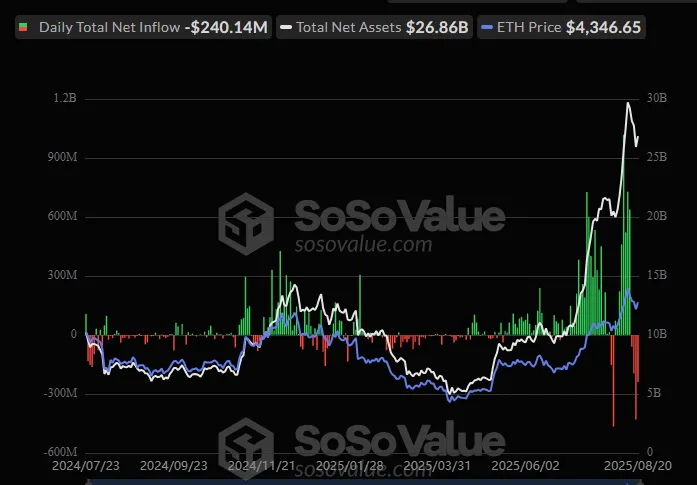

The crypto market is showing a regular outflow from the past fews days which is indirectly affecting the Bitcoin ETFs, Ethereum and other Altcoins prices. As of today the daily total net outflow of Ethereum and Bitcoin ETFs recorded by the SoSo Value is $240.14 million and $311.57 million. Let’s analyse the reasons and factors which can make green signals from regular reds.

As per the updated data from SoSo Value of August 21, BTC Exchange-Traded Funds has shown a slight decrease in its outflow from yesterday when it was $523.31M and now it is $311.57M.

The daily total net asset value of Bitcoin ETFs is $147.02B which is 6.46% of BTC Market Cap with a cumulative sum inflow of $54.02B.

Source: SoSo Value

Whereas showing optimism by Bitwise (BITB) it showed a daily total net inflow of $619.81k with a cumulative net inflow of $2.23B, and yesterday it was showing reduction with $86.76million. GrayScale (GBTC) and Fidelity (FBTC) are still stuck to reductions with $8.98million and $7.46 million.

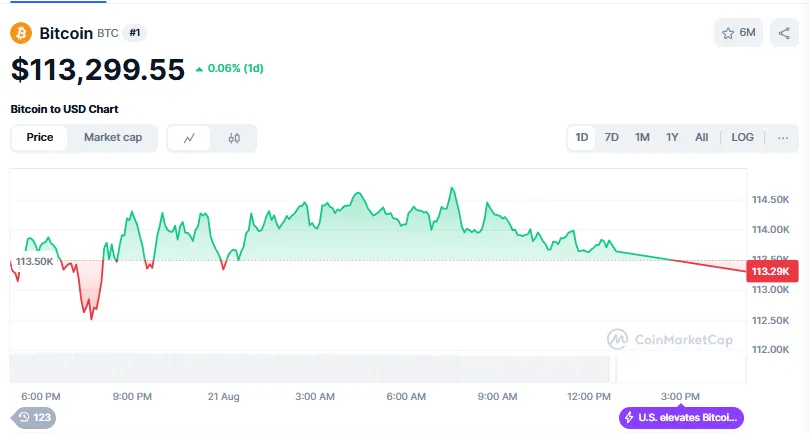

As these reductions in Bitcoin ETFs have an impact on BTC prices also as currently it is trading at $113,299.55 with a little rise of 0.06% in a day, as per the data of CoinMarketCap.

Source: CMC

Ethereum Exchange-Traded Funds recorded a daily net reduction of $240.14M today which is lesser from yesterday’s $422.30M as per the data collected from SoSo Value.

Despite facing the dips the total value traded by ETH Exchange-Traded Funds is $2.65 billion and the total net asset value recorded at $26.86 billion which is 5.11% of Ethereum market cap. Having a Cumulative total net inflow of $11.80 billion, it seems that in the coming day as improvement in the Exchange-Traded Funds will be seen.

On the other hand firms which were running with huge reduction are today showing inflows like with a daily total inflows, Fidelity (FETH) at $8.64 million, Grayscale (ETH) with $9.00 millions whereas Blackrock still showing an outflow with $257.78 millions.

Ethereum prices have increased by 1.73% in 24 hours and are currently trading at $4,262.61 (at the time of writing). It is due to little decrease in Exchange-Traded Funds outflows and SEC decision on staking for Exchange-Traded Funds and that approval could unlock $4B+ annual yield demand.

Source: CMC

As a decrease in Ethereum and Bitcoin ETFs outflow compared to the previous data is a positive signal for the crypto investors, it might happen that in the coming days it gives green signals, and also a surge in prices could be seen.

As soon the geopolitical tension gets resolved or if the Fed decreases the interest rates which is currently 4.25% to 4.5%, it will impact the crypto market positively.

Importantly, tomorrow's Jerome Powell speech might show market movement.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.