The crypto scene took a tumble today going down 1.51% in just a day. Right now, the whole market is worth $3.32 trillion. We're going to dive into the top 5 big changes that caused this drop and how they're shaking up coins like Bitcoin, XRP, and others.

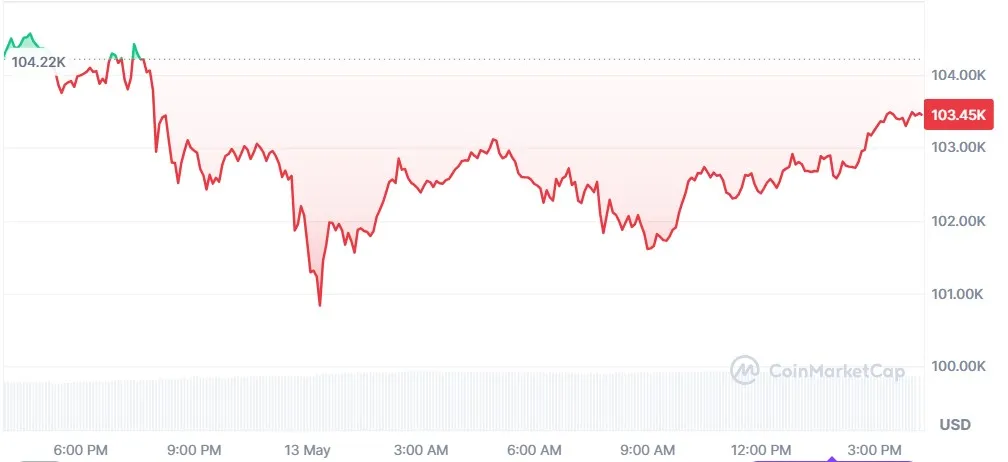

Bitcoin price crossed $105K after the US-China tariff deal, but soon dropped to $100.7K, losing all gains. It then recovered slightly to $103.45K, showing buyers are still active, according to coinmarketcap. This drop came as investors turn cautious before the US inflation (CPI) report today.

Source: CoinMarketCap

Even Ethereum and Solana prices dropped. However, XRP stayed strong, rising to the 3rd spot thanks to more users and Missouri’s new cryptocurrency law proposal. The whole market is waiting to see what happens next.

Coinbase is now the first company to join the S&P 500 index. This big move was announced after Capital One decided to buy Discover Financial, which Coinbase will now replace.

Source: Coinbase

The news made COIN stock go up by 8%, now trading near $224. It’s still down this year but rising fast. Coinbase also plans to buy Deribit for $2.9 billion. Experts say this could help Coinbase grow into a trillion-dollar company someday.

While most cryptocurrencies are going down, XRP is rising fast. Its price jumped to $2.48, gaining over 18% in a week. This happened because Ripple finally settled its long legal fight with the U.S. SEC, agreeing to pay a $50 million fine.

Experts think the court will soon remove restrictions on Ripple. Also, Robinhood might buy Bitstamp and launch a exchange using Ripple’s tech, which could make XRP even more useful in global trading.

The SEC is now changing how it deals with this industry. New Chairman Paul Atkins, chosen by Donald Trump, wants to stop sudden crackdowns and instead make simple rules for crypto companies.

At a recent meeting, he said it’s a “new day” for this marketplace. Unlike the last chairman, Atkins wants to help the crypto industry grow. He also plans to update rules so companies can hold and trade crypto legally and safely. This means big changes ahead for crypto in the U.S.

Uzbekistan has started testing a new digital currency called HUMO. It’s backed by the Uzbekistani sum and government bonds, which means it’s stable and not for risky trading.

One HUMO equals 1,000 UZS. The goal is to make payments cheaper and more transparent. It’s connected to the HUMO payment system, already used by 35 million people. This project shows how the country wants to use blockchain to make its economy smarter and more digital.

Conclusion

Today’s crypto crash was triggered by a mix of global events, legal updates, and investor caution. While Bitcoin and Ethereum dipped, XRP showed strength.

Big moves from Coinbase and new laws may shape what’s next. As the CPI data nears, the market waits to see which direction things head. Investors should stay alert, watch key trends, and wait for signs of recovery before making any major buying or selling decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.