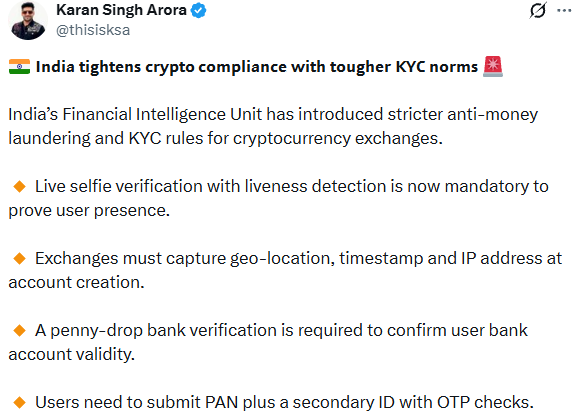

If you trade crypto in India, your next login is going to look a little different. The Financial Intelligence Unit (FIU) basically hit the "refresh" button on how we access our accounts. They’ve rolled out much tougher India crypto KYC rules that move way beyond just scanning your Aadhaar card. Now, the government wants to be 100% sure that it’s actually you behind the screen and that you’re physically in India when you hit that "buy" button.

Source: X(formerly Twitter)

Source: X(formerly Twitter)

These changes aren't just for newcomers. Whether you're a pro or a casual trader on one of the 49 registered exchanges like WazirX or CoinDCX you're going to see these high-tech security steps pop up very soon.

So, why the sudden change? The government is trying to make it impossible for scammers to use "deepfakes" or stolen IDs to open fake accounts. To stop the bad actors, they’ve added three specific layers to the India crypto KYC process that every trader now has to navigate.

Forget about uploading a saved photo from your gallery. The new rules require a live selfie. You’ll use software that checks for "liveness" which just means you’ll have to blink your eyes or move your head while the camera is on. It’s a simple, two-second task that proves you aren't just a static photo or an AI-generated video trying to trick the system.

This is the one that might surprise you the most. Every time you open an account, the exchange is now required to log exactly where you are. We're talking actual GPS coordinates (latitude and longitude), along with your IP address and a timestamp. Think of it as a "digital check-in." The government's goal here is to make sure people aren't using VPNs to pretend they’re somewhere they’re not or trying to sidestep Indian laws from abroad. By doing this, the exchange creates a permanent trail that proves your account was legally set up right here in India.

Exchanges also have to do what’s called a "penny-drop" test. They’ll send a tiny amount—just Re 1 to your bank account. If the name on your bank account doesn’t perfectly match your ID, the account won’t be verified. On top of that, you’ll need to provide your PAN card plus a second ID (like a Passport or Voter ID), all backed by an OTP sent to your phone.

The government is basically trying to "clean up" the market. By tightening these India crypto KYC norms, they’re making it incredibly hard for anyone to use crypto for money laundering or fraud. They’re also taking a hard stance against things like Initial Coin Offerings (ICOs), which they see as high-risk projects that often leave investors with empty pockets.

Even though these extra steps feel like a bit of a hassle, they’re actually meant to protect your money. By 2026, the Indian crypto world is looking more and more like a regular bank—highly regulated, transparent, and safe. Just keep your phone and your Aadhaar card handy the next time you log in, and you’ll be good to go!

Yash Shelke is a crypto news writer with one year of hands-on experience in covering cryptocurrency markets, blockchain technology, and emerging Web3 trends. His work focuses on breaking crypto news, token price analysis, on-chain data insights, and market sentiment during high-volatility events.

With a strong interest in DeFi protocols, altcoins, and macro crypto cycles, Yash aims to deliver clear, data-backed, and reader-friendly content for both retail investors and seasoned traders. His analytical approach helps readers understand not just what is happening in the crypto market, but why it matters.