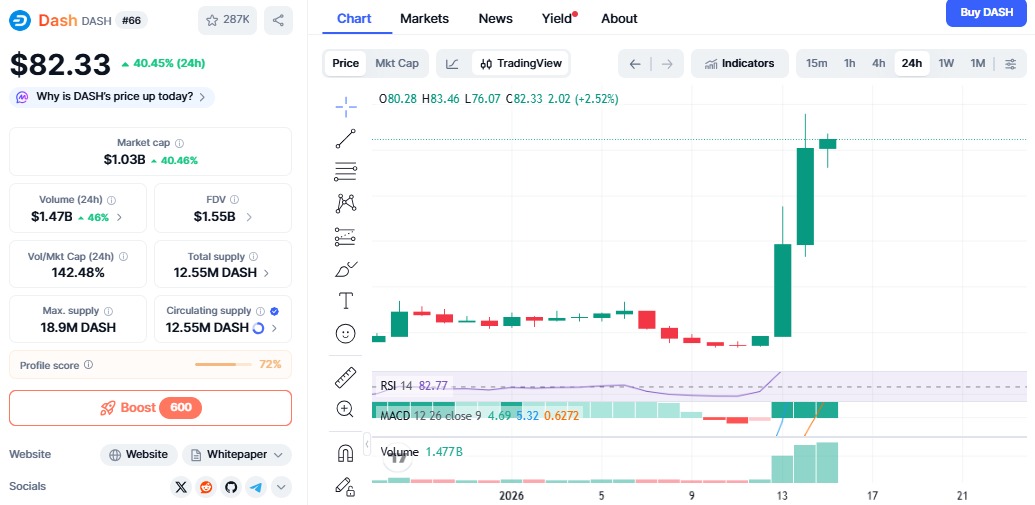

Dash surprised the market after jumping more than 42% in the last 24 hours. This sudden move has pushed traders to ask what is driving the rally. The Dash price surge is not happening by chance. It is supported by strong activity in privacy coins, a major new partnership, and a short squeeze in the futures market.

Over the past week, the coin has gained more than 100%, placing it among the top-performing crypto assets of 2026. Still, the fast rise also brings higher volatility, so investors are watching carefully.

Source: CoinMarketCap Chart

Part of the reason behind the surge in prices has to do with the rotation into privacy coins. Following a governance issue, Zcash's development team resigned, and confidence in ZEC was weakened. Its price fell sharply, and traders shifted funds to stronger alternatives, including Dash and Monero. Monero XMR’s price sees a weekly gain of 59%.

Simultaneously, more strict regulations in Europe, like the DAC8 tax reporting rules, only allow an increase in interest in privacy-oriented cryptocurrencies. Thus, users in large part now prefer to hold assets that will give them more control over transaction data.

Due to this, the privacy coins sector started growing fast, with the total market value crossing $24 billion.

Alchemy Pay Partnership Expands Access

Another strong driver of this altcoin price rally is its partnership with Alchemy Pay. It has been announced on January 13th, the integration will allow users in 173 countries to buy this coin using credit cards, Apple Pay, and more than 300 payment methods.

This makes the coin easier to buy for normal users who are new to crypto. Easy access is important for growth. After the announcement, its trading volume jumped to $1.47 billion, showing strong buying pressure.

This partnership improves Dash’s use as “digital cash” and adds long-term value, not just short-term excitement.

The price surge was also powered by a short squeeze. As it broke key resistance levels, more than $7.7 million worth of short positions were liquidated in one day.

When short traders are forced to close positions, they must buy the token, which pushes prices higher. This created a fast chain reaction of buying.

From a technical view, it broke a long-term downtrend and touched highs near $88. However, RSI levels moved above 90, which signals that the market is overbought and may cool down soon.

