After crashing to over 5% in a day, the global crypto market is showing signs of recovery today, with a total market cap of $3.27 trillion, up by 1% in the last 24 hours. The total trading volume is at $99.6 billion, and Bitcoin dominance stands at 61.5%, while Ethereum is at 9.01%.

So, why is the crypto market up today? There are a few major reasons behind this sudden jump.

GENIUS Act Stablecoin Bill to Be Voted Soon: The U.S. Senate is all set to vote on the GENIUS Act Stablecoin Bill on June 17. This latest crypto news today is a major reason for the bounce in prices. The bill aims to regulate stablecoins in the U.S., and lawmakers also want to ban elected officials and their families from making profits using cryptocurrency.

This genius act stablecoin news is being seen as a big step toward clear regulations, which has increased investor confidence. At the same time, the U.S. House is working on another bill to define the roles of the SEC and CFTC in the sector oversight.

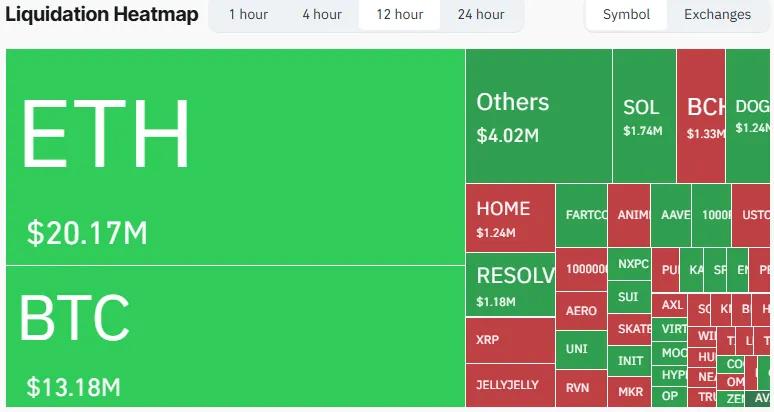

Liquidation Heatmap Turns Green: In the last 12 hours, $55.9 million worth of cryptocurrency was liquidated. Most of this came from long positions ($38.47 million), while shorts faced $17.43 million in losses. The green color in the heatmap indicates more long liquidations, showing aggressive buying behavior.

Source: Coinglaass

Trump Media's Bold Move on Bitcoin Treasury: In another big update, Trump Media got approval from the SEC for its Bitcoin Treasury initiative. The plan includes $2.3 billion worth of expansion involving equity shares and convertible notes. The aim is to support fintech and media growth.

This trump bitcoin treasury reserve approval has created buzz in the crypto news today space, with many seeing it as a sign of growing support from U.S. regulators. Interestingly, Trump has reportedly earned over $600 million recently, including digital assets and 15.75 billion governance tokens from World Liberty Financial.

More than 235 institutions now hold over 3.4 million BTC, which adds further strength to this recovery.

Fear and Greed Index in ‘Greed’ Zone: The Fear and Greed Index is now at 63 (Greed), up from last week's Neutral 52. This shows investors are now more confident in the market. However, extreme greed often leads to a pullback, so traders need to stay alert.

Despite recent recovery in the crypto market, several alarming global developments could trigger another crash. Reports indicate that Iran has attacked a nuclear facility in Dimona, Israel, and has threatened to target U.S. military bases. These Iran-Israel tensions have caused panic in global markets, with the Dow Jones plunging over 900 points in a single day. Adding to the uncertainty, the U.S. faces economic pressure from Trump’s tariff war, contributing to fears of a wider crisis.

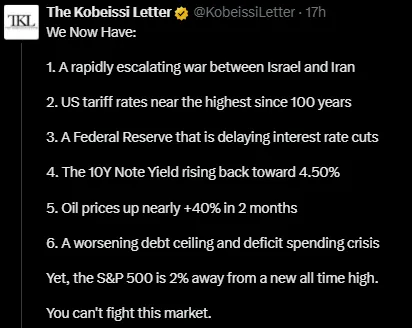

According to The Kobeissi Letter, multiple red flags are emerging: the Iran-Israel conflict, increased U.S. tariffs, delayed Federal Reserve rate cuts, 10-year bond yields nearing 4.5%, a 40% surge in oil prices over two months, and a worsening U.S. debt crisis.

Source: X

Despite the crypto market now demonstrating resilience, geopolitical and economic threats like these indicate the recovery to be temporary. Any intensification could initiate a sudden and rapid market decline.

The crypto market is increasing today with positive news such as the GENIUS Act Stablecoin Bill and the Trump Bitcoin Treasury Reserve. Liquidation statistics and the Fear and Greed Index are also working in favor of the increase. But the world situation, with the Trump tariff war and Iran-Israel war, has the ability to reverse investor sentiment overnight. While we are in a rebound today, it is not necessarily going to persist.

Disclaimer: This is for educational purposes only. Always do your own research before any digital investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.