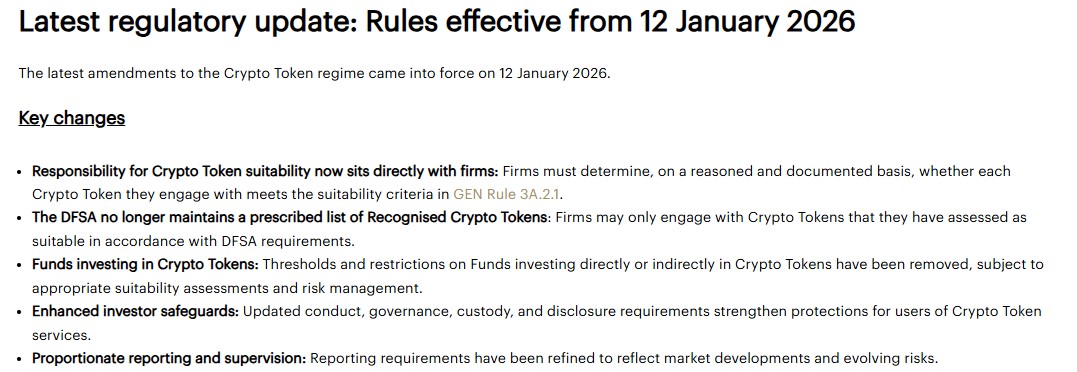

Dubai DFSA crypto rules have entered a stricter phase as regulators tighten control over digital assets inside the Dubai International Financial Centre (DIFC). Effective January 12, 2026, the Dubai Financial Services Authority (DFSA) has banned privacy-focused cryptocurrencies and imposed tougher standards on stablecoin approvals.

Source: Official Release

The move surprised many in the cryptocurrency community, especially those who viewed the nation as a crypto-friendly hub. With global regulators increasing pressure on anonymity and compliance, is the nation now choosing regulation over decentralisation?

The updated rules are designed to reduce money laundering risks and align the DIFC with global standards set by the Financial Action Task Force (FATF).

Under the new framework, privacy tokens such as Monero (XMR) and Zcash (ZEC) are fully banned within the DIFC. DFSA-licensed firms are no longer allowed to trade, promote, offer, manage funds, or provide any services linked to these assets. Tools like crypto mixers and tumblers, which hide transaction details, are also prohibited.

Regulators said these assets make it difficult to track transactions, identify users, and monitor suspicious activity. As a result, they no longer fit within a regulated financial environment.

These regulations apply only inside the DIFC, the country’s regulated financial zone, and not to mainland of the country. However, similar laws could spread over time.

The Dubai DFSA crypto rules also introduce tighter controls on stablecoins. Only fiat-backed stablecoins supported by high-quality liquid assets now qualify as approved “Fiat Crypto-Tokens.”

This means stablecoins must have clear reserves, regular audits, and strong backing to qualify. Algorithm-based or complex stablecoins no longer receive special treatment.

Projects like Ethena’s USDe have been reclassified as regular cryptocurrency tokens, not stablecoins. This change is meant to ensure users can redeem their funds even during market stress.

Ethena is a virtualized project that issues USDe, a token designed to stay close to the US dollar using trading strategies instead of traditional cash reserves.

While innovative, this structure does not meet the DFSA’s definition of a fully backed stablecoin. Under the new cryptocurrency rules, such models are allowed to exist but are treated like regular digital assets, not stable payment tools.

At its core, the Dubai DFSA crypto rules signal a clear choice. The country’s main financial centre is prioritising regulation, AML compliance, and institutional confidence over anonymity-focused innovation.

However the announcement triggered strong reactions, with users questioning whether Dubai is moving away from its reputation as a tax-friendly crypto hub. Some fear liquidity could shift to offshore or less regulated jurisdictions.

Others see the move as positive for institutions, arguing that stricter rules improve trust, transparency, and long-term adoption. Similar privacy-token crackdowns have already occurred in Japan, South Korea, and parts of Europe.

While no panic selling has been reported, the decision adds to a global trend toward traceable, compliance-first crypto markets.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.