The global crypto market news is buzzing as the total market cap has surged to $2.79 trillion, reflecting a 4.41% increase in a day. Despite a 28.65% decrease in total market volume, Bitcoin dominance has risen to 60.17%, reinforcing its market strength. Several key factors, including the White House Crypto Summit, Warren Buffett’s market sentiment, and Spot Bitcoin ETFs, are driving this bullish trend.

A major catalyst behind why is crypto market going up is the upcoming White House Crypto Summit on March 7, hosted by Donald Trump. This event will bring together top crypto leaders, institutional investors, and government officials to discuss key issues such as crypto regulations, blockchain innovation, and institutional adoption. Industry figures from Coinbase, Binance.US, and Andreessen Horowitz are expected to attend.

The summit could be a significant milestone in shaping the U.S. crypto policy, as inconsistent regulations have long hindered market growth. If the discussions lead to clearer regulatory frameworks, it could provide a boost in confidence for investors and institutions. This development is a major reason why the market is up today and why investors remain optimistic about long-term growth.

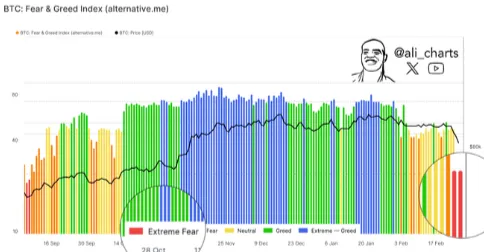

A key psychological factor influencing market trends is the Fear and Greed Index Crypto, which measures investor sentiment. Historically, Warren Buffett’s principle—“Be greedy when others are fearful”—has proven effective in predicting market movements.

Source: X

October 28: The index was in Extreme Fear (<25)

Mid-November to late January: The index showed Extreme Greed (>75)

Mid-February: A shift back to Extreme Fear was observed

At present, the index is at 20 (Extreme Fear), signaling a potential buying opportunity. This aligns with market patterns where investors accumulate assets at low prices before the next rally. Such behavioral trends are a major factor in why the crypto market is going up.

Institutional investments through Spot Bitcoin ETFs have significantly contributed to the market surge. Recent data shows:

Daily Net Inflow: $94.34 million

Cumulative Net Inflow: $36.94 billion

Total Value Traded: $3.91 billion

Total Net Assets: $95.38 billion (5.71% of Bitcoin Market Cap)

These figures demonstrate the growing institutional confidence in Bitcoin, further explaining why the market is up today and why the crypto space is attracting long-term investors.

As of now, Bitcoin price today is $84,537.34, experiencing an intraday surge of 5.07%, with a market cap of $1.67 trillion and $54.31 billion in trading volume. Ethereum, on the other hand, is trading at $2,182.14, with a 2.43% increase.

A major positive sign for the market is Ukraine’s plan to legalize crypto in 2025 and its ongoing efforts to implement a crypto taxation policy. Additionally, the SEC case against Richard Heart was dismissed, citing insufficient ties to the U.S. The Richard Heart SEC update suggests that global crypto regulations may become more structured, reducing legal uncertainties.

However, the key question remains: Will crypto crash again? While short-term corrections are expected, the ongoing institutional adoption, regulatory clarity, and macroeconomic factors suggest that a major crash is unlikely in the near future.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

3 months ago

Crypto news for beginners

3 months ago

Stablecoin news

3 months ago

New cryptocurrency releases

3 months ago

Cardano news

3 months ago

Crypto news today

3 months ago

Cryptocurrency industry insights

3 months ago

Blockchain technology news

3 months ago

News on digital wallets

3 months ago

Crypto market trends

3 months ago

Cryptocurrency regulation updates