SB Seker, head of APAC at Binance, emphasized that regulatory clarity is essential for a broader institutional crypto adoption in India. In an interview with YourStory, he noted that delays in policy are pushing users toward offshore and decentralised platforms.

“Once users move offshore, bringing them back to regulated platforms will be harder,” Seker said.

He explained that proper rules could attract Web3 talent back to India, encourage innovation, and rebuild trust after recent exchange hacks like WazirX and CoinDCX. Seker also highlighted that the nation already has a large pool of Web3 developers, but many work overseas due to lack of clarity. With clear regulations, these talents could return, boosting domestic innovation and market growth.

Interview Highlights: Binance APAC Head’s View

Clear rules are essential for crypto adoption in India; delays push users offshore.

Regulations could attract Web3 talent back and boost innovation.

Defining exchange roles and products would increase institutional participation.

Security and trust measures are vital to protect users.

The country could become a global crypto leader with timely, clear policies.

Seker put pressure on the importance of defining roles for exchanges, brokers, and products. Institutions, he said, will be more willing to invest once rules ensure compliance and consumer protection.

India is one of the top countries whose natives are heavily exploring digital assets. It has ranked first in global digital assets adoption by Chainalysis, three consecutive years, showing a strong growth trend despite regulatory uncertainty.

In the recent data, crypto adoption in India is now expanding beyond metro cities. Tier-2 cities now account for 32.2% of users, while Tier-3 and Tier-4 cities contribute 43.4%. Uttar Pradesh leads in investment with 13%, followed by Maharashtra at 12.1%, according to CoinSwitch’s 2025 report.

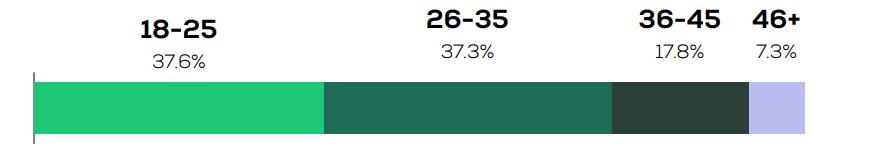

The market remains largely youth-driven, with the 26–35 age group contributing 45% of investments and the 18–25 cohort contributing 25.3%. Adoption is now gradually spreading to older age groups as well.

This young and wide population’s interest in digital assets is attracting the attention of global crypto-dealing giants. Coinbase, Binance, Bybit, OpenAI and many more are entering the Indian markets despite the unclear rules and strict restrictions.

Millions of Indians are using digital assets, yet businesses remain cautious, mainly by unclear regulations. Seker pointed to the UAE as an example. Five years ago, the crypto market there was nascent. Today, with clear licenses and financial integration, it now has over 1,300 licensed companies and a projected $30 billion revenue by 2030.

Other major players like the U.S. with GENIUS Act, Clarity Act, SAFE Act (under discussion), European Union with MiCA paving the way for better management and exploration.

This shows how proactive regulation can create a safe, thriving crypto market and attract both local and global participants.

With its large population, strong tech talent, and growing adoption in Tier-2 and Tier-3 cities, India has the potential to replicate such success. Regulatory clarity could provide INR on-ramps, define product rules, and ensure investor protection.

Policies could include stablecoins or CBDCs to facilitate legal trading while maintaining banking liquidity. Seker also stressed that building trust through robust security practices, audits, and compensation funds for users is crucial to encourage wider participation.

If India sets clear rules soon, adoption could rise sharply across all regions and age groups. Web3 companies could anchor themselves domestically, and institutions might increase their digital-asset portfolios. Clear policies could also help India maintain its top position in global global digital asset investment while ensuring safe, regulated growth.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.