The crypto market witnessed a wave of high impact developments over the past 24 hours, spanning liquidity injections by the U.S Federal Reserve, major bitcoin accumulation, key token listings, stablecoin regulatory momentum, heavy prediction activity, and rising tensions in BNB linked treasury operations. Here is a full breakdown of everything shaping today's market narrative.

Source: X

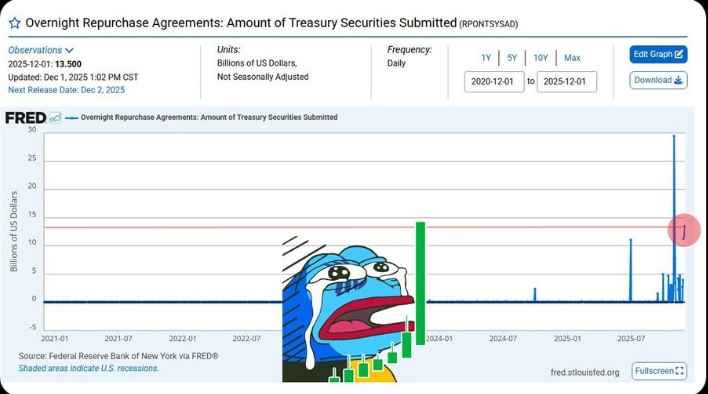

According to FRED overnight repo data, the federal reserve injected $13.5 billion into the U.S banking system, marking the second largest liquidity boost since the covid era. This sudden move signals tightening liquidity conditions in traditional finance, prompting the Fed to stabilize short term funding digital assets.

Source: X

Liquidity injections often support risk assets, including crypto.

Market view repos as an early sign the Fed wants to calm volatility.

Traders interpret this as a near term bullish driver for bitcoin and altcoins

Coinbase announced new spot market listings for Rayls Labs (RLS) and Plasma (XPL)

RLS trading started from Dec 1

XPL trading begins from Dec 2

Trading will go live once the liquidity conditions are met in supported regions. The addition of these coins could expand retail exposure as coinbase continues to onboard emerging ecosystem tokens

Zama revealed that 10% of its token supply will be offered through a sealed bid dutch auction on Ethereum scheduled on january 12. The sale will leverage Zama protocol’s fully homomorphic encryption to keep bids confidential until settlement.

All tokens purchased will be fully unlocked at mainnet launch, allowing immediate use for encryption fees, delegation or staking, marking one of the most innovative token sale mechanisms surfacing in the market.

Strategy closely linked to microstrategy confirmed the purchase of 130 BTC worth approximately $11.7 million at an average cost of $89,960 per BTC

Michael saylor and the CEO stated that MSTR may consider selling BTC or its derivatives if mNAV falls under 1x

The company now holds 650,000 BTC valued at around $56.2B compared to its market cap of $55.4B, a development that is drawing heightened landscape attention.

FDIC acting chairman Travis hill stated the agency is ready to propose the first stablecoin application rule under the genius act before month end

This could be the first federal level clarity on stablecoin issuance.

The genius act involves cooperation between multiple regulators.

Stablecoin regulation is one of the biggest catalysts for mainstream adoption.

Both major prediction posted record breaking volumes:

Kalshi: $5.8B(+32%)

Polymarket: $3.74B (+23%)

Kalshi also introduced tokenized event contracts on solana

Election season, and macro uncertainty drive demand.

Chain markets offer faster settlement and transparency.

Tokenized contracts are the next step toward tradable real world information.

SEC Chairman Paul Atkins will deliver a high profile speech at 10:00 a.m ET tomorrow, describing it as a reflection on principles powering America's economy for 250 years.

Policy tone from the SEC can shift crypto sentiment instantly.

participants want insights into how the SEC will approach digital assets in 2025.

Overall cryptocurrency enters a high impact and high volatility phase

With liquidity injections, new listings, innovative token mechanisms, stronger regulatory signals, and a major SEC speech ahead, the virtual asset is poised for:

Short term volatility spikes

Bullish pressure on BTC and altcoins

Growing institutional interest via regulation

Narrative driven opportunities across privacy, and stablecoins

This is shaping up to be one of the most influential weeks for the crypto market in recent months.

The past 24 hours show the market is entering a pivotal phase, driven by liquidity movements, regulatory clarity, and rapid innovation. With the Fed injecting liquidity, coinbase broadening access, prediction markets hitting new high, and key regulatory speeches around the corner, investors are preparing for heightened volatility and potential trend shifts.

Tomorrow’s SEC announcement and the upcoming stablecoin rule may set the direction for December;s narrative , making this one of the most influential weeks for the cryptocurrency market in months.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.