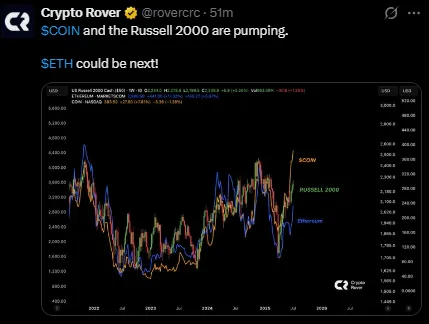

Ethereum Price is gaining strong momentum again, but how does it compare to other assets like Coinbase stock (COIN) and the Russell 2000 Index? According to a new weekly chart shared by Crypto Rover, the altcoin is rising fast—but COIN and Russell 2000 are currently leading in performance.

Source: X

Currently, Coinbase price today is approximately $164.2 following a day-long increase of more than 92%, with an enormous market capitalization of $50.59 billion. The strong rally was triggered by two high-profile news items — Coinbase acquiring the team behind the Opyn Markets and a new partnership with Perplexity, a research platform based on AI. These are viewed as Coinbase doubling down on decentralized derivatives and AI solutions and generating more value in the long term.

Over the past year, COIN stock has surged from approximately the $50–$100 region to more than $380 in recent times, as marked on Crypto Rover's chart on the right Y-axis. COIN Stock is currently trading at $387.06. This shows a massive vertical breakout, and investors are viewing COIN as a gateway to bet on the broader crypto industry’s growth — even more directly than the altcoin.

Meanwhile, the Russell 2000, which tracks 2,000 small-cap U.S. stocks, also closed higher at $2,239.8. It has been on a steady climb from a bottom of around $1,650 back in 2022. The Russell 2000 index now trades in an upward channel and reflects increasing risk appetite among investors.

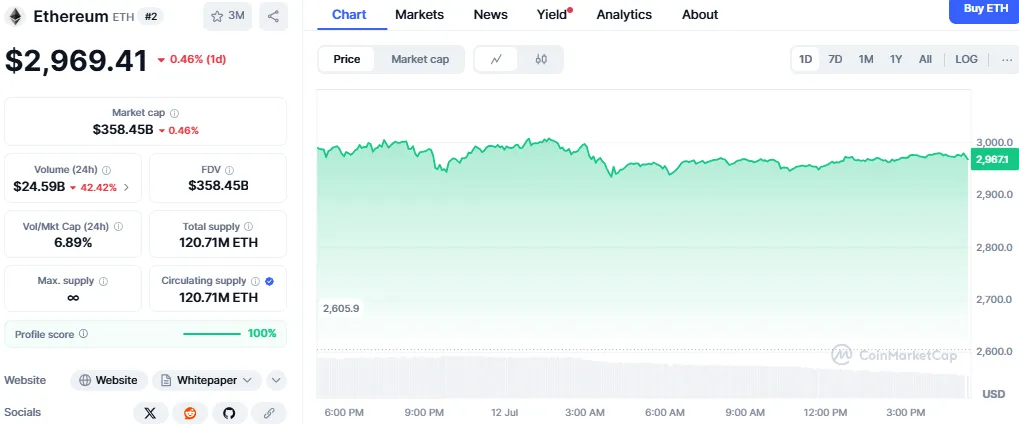

In contrast, ETH is currently trading around $2,966.58, gaining 17.32% this week. Despite this, it is still behind both Coinbase and Russell 2000 in terms of strength.

Source: CoinMarketCap

According to market watchers, the price is rising mainly due to the Bitcoin rally, which hit an all-time high of $118,000 on July 11.

Ethereum price charts depict a massive breakout from months of horizontal action. It was range-bound between $2,200 and $2,700 for months. Now, with heavy volume and strong bullish candles, it has broken above the $2,800 resistance level — an incredibly strong strength indicator.

Analysts indicate it is building an uptrend since April. If it holds over $2,950, then the next goals would be at $3,200 and $3,600. On the other hand, if it fails to hold at over this mark, a drop back to $2,600 or even $2,400 may be seen.

So will its price move higher from here? Momentum is favorable, but it requires a larger impulse to catch up to Coinbase and Russell 2000 Index gains. That impulse might be an ETF approval, increased Layer-2 network usage, or a higher leg in Bitcoin's rally.

Looking forward, there are many traders wondering: when will Ethereum hit 5k?

Based on ongoing chart trends and general market movements, here is a simple price forecast 2025:

Source: TradingView

Short-term: Provided Ethereum remains above $2,950, it can reach $3,200–$3,600 in the next few weeks.

Mid-term: Sustained optimism and ETF inflows can drive it to $4,000 by mid-2025.

Long-term: Provided the broader crypto ecosystem stays healthy, it has the potential to reach $5,000 by Q4 2025 — particularly if macro drivers such as Fed rate cuts and regulatory completeness are benevolent towards crypto.".

That said, if it breaks below $2,400, this outlook would become invalid.

The race between ETH, Coinbase, and the Russell 2000 is heating up. While the altcoin is making a comeback, Coinbase and small-cap stocks are leading the current rally. But the altcoin still has room to run — especially with ETF hopes and Bitcoin support.

Disclaimer: This article is for informational purposes only and not financial advice. Cryptocurrency prices are volatile and can change rapidly. Always do your own research before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.