If you’ve ever sat around waiting 20 minutes for a bridge to move your USDC, hoping your funds didn't disappear into the "void," today is your lucky day.

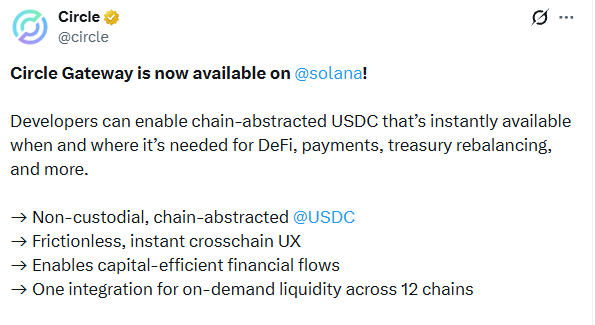

Circle has officially flipped the switch on Circle Gateway Solana. This isn't just another technical update; it’s a total overhaul of how we move money. By bringing "chain abstraction" to the network, The firm is effectively killing off the most annoying part of crypto: manual bridging.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

The market is already voting "yes" on this move. Following the news, Solana’s price staged a sharp recovery to $131, a signal that could launch SOL toward the $150–$185 range.

Think of it as a "Universal Wallet." Usually, if you have USDC on Ethereum, it’s stuck there. To use it on the network, you’d have to bridge it.

With the Circle Gateway Solana launch, you now have a unified USDC balance. You deposit your USDC into a non-custodial contract, and it becomes "chain-abstracted." This means you can spend that USDC on any of the 12 supported chains (like Arbitrum, Base, or Avalanche) instantly. No waiting for confirmations, no third-party bridge risks, and most importantly no more headaches.

The Company has made this entirely non-custodial. You are still the only one who holds the keys. If you want your money back, you sign a "burn intent," and the system mints your asset exactly where you need it. It’s fast, it’s secure, and it’s how crypto was always supposed to work.

The timing of this launch is perfect. Solana is already a beast when it comes to stablecoins, having processed over $1 trillion in USDC transactions last year alone. But the network is evolving.

Alongside the Circle news, Ondo Finance has just expanded its tokenized stock platform on the network. We aren’t just talking about a few niche assets; they’ve activated over 200 tokenized stocks and ETFs. You can now trade real-world equities with the same speed you’d trade a memecoin. According to TokenTerminal, the network is already hosting over $1.5 billion in tokenized assets, proving that big institutions are finally moving their capital onto the chain.

For the traders out there, the charts are looking interesting. After dipping to $124, SOL has bounced back to $131.

If the momentum from the Circle Gateway launch continues, analysts expect a retest of the $150 resistance level. A clean break above that could trigger a run to $185, which lines up with the 50% Fibonacci retracement.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.