Highlights of the News: India Crypto TDS Collection

India collected ₹1,096 crore in TDS between FY23 and FY25, with a sharp jump in FY25

Maharashtra alone contributed nearly 60% of the total, showing highly concentrated trading activity.

Government investigations uncovered ₹1,000+ crore in undisclosed crypto income, signalling tighter oversight ahead.

Indian cryptocurrency market continues to grow despite strict taxation and regulatory scrutiny. According to data shared by the Ministry of Finance in the Lok Sabha, the government collected nearly ₹1,100 cr. as Tax Deducted at Source (TDS) from cryptocurremcy transactions over the last 3 financial years.

This data highlights strong participation in trading and rising compliance under Indian cryptocurrency regulation, even after the introduction of high taxes in 2022.

Source: WiseAdvise official X

Tax Deducted at Source is a system where tax is deducted at the time a transaction happens, instead of at the end of the year. This helps the government track trading activity in real time.

The Ministry of Finance confirmed that cryptocurrency exchanges deducted ₹1,096 crore as TDS between FY 2022–23 and FY 2024–25.

This collection comes under Section 194S of the Finance Act, 2022, which mandates a 1% TDS on all Virtual Digital Asset (VDA) transactions. VDAs include cryptocurrencies like Bitcoin, Ethereum, and other digital tokens.

The rule applies to all platforms, whether Indian or foreign exchanges serving Indian users, strengthening India's tax monitoring.

Primary source: Lok Sabha reply by the Ministry of Finance (available on the official Lok Sabha website)

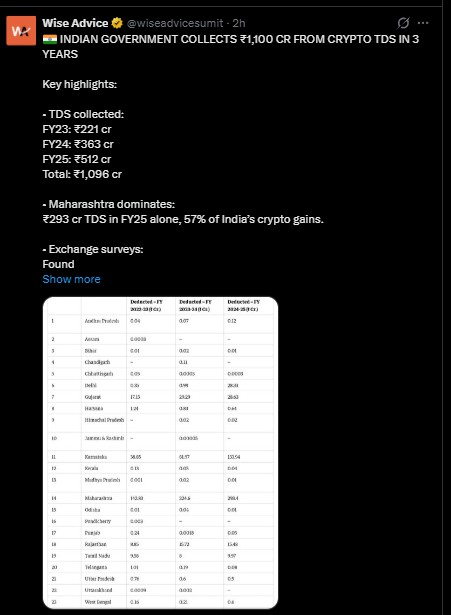

Data presented in Parliament by Pankaj Chaudhary, Minister of State for Finance, shows steady year-on-year growth in TDS collections (₹ crore):

Financial Year 2022–23: ₹221.27

FY 2023–24: ₹362.70

FY 2024–25: ₹511.83

The jump from ₹363 cr. to nearly ₹512 cr. represents a 41% year-on-year increase, suggesting that trading activity in India remains strong despite high taxation and compliance requirements.

This trend reinforces the expanding scope of virtual digital asset taxation in India.

One key finding from the government data is the dominant contribution of Maharashtra, which accounts for nearly 60% of India’s total crypto TDS collections.

TDS collected in Maharashtra (₹ crore):

Financial year 2023: ₹142.83

Year 2024: ₹224.60

Year 2025: ₹293.40

Over three years, this adds up to around ₹661 cr., with Maharashtra alone contributing 57% of national collections in FY25.

This concentration reflects higher crypto adoption in financial hubs such as Mumbai and Pune, where access to digital infrastructure, exchanges, and investment awareness is stronger.

Alongside rising tax collections, the government has also flagged serious compliance gaps in the cryptocurrency sector. Investigations and surveys by tax authorities revealed:

₹39.8 crore in crypto TDS non-compliance

₹125.79 crore in undisclosed income from exchanges and intermediaries

₹888.82 crore in unreported crypto-related earnings

In total, authorities detected over ₹1,000 crore in undisclosed income linked to VDA transactions. Investigations are ongoing against three major crypto exchanges and multiple other entities suspected of tax evasion.

These actions underline the government’s stricter stance on Section 194S Enforcement.

To improve transparency and curb illegal activity, the government has mandated that all Virtual Asset Service Providers (VASPs) must register with FIU-IND.

FIU-IND (Financial Intelligence Unit – India) is the country’s anti-money laundering authority. Registration helps track suspicious transactions, improve AML compliance, and protect investors.

The rule applies to both Indian and foreign cryptocurrency platforms operating in India, further strengthening oversight under Indian cryptocurrency regulation.

Primary source: FIU-IND notification on mandatory registration for VASPs

Rising collections and large-scale detection of undisclosed income show that:

Still actively growing despite high taxes

Becoming more transparent due to tighter compliance

Moving toward stronger regulatory enforcement rather than an outright ban

While taxation remains a concern for traders, the data suggests that cryptocurrency adoption continues to expand under a closely monitored framework.

India’s crypto TDS collections crossing ₹1,096 crore highlight a fast-growing yet tightly regulated digital asset market. With stronger enforcement of virtual digital asset taxation, mandatory FIU-IND registration, and deeper investigations into non-compliance, the government is clearly focused on improving oversight rather than restricting participation.

As regulations evolve, participants should stay updated and compliant with India's taxation rules.

This article is for informational purposes only. It does not constitute financial, tax, or legal advice. Cryptocurrency tax laws and regulations in India can change. Readers are strongly advised to consult a qualified tax professional or legal advisor before making any decisions related to investments or filings.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.