The crypto market is turning its attention toward ESP after the release of Espresso tokenomics, especially since Coinbase recently added the ESP token to its listing roadmap. Although this does not confirm a listing, it usually means the exchange is reviewing the asset, a step that often boosts visibility and investor curiosity.

Source: Espresso Foundation X (formerly Twitter)

Because of this double update, many traders are now wondering whether an Espresso ESP listing date and token generation event (TGE) could be announced soon. For now, the team has asked the community to wait for further updates.

The newly released tokenomics reveal an initial supply of 3.59 billion ESP tokens. The project does not have a fixed maximum supply because staking rewards will gradually introduce new tokens over time.

Source: Paragraph Redirected through ESP X

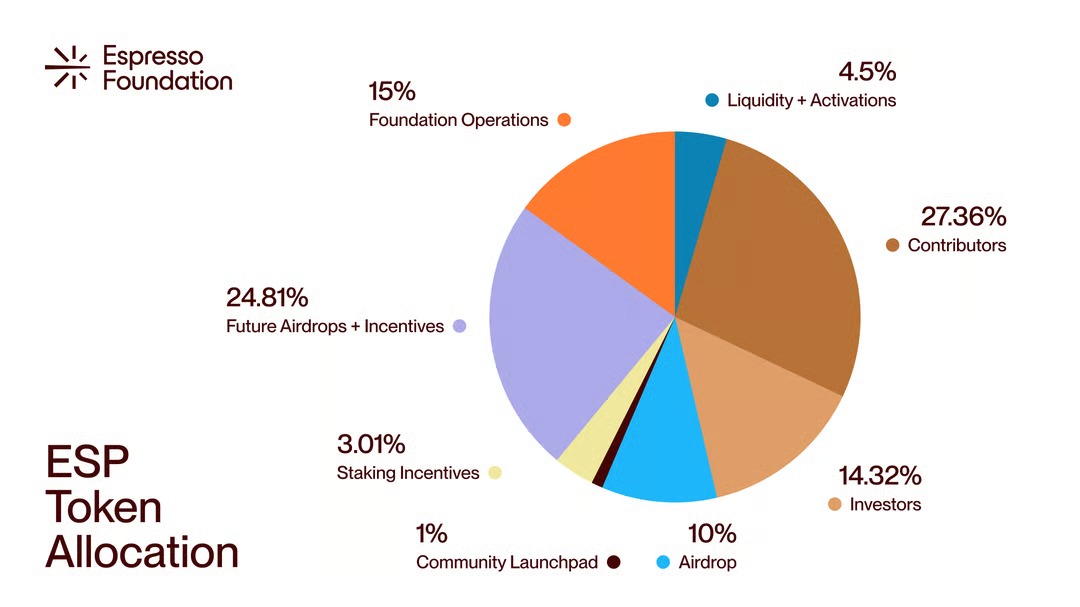

Here is how the allocation is structured:

27.36% reserved for contributors

14.32% allocated to investors

10% community airdrop, fully unlocked at launch

24.81% set aside for future incentives and ecosystem growth

15% dedicated to foundation operations

4.5% for liquidity and market support

The token will help run the network through proof-of-stake validation, pay protocol fees, and support security via the HotShot consensus system.

One important detail is the fully unlocked airdrop. While this can attract users and boost early activity, it may also lead to short-term selling once trading begins.

The release of ESP tokenomics became even more notable after Coinbase shared the Ethereum contract address for ESP. Historically, projects placed on exchange roadmaps often see increased attention before launch.

Source: X (formerly Twitter)

However, investors should remember that a Coinbase roadmap is not a guarantee. Confirmed updates about the ESP TGE, exchange support, and launch schedule are still pending.

Until those announcements arrive, the best approach may be staying informed rather than rushing into community buzz.

Since no official price has been revealed, estimates depend on supply, sector demand, and market conditions.

With 3.59 billion tokens, analysts may expect an early trading range between $0.04 and $0.10 if the broader crypto market remains stable. That would suggest a fully diluted valuation of roughly $140 million to $350 million, which is common for new infrastructure projects.

Short-term: It may launch around $0.04–$0.10, with possible dips to $0.03 if early sellers enter. Strong demand could push it near $0.12.

Long-term: If adoption, it could trend toward $0.15–$0.30, supported by listings and network growth.

Several factors could influence price movement:

Possible listings on major exchanges

Strong staking rewards that could reduce circulating supply

Airdrop-driven demand

Overall crypto market sentiment

Espresso has been quietly building momentum. The project currently has about 68,000 followers on X, which shows steady interest even before the token officially launches.

At a basic level, Espresso is focused on blockchain infrastructure. As more developers build apps using rollups and layer-2 networks, one major problem has been fragmentation chains struggling to communicate smoothly with each other. Espresso aims to fix this by acting as a shared consensus layer that helps networks confirm transactions faster and more securely.

The project already connects with ecosystems like RARI Chain, ApeChain, and Celo, and has worked alongside infrastructure providers such as Arbitrum and Caldera. This places Espresso in a sector many analysts consider important for the long-term growth of crypto.

The biggest catalysts are still ahead, the official TGE announcement, confirmed listings, and final launch details. These events often shape a token’s early trajectory more than speculation alone.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.