Highlights:

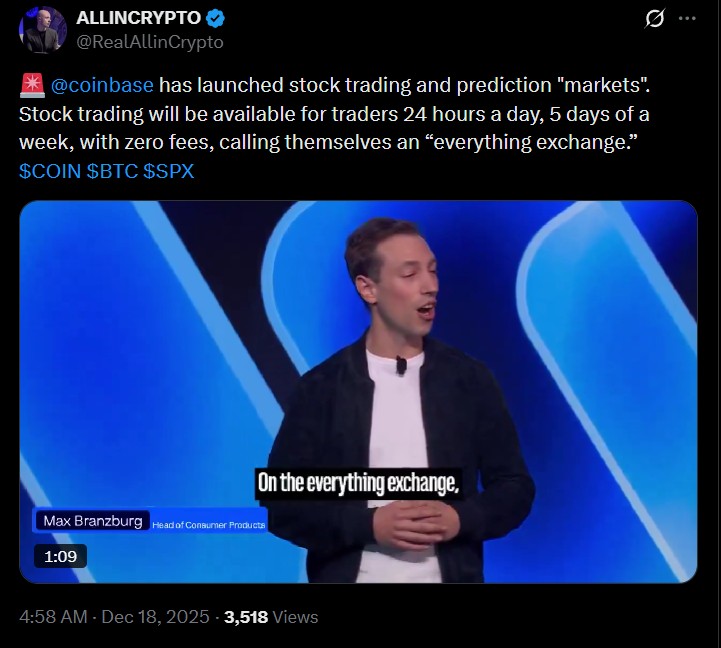

Coinbase launched zero-fee stock trading in the U.S.

In-app prediction markets were added to the exchange through a collaboration with Kalshi.

The relocation makes a one-stop shop for an exchange.

Coinbase Latest Update: On December 17, 2025, in its System Update, the company declared the introduction of stock trading and prediction markets as well as new on-chain tools, marking a strategic move to integrate traditional finance and crypto on the same platform.

Source: Coinbase Official X

Source: Coinbase Official X

The platform announced that soon, U.S. users will be able to use zero-fee stock trading, 24/7, five days a week. It is the first direct entry into the retail equity trading arena by the company.

In addition to stocks, it is also launching prediction markets in an authorized collaboration with Kalshi.

The users will be able to trade on elections, sports, and macroeconomic outcomes directly on the Coinbase app.

CEO Brian Armstrong positioned the update as a larger vision to make the destination to trade everything, which is crypto, equities, futures, perpetuals, and outcome-based markets, all on a single interface.

Source: Official X

Source: Official X

In 2025, prediction markets experienced a surge in growth, and the amount of money traded is said to be over $10 billion. These are nowadays not only considered as a speculative instrument, but also as a gauge of what people think in real time.

The exchange believes that the majority of users are in prediction markets to know what will come next and not necessarily to make money.

This intuitive need is in line with the objective of the platform of enhancing user interaction beyond the traditional forms of buy-and-hold investment.

In the case of markets, it means that the sentiment-based trading approach can be integrated with equities and crypto-assets to allow users to engage with a variety of assets in one application.

Source: X

Source: X

Kalshi collaboration enables Coinbase to provide regulated event contracts, which is unlike crypto-native competitors such as Polymarket. Simultaneously, the platform is implementing a tokenization roadmap that would eventually see traditional assets, such as equities, go on-chain.

The company is also launching APIs to businesses and developers in the areas of custody, payments, trading, and stablecoins, further supporting its position as financial infrastructure, not merely an exchange.

This plan puts Coinbase in a head-on collision with Robinhood, DraftKings-affiliated exchanges, and CME-supported programs that are moving into the prediction market.

Although there is a lot of excitement regarding the announcement, one of the major challenges is regulatory scrutiny, especially for prediction markets and event-based contracts in the U.S.

Should it succeed, the unified model can capture non-crypto users in the traditional financial sector by using its base of more than 100 million verified accounts. Nevertheless, it might be challenged by a rise in competition and the complexity of features in the coming months.

The update in December 2025 is a turning point in the development of this company. The company is a crypto, stock, and prediction market combination, making it a legitimate everything exchange, crossing the boundary between traditional finance and digital assets.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highlyvolatilee and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.