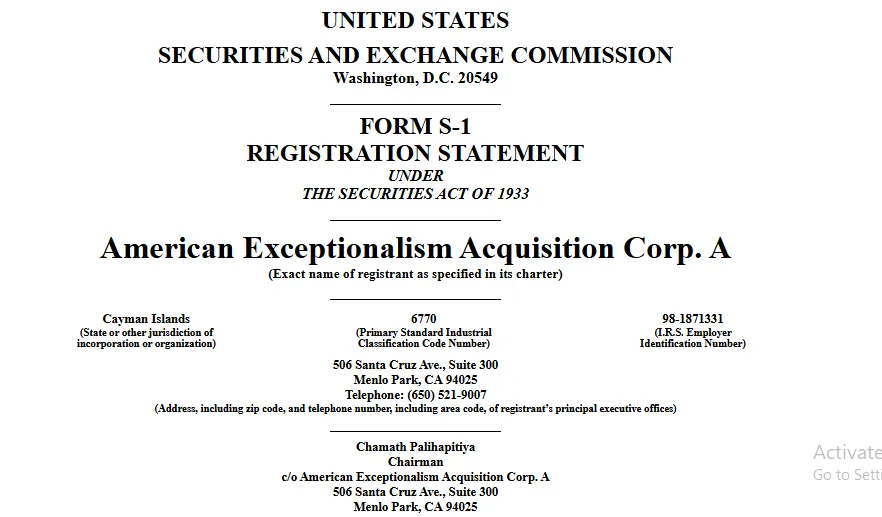

New SPAC Filing: American Exceptionalism Acquisition Corp.

Chamath Palihapitiya, famously known as “SPACs King”, is back in the field. According to a new SEC filing, he is setting up to launch a new SPAC called American Exceptionalism Acquisition Corp., here SPACs are basically a company created to buy another company and its public.

The new Chamath SPAC is aiming to raise $250 million through common share sales ($10 each and 175,000 private placement shares) and listing on the New York Stock Exchange (NYSE). The company is using 24 months time to find a suitable private firm to merge with and take public.

In the filing it is mentioned that Chamath SPAC will focus on industries that support America’s strength and reduce global risks. The key areas include:

Artificial Intelligence (AI)

Decentralized Finance (DeFi)

Warfighting robotics and drones (Defence)

Clean energy innovation, i.e. nuclear and solar power

The plan is to find and support companies that can help the U.S. stay strong and ahead of other countries in upcoming years.

Palihapitiya, a longtime Bitcoin supporter, highlighted DeFi as a key focus. He said the next big step will be combining traditional finance with distributed finance

A clear example he mentioned is Circle’s USD Coin (USDC), which has a market cap of 68 billion and stablecoins, which are now processed in billions of dollars daily, showing how on-chain money is already working alongside banks and card networks. This is why Palihapitiya sees DeFi as moving from experiments into mainstream finance.

The upcoming is the 13th number. He has started 12 SPACs before with his company, Social Capital. Some famous companies that became public through his SPACs are:

Virgin Galactic: A space tourism venture

Opendoor: Real estate technological Startup

Clover Health: Health insurance

SoFi: A fintech platform

The previous initiative structure shows that Chamath SPAC followed every possible field. And as for now it takes big on digital terms.

The filling clearly says this investment is very risky. Palihapitiya said that even though they want to find a great company at a great price, there is still a chance of losing everything.

The things are maybe said in the context of previous scenarios. In the past, SPACs raised billions, but many later lost 70% to 95% of their highest value, which has made investors more careful.

Chamath SPAC comeback comes as tokenisation of stocks is getting more attention. Companies like Kraken and Robinhood are finding ways for regular investors to access private markets using on-chain stock versions.

If the new Chamath SPAC raises $250 million, it will enter a more potentially competitive market than during the 2020-21 boom. Its success will depend on finding a fast growing area in the targeted area.

So, let’s see will this new framework work or going to add in other previous syllabus.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.