It turns out that even the most loyal crypto fans have a breaking point. As of January 12, 2026, the digital noise has gone surprisingly quiet. Crypto YouTube viewership has officially hit its lowest level in five years, dragging engagement back to where it was in January 2021.

Source: X(formerly X)

Source: X(formerly X)

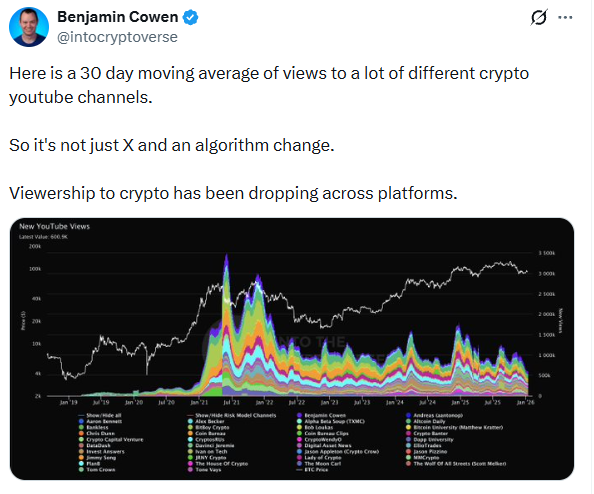

According to data shared by Benjamin Cowen, the average number of views across major channels has been in a freefall for three months straight. This isn't just a glitch in the algorithm; it’s a sign that the "average Joe" investor has essentially packed his bags and left the building. As analyst Tom Crown put it, the social side of the market has been in a "bear market" since 2021, and we are finally seeing the total exhaustion of the retail crowd.

Why are people hitting the "unsubscribe" button? It isn't just because the prices are volatile—it’s because people are tired.

The simplest reason for the drop? People are just tired of getting burned. Creators on TikTok and YouTube, like Cloud9 Markets and Jesus Martinez, have noticed a huge shift in their comment sections: audiences are totally drained by the constant barrage of "pump-and-dump" schemes and shady altcoins. The massive crash on October 10, 2025, which saw $19 billion vanish in a single day, was the final straw for many. After that, a lot of smaller investors decided they’d had enough of the stress and simply walked away from the screen.

It’s not just that people are leaving crypto; they’re actually moving their money elsewhere. While Bitcoin was struggling with a -7% return in 2025, traditional heavyweights like gold, silver, and even cobalt were actually making people money. It seems the "Main Street" investor is looking for returns they can actually see and touch, rather than just chasing "to the moon" stories that haven't lived up to the hype lately.

The 2026 market doesn't look like it used to. It’s being driven by massive banks and institutional ETFs rather than viral YouTube clips. Now that professional firms are handling most of the heavy trading, that desperate need for "daily moon updates" has mostly disappeared. The crypto market has finally "grown up," but for a lot of content creators, that maturity is actually a bit of a buzzkill. It’s harder to get millions of views on a boring, stable institutional trade than it was on a wild speculative pump.

While the falling crypto YouTube viewership numbers look scary, it might actually be a sign of a healthier, quieter market. On-chain experts at Santiment have noticed that while the "hype" is gone, the actual sentiment around Bitcoin is starting to stabilize. As long as Bitcoin stays above the $90,000 mark, the market feels steady, just less noisy. We are moving away from the era of "get rich quick" videos and into an era of professional finance. If the market will work properly then only the people will take interest and then only the youtube views can rise.

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.