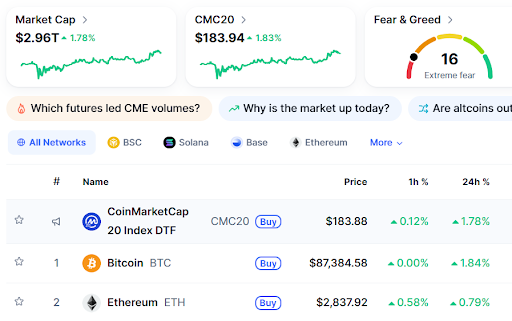

As of this press time, on the second of December, Crypto News pointed out with a cautious tone, noting that although the total market capitalisation increased by 1.78%, many major digital currency holdings showed modest growth, while trader confidence continued to deteriorate and renewed warnings were issued regarding unforeseen market fluctuations.

As of this writing, Bitcoin gained 1.84% to $87,384; Ethereum gained 0.79% to $2,837. Of the top 100 coins, 63 saw a positive increase, and three coins in the top 10 were also positive. Analysts indicate that we may not yet have reached a bottom phase, as the existing momentum is weak due to traders closing out positions at a loss, suggesting that overall momentum is weak within the cryptocurrency news cycle.

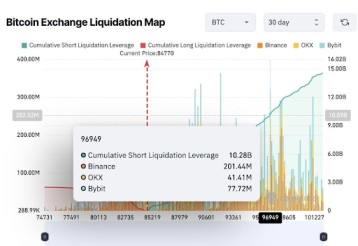

Within 24 hours of the reporting date, $1 billion was liquidated, indicating considerable uncertainty in the market due to the year-end ending within a few days. Market analysts anticipate that broad price fluctuations are imminent. Some forecasts predict that Bitcoin may fall below $80,000 by early 2026, causing traders to watch key levels closely.

Although we have seen significant price fluctuations lately, the level of liquidations has not been very high, suggesting that the cryptocurrency community will be able to transition into a stable trading phase if these patterns continue.

Source Coinmarketcap

The latest data on cryptocurrency ETFs illustrate an inconsistent and uneven trend. Bitcoin spot Exchange Traded Funds (ETFs) from the U.S. saw a very small $8.48 million in new inflows, while Ethereum spot ETFs experienced a much larger $79.01 million outflow. It reflects the changing attitudes of institutional investors following the crypto news cycle, indicating a shift in sentiment among these institutions. Many institutional investors took advantage of lower prices and increased their holdings during the downturn; for instance, BitMine increased its holdings in ETH.

Another significant development came from Vanguard. The firm manages assets totalling approximately $11 trillion, and it has recently made its brokerage platform available to trade on ETFs and Mutual Funds focused on the cryptocurrency market. As part of the new initiative, Vanguard added BlackRock's Spot Bitcoin ETF, which will allow clients to begin trading very shortly after it is added. The development represents a shift in Vanguard's policies, which have historically excluded digital assets.

https://x.com/BitcoinMagazine/status/1995605482242015730?s=20

The topic of short exposure has developed into a major talking point. CryptoRUs cited estimates of nearly $10.2 billion in short leveraged assets that would be liquidated if the price of Bitcoin reaches $96,900. This event received widespread coverage throughout the crypto news industry as traders are now closely monitoring an increased likelihood of a rapid liquidity event occurring within the ecosystem.

SOURCE X

Traders are also responding to more recent policy developments when interpreting the overall state of liquidity in the crypto news sector. According to Danny_Crypton, the Federal Reserve has recently announced an end to quantitative tightening (QT). Traders view this announcement as positive for liquidity in the crypto news space, since easing cycles have historically resulted in increased levels of activity in the markets.

Sentiment moved sharply lower, pushing the crypto news environment back into extreme fear. Traders continued to watch market conditions closely as volatility signs increased and short-term confidence softened.

Shristy Malviya is a skilled English Blog Writer and Content Writer associated with Coin Gabbar, specializing in producing well-researched and SEO-friendly content on cryptocurrency, blockchain innovation, and financial technology. She is passionate about making complex industry topics accessible and valuable to a wide audience. Shristy’s work reflects her commitment to delivering credible and high-quality information that aligns with current market trends. Outside her writing career, she enjoys reading books, an activity that deepens her understanding of global markets and continuously inspires her professional growth.