Arc layer 1 blockchain launch is making waves in the stablecoin news today, But why? Well, In a major step toward redefining the stablecoin payment system, Circle Launches ARC Blockchain — an open new network developed for enterprises, payment providers and capital markets.

Source: Wu Blockchain X Account

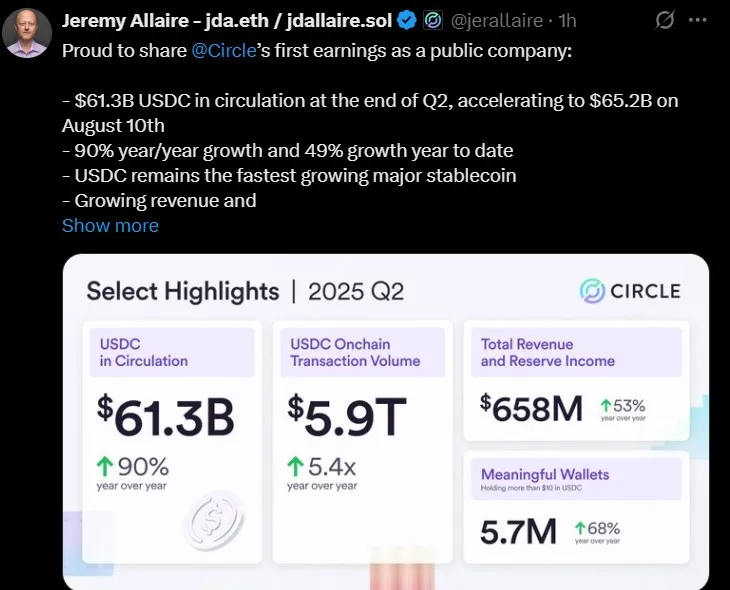

Jeremy Allaire , Co-founder of the company, disclosed the company had delivered good financial performance in Q2 2025, and that chain seeks to integrate fast and efficient settlements, EVM compatibility, and USDC gas token utility, all in one credible platform.

Note: With the Arc blockchain public testnet expected later this fall, it could mark a pivotal moment in the evolution of stablecoin technology.

The platform is EVM-compatible and works with Ethereum dApps so developers can easily plug into the benefit of this chain

Uses USDC as the native gas token for stable, predictable fees.

Turns USDC into part of the pegged-currency payment system, not just a transfer coin.

Enables faster, cheaper transactions for businesses in FX, payments, and settlements.

In my view, being a crypto analyst, this intersection of stability, speed, and enterprise will position the enterprise as a serious player in the stablecoin infrastructure race.

This launch strategy goes beyond payments. Here's why? This ledger is designed to serve as a foundation for enterprise-grade infrastructure in areas like foreign exchange, cross-border commerce, and capital market products.

The chain integrates an advanced stablecoin FX engine, sub-second settlement capabilities, and optional privacy features — all aimed at attracting banks, fintech firms, and institutional players. This latest news is clearly a defining moment in the company’s plan to deliver a full-stack platform for the internet financial system.

This launch could heat up competition in the pegged-crypto asset market. Big names like Tether, PayPal USD, and other Layer-1 blockchain projects are already working hard to win over enterprise users.

Company's strong position in the regulated pegged-digital asset space, along with its partnerships with Binance, FIS, Fiserv, OKX, and Corpay, puts it in a great spot. This could help drive Circle USDC adoption 2025 and push competitors to rethink their plans.

The public testnet for the ledger will be launching some time later this year where developers, institutions, and others will be able to test using the chain in a public manner.

The Circle ARC Blockchain Launch follows a thrilling timeline of major company events including the Circle IPO announcement valued at $1.2 billion and the announcements of the deployment of its payments network.

If the vision for the ledger succeeds, it may be the reference standard for regulated pegged-currency transactions, and this development may radically shape the manner in which stablecoin payment systems work in the realm of the crypto market industry.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.