China’s central bank continues to build its gold reserves, even as global markets remain volatile. In January 2026, the People’s Bank of China extended its gold-buying streak to 15 consecutive months, adding 40,000 troy ounces to its reserves. This pushed total holdings to 74.19 million ounces, valued at around $369.58 billion.

Source: Bloomberg Official

Notably, the purchase came despite a sharp market correction. Gold prices fell nearly 10% in a single day after surging about 30% earlier in the year, following a wave of speculative buying. Prices have since recovered partially, currently at $4968, though volatility remains.

Chinese central bank’s steady accumulation suggests confidence in gold as a long-term store of value, especially during periods of currency risk and global economic uncertainty.

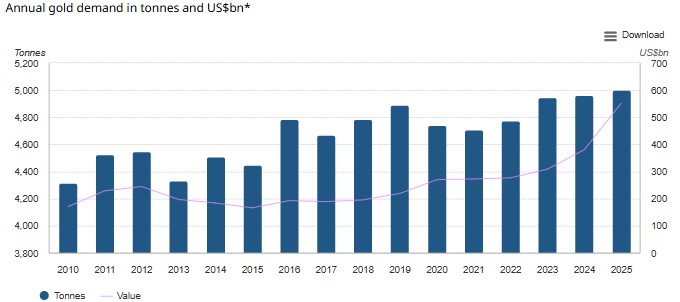

The country's move is part of a broader global trend. According to the World Gold Council, central banks around the globe bought more than 860 tons of gold in 2025. While slightly below the 1,000-ton levels seen in previous years, demand remains historically strong. Over annual demand is also surging with 2025 crossed 5,000 tonnes.

Source: Global Gold-Demand, WGC

Analysts say this sustained buying supports the precious metal’s floor price and reinforces its role as a reserve asset. China’s actions may also encourage other emerging economies to diversify away from US dollar exposure, strengthening gold’s position in global reserves.

Where the country explores precious metals enormously, China’s latest regulatory move restricts many crypto developments. February 6, 2026, the country released a notice clearly:

denied legal status to cryptocurrencies,

classified crypto-related business activities as financial crimes, and

barred foreign cryptocurrency platforms from operating inside China.

Authorities placed specific emphasis on unauthorized yuan-pegged stablecoins issued offshore and offshore tokenization of real-world assets linked to Chinese holdings, citing risks of capital flight and threats to monetary sovereignty.

This action reinforces the nation's long-standing opposition to cryptocurrencies. The 2026 notice follows the historical pattern:

2013: Banks and payment firms barred from Bitcoin services

2017: ICOs banned; domestic crypto exchanges shut down

2021: Nationwide mining ban and all crypto transactions declared illegal

2026: Restrictions reaffirmed, with added focus on offshore stablecoins and RWA tokenization

Authorities cite risks such as money laundering, capital flight, and threats to monetary sovereignty as key reasons behind the crackdown.

However, the measures also align closely with China’s push for its digital yuan (e-CNY) as the only acceptable digital payment system. The central bank digital currency has been piloted in over 20 cities since 2020 and remains a priority over private cryptocurrency alternatives.

The latest update does not criminalize individual holding of crypto, but continues to outlaw trading, mining, and business activity involving digital assets. Offshore platforms remain inaccessible to Chinese users, and businesses engaging in crypto services face stricter enforcement risks.

For market perspectives, Community analysis shows that each major announcement historically triggered short-term market sell-offs, but often coincided with long-term price recoveries.

For now, the crypto market is comparatively performing better, while the recent downturn and bitcoin drop below $65,000, were mainly caused by the broader market crash.

Taken together with China’s ongoing gold accumulation, and restrictions on crypto highlights a clear policy preference: reliance on physical reserves and state-controlled digital money, rather than decentralized assets.

Note: The article above is for informational purposes only. It does not promote any financial claim and advice.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.