Coinbase Deribit acquisition is one of the most daring moves in cryptocurrency history. This largest exchange became the global leader in crypto futures instantly after purchasing Deribit for $2.9 billion. Isn't it fascinating?

But this acquisition is about a lot more than market share—it's a huge step toward redefining the entire trading ecosystem. The latest news assures that the merger will unleash tighter spreads, greater liquidity, and improved execution quality on all markets, creating a new benchmark in the coins margins arena.

This article explores why this merger is significant, what to expect next for traders, and how this might reshape the global market.

The top exchange buying Deribit news is really big—but what does it actually mean for regular crypto traders? Let’s break it down into 5 easy points:

Liquidity Boost: Spot, futures, and options liquidity all combined = thinner books, tighter spreads, smoother execution across the board.

Unified Margin: Cross-margining among spot, margins, and swaps enhances capital efficiency and reduces collateral requirements.

Quicker Execution: The overtaken exchange news spotlights that its extremely low-latency technology, along with the outperformers infrastructure, will provide super-fast and accurate trades.

Increased Products: Traders will witness an expansion of new crypto futures, perpetuals, and exotic options on a single trusted, regulated platform.

Better Compliance: Top platform regulatory heft on the global level will bolster outpaced marketplace security, compliance, and extend its global footprint.

All crypto exchanges have toyed with derivatives, but none have cracked the code completely—until today. According to its official x announcement, acquisition of overtaken marketplace unites its futures and spot powerhouse with its advanced options infrastructure, opening up:

Source: Coinbase

One-Stop Derivatives Destination: Spot, futures, perpetuals, and now deep liquidity options in one place—an upgrade for Coin base expands customers globally.

Capital Efficiency on Steroids: Traders will enjoy quicker onboarding, frictionless fiat ramps, and level-up margin optimization.

A Gateway to Institutions: This transaction forms the perfect platform for hedge funds, banks, and asset managers that have been awaiting a fully regulated, trusted gateway into asset swaps.

Important Facts You Should Know

Price of Acquisition: $2.9 billion

Structure: Cash consideration of $700 million + 11 million Class A shares

What is Acquired: Deribit's whole token options business—processing ~$30B worth of open interest and more than $1 trillion of trading volume yearly.

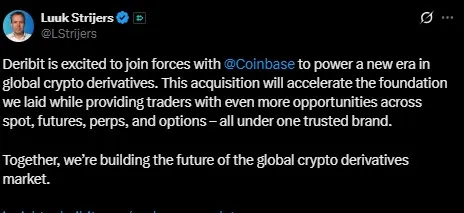

“We’re excited to join forces with Coinbase to power a new era in global token derivatives,” said Deribit CEO Luuk Strijers, emphasizing the vision behind this strategic union.

Source: X

The top platform, sharing the excitement on X, stated: “This makes Coinbase exchange the #1 global platform for crypto derivatives by open interest and options volume.”

Look for closer spreads, broader order books, and new products internationally launching quickly. If Coinbase acquisition gets its acts together, it is not hard to imagine the asset derivatives taking off as rapidly as equity futures and options have.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.