Can a trusted crypto name be misused to trap users into a dangerous wallet scam? That question shook the crypto space after reports surfaced about a fake Circle swap crypto platform claiming to offer tokenized gold and silver trading.

On Christmas Eve, when many businesses were offline, a press release appeared online announcing a new platform called “CircleMetals.” It claimed users could swap USDC for gold (GLDC) and silver (SILC) tokens at any time. The account was a compelling one, but there was something fishy about it. The truth was not long in coming out.

This press release was advertising USDC/precious metals token swaps around the clock, purportedly in conjunction with COMEX liquidity. It even offered a 1.25% bonus in a token called “CIRM.” The problem was that there was not a single token on prominent data sites by that name.

The website asked visitors to connect their wallets in order to begin the swap process. This is a trick commonly employed by scammers. Once a wallet is connected to an unverified site, malicious code can drain funds within seconds.

However, soon after media scrutiny increased, the website was taken down.

Circle’s Official X confirms that the platform was fake and had no connection to the company. The fraudulent release even misused branding and falsely quoted executives, including CEO Jeremy Allaire.

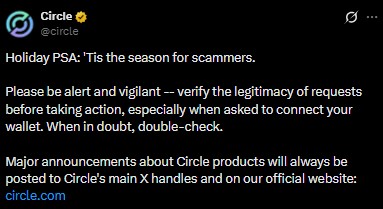

Following the investigation, Circle platform warned users on X to stay alert and double-check all wallet connection requests. The company clarified that major announcements are always shared through official channels only.

Source: Circle Official X

The fake article was initially posted on a community forum and later pushed through cryptoPR wires. A PR agency reportedly submitted the release, but it was removed after compliance checks.

This incident fits a troubling trend. Crypto crime is increasing sharply again. According to industry reports:

• 2022: $3.8 billion stolen

• 2023: $1.7 billion stolen

• 2024: $2.2 billion stolen

• 2025 (mid-July): $2.17 billion already lost

Q1 2025 alone recorded $1.64 billion in losses, the worst quarter ever. Over $28 billion of cryptocurrency has been laundered since 2024, according to estimates, and this is a result of fewer but larger attacks.

Scammers today use trust, timing, and brand – exactly what was seen in the Circle swap crypto scam. Moreover, a lack of regulations and tough policies gives scammers a chance to thrive.

The Circle swap crypto scam is a clear example that even well-known brands will not be safe from scammers. It is essential that all announcements are checked and that only the official sources are trusted. It is a fact that in the current market, the greatest defense is caution.

YMYL Disclaimer: This post is for general informational purposes only and is not intended to be financial advice or to serve as an investment/instrumental securities guide to act upon. Working with digital assets is high-risk so do your own research before investing.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.