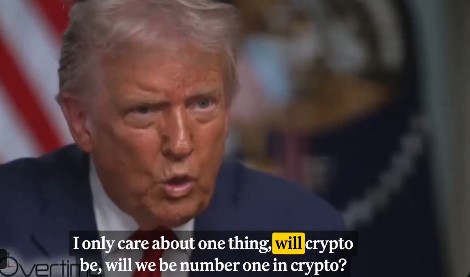

The year 2025 marked one of the most significant regulatory turns favoring crypto under Trump administration in modern U.S. history. After taking the vows of his second presidency in January 2025, Donald Trump not only supported the pro-crypto agenda but also leaped the barrier of his previous skepticism all the way to where he was considering Bitcoin a “scam” once.

In terms of policy, the administration presented what the crypto industry had been longing for a long time: better regulation, banking access, and legal clarity. However, the results on the markets were much less jubilant. The verdict is unambiguous, the policy momentum soared, but the prices behaved like global liquidity, not politics.

The Trump administration entered office with a pro-crypto agenda that overturned years of restrictive oversight. The new president in early 2025 was quick to issue executive orders which not only revoked Biden's cryptocurrency policies but also established a Digital Asset Market Working Group and a Strategic Bitcoin Reserve made up of confiscated assets that are estimated to include up to 200,000 BTC.

By March, Bitcoin had been officially acknowledged as “digital gold,” thus marking a strategic repositioning of the U.S. government regarding cryptocurrencies.

A significant turning point came in July 2025 with the genesis of the GENIUS Act, the very first stablecoin law at the federal level. It required 100% reserves in liquid assets like U.S. Treasuries, boosting confidence in dollar-backed stablecoins and accelerating tokenized settlement.

At the same time, the SEC, under new leadership, paused or dropped a number of enforcement actions and even ceased to impose the restrictive accounting rules like SAB 121 that had been implemented in the first place.

Soon the banking regulators also followed their lead. The OCC paved the way for banks to take custody of crypto-assets and serve as intermediaries in the settlement of low-risk transactions. In simple terms, the banks received the green light to deal with crypto-assets but with hosting minimal restrictions, therefore, this became a significant step in favor of institutional adoption.

On the surface, Crypto under Trump thrived institutionally.

$8.6 billion in crypto-related M&A deals closed in 2025

Over 250 public companies added crypto to their treasuries

83% of institutions surveyed planned to increase allocations

IPO activity surged, including firms like Gemini and Circle

By the year's end, major new laws were not enacted, but the regulatory environment was almost completely set, making the U.S. a global crypto center.

The crypto prices, however, went down drastically in 2025 despite the strong policy support coming from the government. From the inauguration highs of Trump:

Bitcoin: -18%

Ethereum: -10%

XRP: -42%

Solana: -52%

DOGE: -68%

Note: Data Are Sourced from Crypto Rover

The turning point came on October 10, 2025, when a crash wiped out an estimated $1.3–$3 trillion in market value along with a record $19 billion in liquidations. The optimistic view of the market created by the regulation was swallowed by the tariff fears, thin liquidity, leverage, Fed's signals of fewer rate cuts, and rising yields accompanied by a global risk-off sentiment.

This also brings the point home that while regulatory clarity supports and facilitates adoption, the prices still rely on liquidity, interest rates, and global risk tolerance.

Crypto under Trump was granted one of the most radical regulatory changes in U.S. history throughout the year 2025. Having taken the oath for his second presidential term in January 2025, Donald Trump would go on to not only embrace the pro-crypto agenda but to even call it a "dramatic shift.”

The policy variously enabled the industry to enjoy what it had been advocating for a long time: the abolition of denial regulations, access to banks, and clarification of the legal situation.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.