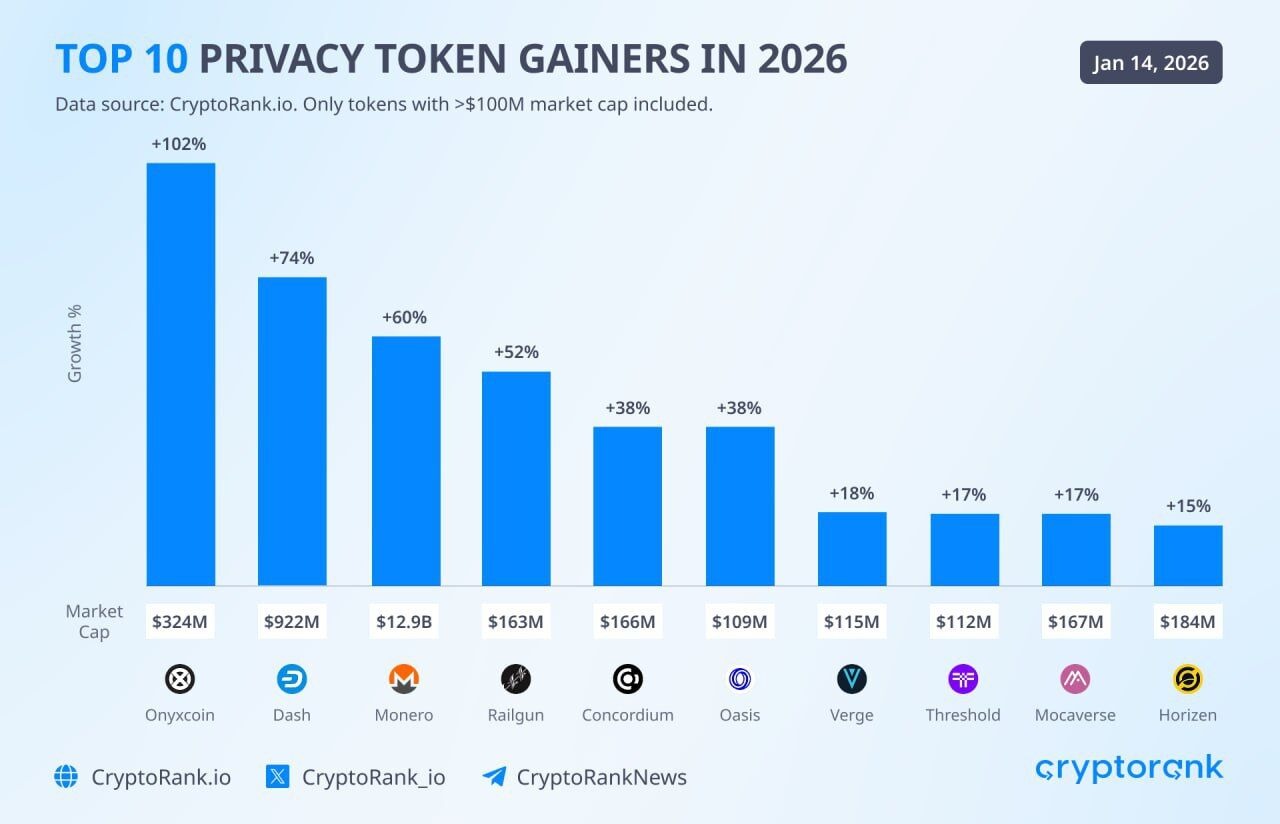

The price surge fits into a bigger pattern. Privacy tokens are among the best performers this year as per the CryptoRank.

Onyxcoin (XNC): +102%

Dash: +74%

Monero (XMR): +60%

Source: CryptoRank

More than 80% of privacy tokens with over $100 million market cap are in profit in 2026. This shows strong confidence in the sector.

The price surge remains strong, but resistance lies near $102. If it breaks and holds above this level, the next target could be around $120.

If it fails, a pullback toward $75 is possible. Strong support is near $80. Holding above this zone would confirm that the rally is real and not just a short-term spike.

Because RSI is very high, a small correction would be normal and even healthy.

The Dash price surge is supported by real market forces: sector rotation, better accessibility, and strong trading activity. Privacy coins are gaining attention in 2026, and this altcoin is becoming one of the leading names.

While short-term volatility is expected, it has clearly returned to the spotlight. The next few days will show whether this rally becomes a lasting trend or a temporary move.

YMYL Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are risky; always do your own research before making any decision.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.