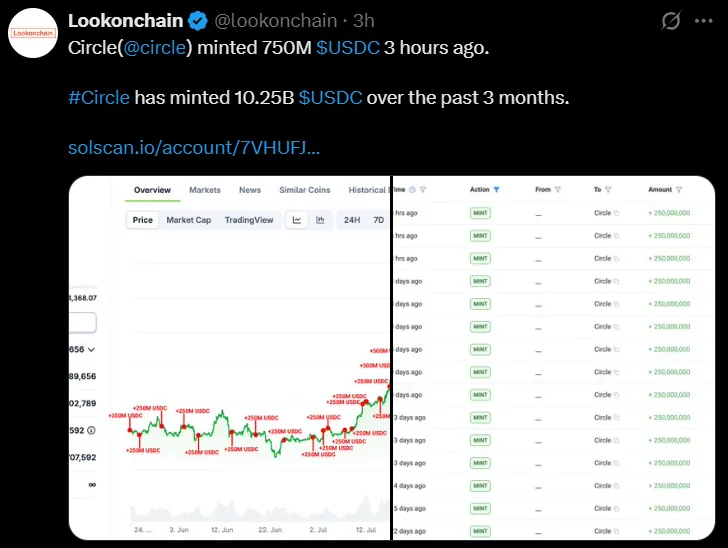

The crypto world got two big updates that surprised everyone. First, the Circle USDC Mint jumped again with $750 million created in just three hours.

But at the same time, the $CRCL Stock Price is falling. Popular analyst Ali says the chart now shows a confirmed bearish breakout that could pull the share all the way down to $100.

How can firm grow so big in crypto while its share keeps dropping? So let’s find the answer to this big question now.

New data from Lookonchain shows fintech firm minted 750M coins, adding it into the system. In just three months, it has minted over 10.25B USDC, proving strong demand in trading, DeFi, and payments.

This surge in stablecoin supply is fueling debates across the crypto industry, because $CRCL stock price doesn’t reflect this growth; does it signal rising demand, or is it a warning before a deeper correction?

According to analyst Ali , Circle Internet Group’s equity has broken out of a Descending Triangle. This pattern often signals a bearish move.

$149 support has broken and is now acting as resistance.

Chart levels show possible downside to $123, $112, and $100.

This makes Ali’s warning clear: even though Circle crypto stock is minting billions, the chart looks weak and could fall much lower.

Now, $149 has become a ceiling for the equity as seen in the TradingView chart. The focus is on $132 support, which is the key level to watch.

If $132 breaks, the equity may fall to the $120–100 range.

If it holds, the price could bounce back toward $145–150.

The chart tools confirm the pressure. RSI is near 38.5, close to oversold, while MACD is still below zero. That means sellers are in control, and the risk of more downside is real.

This situation looks strange: The pegged currency minting is growing fast, but its equity is struggling. Analysts explain it like this:

Governments may bring new regulations on stablecoins.

There are doubts about the stablecoin stock's profits.

Fintech shares overall are facing a tough market.

Even with positive Circle USDC news today, investors are not ready to push the share higher.

The fintech giant is living two different stories. The Circle USDC Mint shows big success in crypto adoption. But the $CRCL Stock Price prediction shows risk of a fall to $100.

If $132 fails, Ali’s bearish breakout call may come true. If it holds, the share might recover a little before the next big move.

For now, this news is a mix of sentiments—something the whole industry is watching closely.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.