First 24–72 Hours After Launch: New SocialFi tokens often show rapid movement right after launch, so the expected trading range $0.50 - $1.00.

3. Price Prediction 2026: If it expands its tools, wallet ecosystem, and SocialFi integrations, the 2026 forecast sits around $0.85 - $1.50.

These projections are based on current market trends and the asset’s developing ecosystem. The real value may differ once the token officially launches.

With the Celia Presale Deadline on 25 December, the wallet launching this month, strong development progress, and listing announcements lined up for Q1 2026, the window for presale entry is closing fast.

The project is building real products, not just promises, which is a key reason why interest in the token launch continues to grow worldwide.

Disclaimer: Cryptocurrency markets are highly volatile. This article is for informational purposes only. Always DYOR before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.