Highlights:

Coinbase CEO opposes crypto rewards ban despite potential profit increase.

US stablecoin competitiveness could weaken if reward programs become restricted.

White House negotiations continue as banks challenge stablecoin yield incentives.

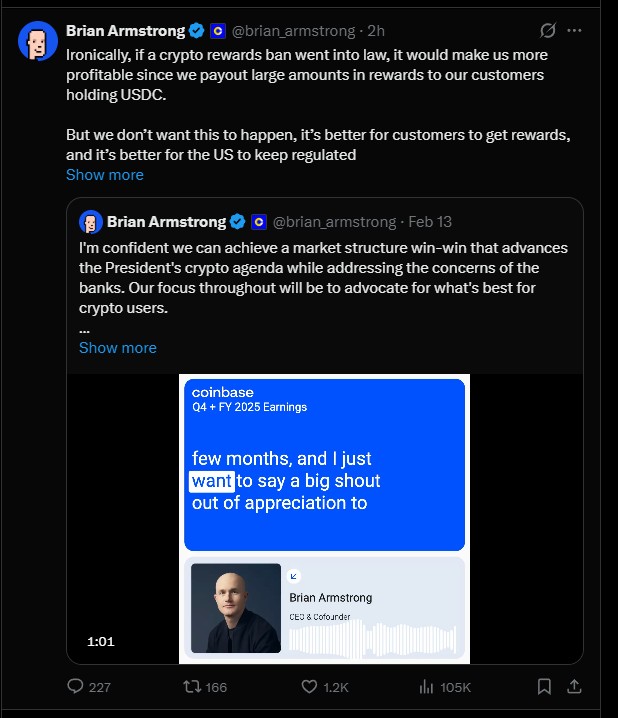

Coinbase CEO Brian Armstrong has stirred debate after revealing an ironic twist in the ongoing U.S. regulatory battle over crypto rewards. In a recent post on X, Armstrong stated that if the proposed “crypto rewards ban” becomes law, Coinbase would actually become more profitable.

Why? Because the company currently pays out significant rewards to users holding USDC. The removal of such payment would cut down on the operational expenses and boost margins. However, Armstrong has come out publicly to oppose the ban, although it has a financial benefit.

Source: Official X

He pointed out that corporate gains are less than the customer benefit. Coinbase rewards users who can hold USDC and provides yield-like rewards, as they would receive interest payments. If lawmakers ban such programs, consumers would lose access to these earnings.

According to him, allowing users to receive rewards strengthens the U.S. position in the global regulated stablecoin market. Limiting such programs, he says, would drive the innovation abroad and undermine the competitiveness of America.

This position represents the wider views of Coinbase in support of moderate regulation of cryptocurrency, as opposed to repressive regulation in favor of the old-fashioned banking system.

The issue is the proposed U.S. Senate bill, which is said to have been affected by the lobby groups of the banking sector. The bill aims to prohibit crypto rewards schemes, such as yield on stablecoins such as USDC, by possibly treating such rewards as securities.

Conventional banks posit that the rewards of stablecoin will pose unfair competition by luring deposits out of the traditional banking system. Cryptocurrency platforms, which provide yield-like returns without acting as banks, undermine the traditional financial systems.

The removal of such payment would cut down on the operational expenses and boost margins. However, Armstrong has come out publicly to oppose the ban, although it has a financial benefit.

Armstrong, however, sees this as regulatory overreach that could stifle innovation while favoring legacy financial institutions.

The discussion is accompanied by the discussion of the proposed CLARITY Act, which is designed to establish more transparent structures in the crypto market. The level of negotiations has also escalated, with banks lobbying to limit the yield on stablecoins.

Armstrong confirmed that Coinbase attended recent White House meetings. He stated that progress is being made toward a “win-win-win” solution between the White House, banks, and the crypto industry.

A key deadline of March 1, 2026, adds urgency to the talks, as policymakers seek consensus on stablecoin regulation and broader market reforms.

Armstrong also cited the GENIUS Act, which was signed in July 2025 to govern payment stablecoins. Despite the legislation enacted six months ago, it is said to be under re-litigation once more as negotiations are being continued.

A reversal or any delay may have a detrimental effect on both the issuers and users of stablecoins. In the case of Coinbase clients, regulatory uncertainty can impact rewards programs, product availability, and market stability in general.

Armstrong stressed that the Coinbase exchange has consistently advocated for market structure reforms—even before crypto regulation became politically mainstream. He reiterated that the company remains “at the table” to defend consumer interests.

The broader concern is international competitiveness. If U.S. regulators limit the rewards of stablecoins, international rivals may gain. As an example, offshore stablecoins such as Tether still operate in less restrictive regulatory settings.

Armstrong believes that it is necessary to have controlled but competitive stablecoin systems for U.S. leadership in digital finance. In his view, empowering consumers with rewards strengthens both adoption and innovation.

The hypocrisy in the suggested ban of crypto rewards is obvious, as the company might make more money by reducing the reward payments. However, Brian Armstrong has decided to speak against the action and put the interests of the customers and long-term competitiveness of the U.S. over the short term profits.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.