Denmark crypto adoption signifies the official change in course of the nation's largest lender. The Danske Bank crypto ban ends after nearly eight years, as the bank now allows customers to gain exposure to Bitcoin and Ethereum through regulated investment products.

Source: Press Release

Danske Bank, which serves more than 5 million customers across Northern Europe, confirmed that users can now access selected crypto-linked products directly through its eBanking and Banking apps. The move marks a major shift for a bank that blocked crypto-related services in 2018 due to regulatory and transparency concerns.

Instead of direct digital asset trading or self-custody wallets, Danske Bank is offering access through Exchange-Traded Products (ETPs), a product that lets investors gain exposure to assets without owning them directly.

At launch, three ETPs are available:

Two tracking Bitcoin (BTC)

One tracking Ethereum (ETH)

These products are issued by well-known providers such as BlackRock, WisdomTree, and 21Shares, and operate under strict EU frameworks like MiFID II (Markets in Financial Instruments Directive II), offering higher transparency and investor protection. Customers can invest using familiar banking tools, without relying on external or offshore digital asset exchanges.

However, the banking organisation has been clear on cryptocurrency’s volatile nature, stating that it remains a high-risk and speculative asset class. The products are available only to self-directed investors, and Danske will not provide investment advice or recommendations related to cryptocurrencies.

The decision comes down to two main factors:

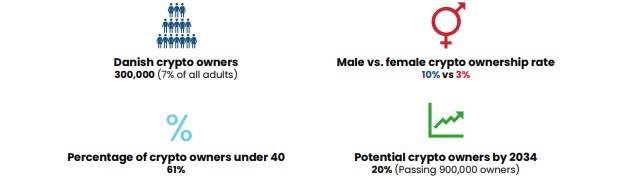

Strong Customer Demand: The banking institute reported a steady rise in client requests for cryptocurrency exposure. This aligns with the country’s growing digital asset user-base. According to the Danish Crypto Adoption Survey 2024 by K33 Research and EY, around 300,000 Danes, ~5% of total population, own cryptocurrency. This number is expected to rise up to 900,000 by 2034, a massive 20% increment. Traditional institutions have to accept the growing demand when numbers are this strong.

Regulatory Clarity: Second most important player is the growth in clear trading rules. The European Union and many states are exploring ways to make digital asset trading more compliant.

The EU’s MiCA (Markets in Crypto-Assets) framework, which standardizes cryptocurrency rules across Europe and reduces uncertainty for traditional banks, emerged as a key benchmark. It covers all 27 member states with Iceland, Liechtenstein, and Norway.

This shift reflects a wider European trend. Other major banks, including ING and DZ in Germany, are also integrating regulated cryptocurrency products rather than avoiding the sector entirely.

While the market reaction for BTC and ETF prices has been muted so far,

Bitcoin: Around $67,000, facing 26.72% monthly and 29.81% yearly loss,

Ethereum: Near $1,960, lost 37% on monthly and 24.24% on yearly basis,

Analysts see this as another step toward mainstream adoption. With the Danske Bank crypto ban end, crypto became more accessible to everyday retail investors, bringing the gap between traditional finance and digital assets in Europe.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.