Donald Trump is once again making waves with his bold moves. This time, he's targeting Fed Chair Jerome Powell, hinting at replacing him before his term ends in 2026. Powell’s refusal to lower interest rates—a step Donald believes is important to support the economy and boost crypto in the U.S. According to a recent tweet by The Kobeissi Letter.

Source: X

Donald said, “My pick for the next Fed Chair is coming out very soon.” This surprise announcement signals his growing frustration with Powell’s policies.

The US President has made it clear that he has zero tolerance for crypto haters. From removing Gary Gensler as SEC Chair to now targeting Fed Chair Powell, Trump is showing no mercy to those who oppose crypto growth. He wants to make America crypto-friendly again. His model is simple—support crypto supporters and push out the rest. While Powell’s term ends in May 2026, he seems ready to act early. His push for rate cuts is based on the belief that it would help businesses, boost trading, and create a better environment for cryptocurrency adoption in the U.S.

At present, the Federal Reserve policy rate is between 4.25% to 4.50%. Jerome believes keeping rates steady will control inflation and stabilize the economy. But Donald thinks that lower rates can support faster growth—even if it involves risk.

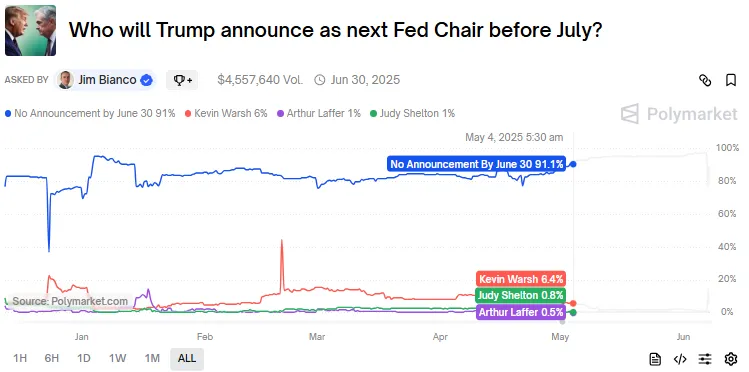

Now, everyone is asking: Who will be next Fed Chairman? According to Polymarket crypto prediction polls, several names are being floated. Leading the list is Kevin Warsh (6.4%), followed by Judy Shelton (0.8%) and Arthur Laffer (0.5%). There are also mentions of Kevin Hassett and Larry Kudlow, but they have received less support so far.

Source: Polymarket Market

Even though Trump is preparing for an early move, around 90% of Polymarket votes suggest that Donald won’t make any formal announcement before June 30. Still, the buzz around these names and the upcoming change shows just how serious he is about shifting power in favor of pro-crypto policies.

This is not the President's first major move. Back in January 2025, he forced Gary Gensler to resign and replaced him with Paul Atkins as SEC Chair. Gensler was seen as a strong critic of crypto, and Trump wasted no time in showing him the door—this marked the first big step in his zero-tolerance journey.

Now, Donald is clashing with another big name—Elon Musk. The fight is over The Big Beautiful Bill Trump supports, which includes tax cuts and economic reforms. Musk has called it the “Big Ugly Bill,” claiming it could push the U.S. into recession. Once allies during the presidential campaign, Trump vs Musk has now become a political battleground.

This battle between the US President and Powell feels a lot like the US China trade war episode. Donald had already levied 140% tariffs on Chinese imports at that time, which triggered a stern reaction. They then both sat down and negotiated a deal afterwards. The same can be done here as well.

If he replace Powell, then the Fed could cut more interest rates, that would stimulate the economy in the short term. Lower interest rates translate into lower-interest loans, more investments, and more opportunities for crypto prices to rise. But it has negative impacts such as inflation or difficulties in the longer term.

Disclaimer: This is just for informational purposes and doesn’t advise any financial investment. Do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.