In the recent GENIUS Act news which was signed into last month has formally legalized approved stablecoins in the U.S but with strict conditions.

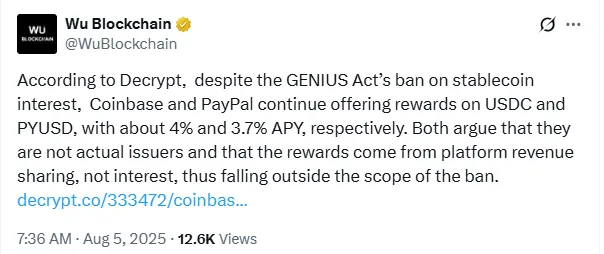

Wu Blockchain has recently shared the information on its X handle which highlights that the crypto law could ban offering interest on stablecoins but the platforms are still giving rewards of around 4% on USDC and 3.7% on PYUSD. They claim that they are not the actual issuers of these stablecoins. Instead the rewards come from platform revenue sharing, so they believe that the ban doesn’t apply to them.

Source: X

Although, experts argued that offering interest bearing features could blur the line between stablecoin and regulated securities that will lead to potential risks and the broader financial systems.

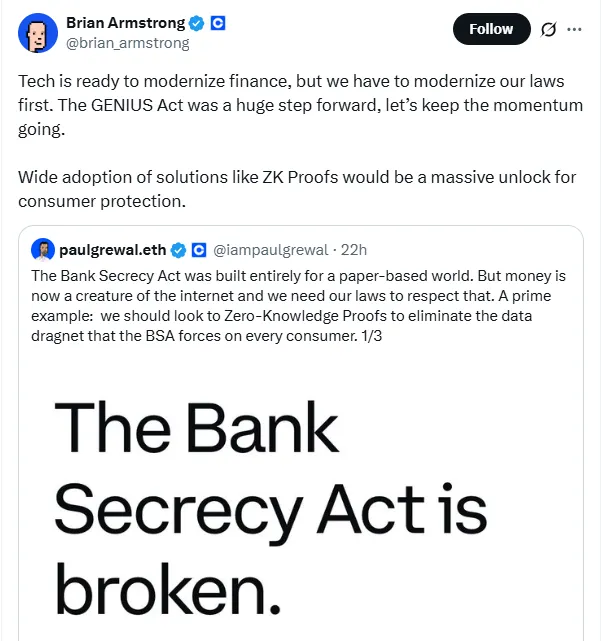

Despite the new restrictions firm has made it clear that its reward program will continue. CEO of Company, Brian Armstrong emphasized that the firm is not an issuer of USDC. Hence the GENIUS Act news will not apply to them directly.

Source: X.

He highlighted that Coinbase does not provide interest but it provides rewards which allow them to legally offer up to 4% to 5% annual yield on USDC deposits. This strategic differentiation has become a major factor in attracting investors to their platform.

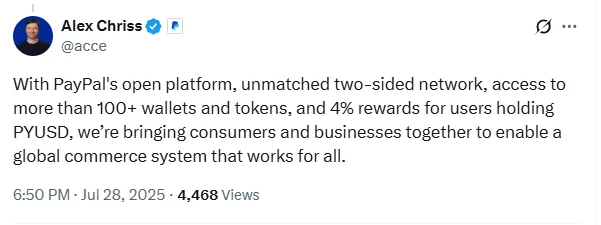

It has also pushed forward with its reward program by offering 3.7%-5% annual returns on PYUSD holdings. Even though PYUSD carries its name that is technically issued by Paxos and not PayPal itself. According to the source, this distinction allows the platform to continue rewarding users bypassing the GENIUS Act news restrictions. The feature is a core strategy to power users' loyalty and draw more customers to ecosystem.

Source: X

The GENIUS Act news was narrowly designed to regulate only stablecoin issuers and leaving platforms that distribute or provide custodial services largely unaffected.

The aim was to prevent issuers from offering deposits like products without full banking regulation while avoiding unnecessary interference in the secondary markets.

The GENIUS Act may have limited stablecoin issuers from paying yields, but platforms like Coinbase and PayPal have found a legal pathway to continue rewarding their customers.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.