The ECOX Network listing date has officially been rescheduled, turning market attention back to $ECX Auction Exchange launch. Earlier, the team had confirmed January 8, 2026, as the listing date, but the plan has now changed.

What Is ECOX? The internal Auction Exchange is more than a trading feature. It is designed to generate real revenue, increase demand, and support long-term ecosystem cash flow.

According to the official ECOX Network team X account and project blog, “more time is needed to complete final upgrades and make sure the platform launches without any glitches or trading issues.”

Their goal is to release the exchange only when it is fully ready. This includes final testing, system optimization, and ensuring smooth trade execution. For a long-term project, doing things this way helps protect people's money and builds real trust.

A new date hasn't been shared yet, but the team promises the wait won't be long. This update keeps everyone focused on the crypto airdrop as traders watch for the next move.

Right now, the project has reached a critical development stage where locking the tokens and finishing the ECOX Network KYC verification are the most important things for users to do.

At the same time, its price is trading at $0.2 in OTC markets, showing early price discovery before major exchange listings.

A major highlight is the new milestone: more than 50,000,000 $ECX airdrop tokens are now locked. This came after the “Lock to Unlock More” feature went live.

Along with this, the team confirmed that over $5 million has been raised from global investors. “Key funding partners include Kenzo Labs, Gemstone Labs, OneShot Ventures, Webcoin Labs, Gain, and Panoray Ventures. This shows strong confidence in the project’s future.”

The network's official blog also confirmed $2 million USDT in strategic funding to develop its Pre-Listing Coin Auction Platform, a new model designed for transparency in token fundraising.

What Should Users Do Now? The ECOX Network listing date change places greater importance on current ECX locking activity. Locked users can enjoy higher vesting ratios and better rewards.

Depending on the lock level, participants can unlock between 5% and 70% of their tokens at TGE. Referral commissions can go up to 40%. These rules will change once the Auction Exchange becomes active.

Note: “Investors should monitor only official channels for confirmed updates.” The current window is to complete KYC and lock coins under early benefit rules.

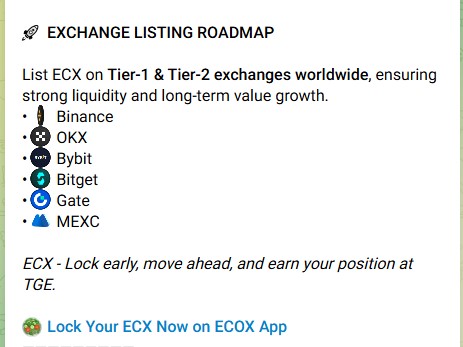

The roadmap strengthens expectations around the ECOX Network listing date and future liquidity.

To ensure this table looks professional and is fully optimized for both mobile and desktop (SEO-friendly), use the following clean HTML/CSS code. You can paste this directly into your website's HTML/Text editor.HTML

| Phase | Time Period | Key Focus |

|---|---|---|

| Phase 3 | Q4 2025 – Q1 2026 | Exchange listings, network expansion, new app features, strategic partnerships |

| Phase 4 | Q2 2026 & Beyond | Buy-back & burn, DeFi integration, DAO governance, ecosystem optimization |

“The crypto exchange listing roadmap includes: ECOX listing on Binance, OKX, Bybit, Bitget, Gate.io, and MEXC”

Source: The Official Telegram

The ECOX Network listing date delay is actually a good sign of preparation rather than a failure. With the $ECX OTC price at $0.2, 50 million tokens locked away to ensure safety, and strong financial backing, the project is moving into its most important stage.

The next new crypto listing update may define its real market direction. According to Coingabbar’s experts, the way this project is handling its money, token rules, and market setup shows they are choosing stability over speed.

Traders should note that projects that delay for platform readiness often reduce long-term risk.

YMYL Disclaimer: This article is for informational purposes only and does not provide financial, or or trading advice. Cryptocurrency investments carry high risk. Always do your own research before making any investment decisions.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.