The total crypto market capitalization is currently at 3.94 trillion, up by 1.8% over the past 24 hours. The total trading volume was over $153 billion, with Bitcoin dominance being 56.3% and Ethereum at 14%. The cryptocurrencies tracked till now are 18425.

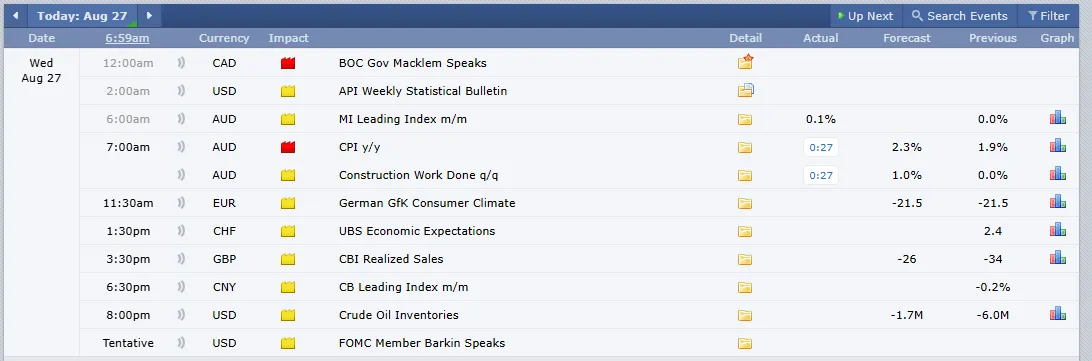

Source: Forex Factory

Bitcoin is priced at $111,186, down by 1.4% over the past day, with a market cap of $2.21 trillion and a massive $38.79 billion in trading volume. Bitcoin is currently dominating at 56.3%.

Top Trending coins: Notcoin (NOT) leads trending coins at $0.001825, up 2.9%, with a $23M trading volume. Cronos(CRO) rose 31.4% to $0.2038 with $726M TV, while Numeraire (NMR) gained 144.9% to $19.53, trading at 370M.

Top Gainers: Numeraire (NMR) soared 137.4% to $19.37 with $341M trading volume, topping today’s gainers. DIMO (DIMO) gained 67.3% to $0.1128 with $20M TV, while BNB Attestation Service (BAS) jumped 65.8% to $0.01756 with $53 million TV.

Top Losers: Wiki Cat (WKc) saw the steepest drop, losing 21.3% to $0.8266 on a huge volume of $1.6M. Access Protocol (ACS) slipped 16.8% to $0.001145 at TV $37.5M, while Donkey (DONKEY) declined 14.8%, trading at $0.04686 with $14.7M volume.

The stablecoin market cap is 283 billion, slightly changed by 0.4% positively. With a 24-hour trading volume of $112.8 billion, it provides liquidity and security in times of volatility.

The current Defi market cap is at 169 billion, up by 4.1% over the past 24 hours. Daily trading volume is at about $9.29 billion, with DeFi contributing 4.3% of the total market activity.

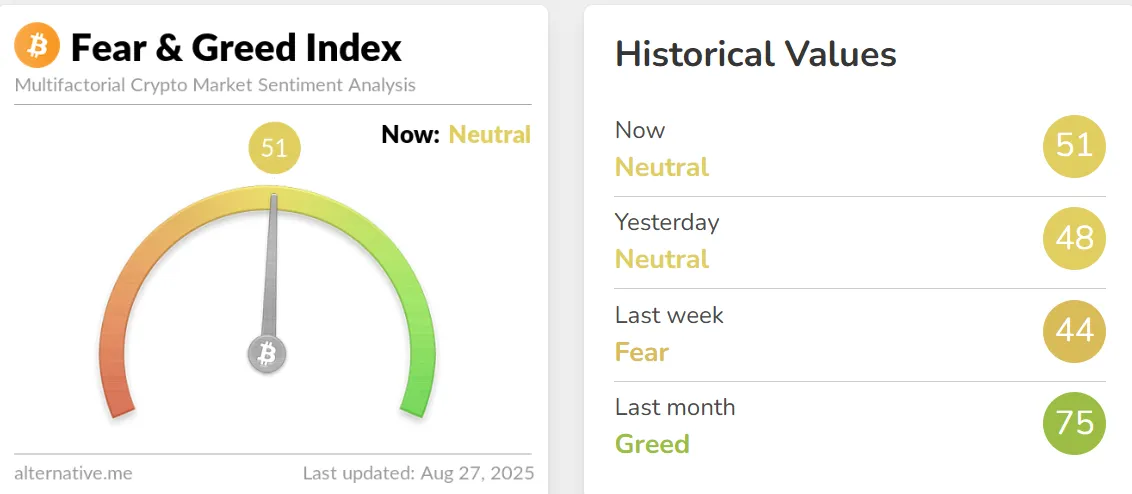

Source: Alternative Me

The Bitcoin Fear & Greed Index is currently at 51, which indicates a neutral market sentiment on August 27, 2025. Sentiment is no longer in fear (44), as it was last week, but has been stable since yesterday in neutral (48) and is lower than last month in greed (75). The index indicates a neutral sentiment among crypto investors

Kindly MD, Inc. has submitted an S-3 registration with the SEC, where it is aiming to raise $5 billion in equity, debt, and hybrid securities. The funds will be used to invest in Bitcoin in the treasury, as well as corporate needs, including working capital, acquisitions, repayment of debt, capital expenditures, and potential stock repurchases at the discretion of management.

Democratic Commissioner Kristin Johnson will resign from the CFTC on September 3, leaving Acting Chair Caroline Pham alone at the helm. After enduring a 15% staff reduction since the Trump administration, the agency now faces the prospect of further cuts to its enforcement division under the fiscal 2026 budget request, which has some worried about lessened market oversight.

DYDX has released its new roadmap, which includes significant changes for traders. Trading on Telegram will go live in September 2025, and new features such as social logins, batch orders, fee-sharing with partners, DYDX staking, Osmosis integration, and performance enhancements will be introduced. Moving forward, the exchange will launch Solana spot trading, USDT/fiat deposits, and real-world asset perpetuals.

Zach Witkoff and Zak Folkman, co-founders of WLFI, discussed the development of the company and the rising popularity of the USD1 stablecoin in the context of remittances, payments and crypto trading, and card services. They talked about the real-world asset tokenization plans, regulatory outreach, and expansion to new regions. Zak highlighted the mission of WLFI Token to enable communities that have been underserved by traditional finance with a comprehensive, easy-to-use financial platform.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.