Research firm Fundstrat has identified Ether as the biggest macro trade investment target for the next 10–15 years, projecting that it could rise to as much as $12,000 by the end of this year.

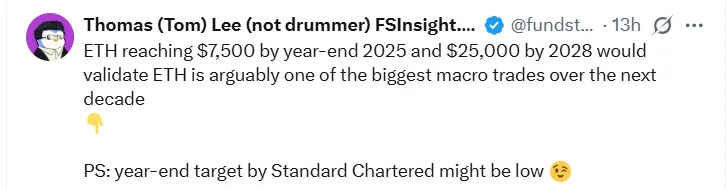

Source: X

Ethereum is transforming into the foundation for the AI creator economy, with tokenized AI influencers and creator coins contributing to on-chain revenue. Tom Lee, chairman of Bitmine Technologies, says Ether is the”biggest macro trade” over the next 10-15 years. Currently, it holds a 55% market share in real-world asset (RWA) tokenization, and many Wall Street projects and stablecoins are built on its foundation.

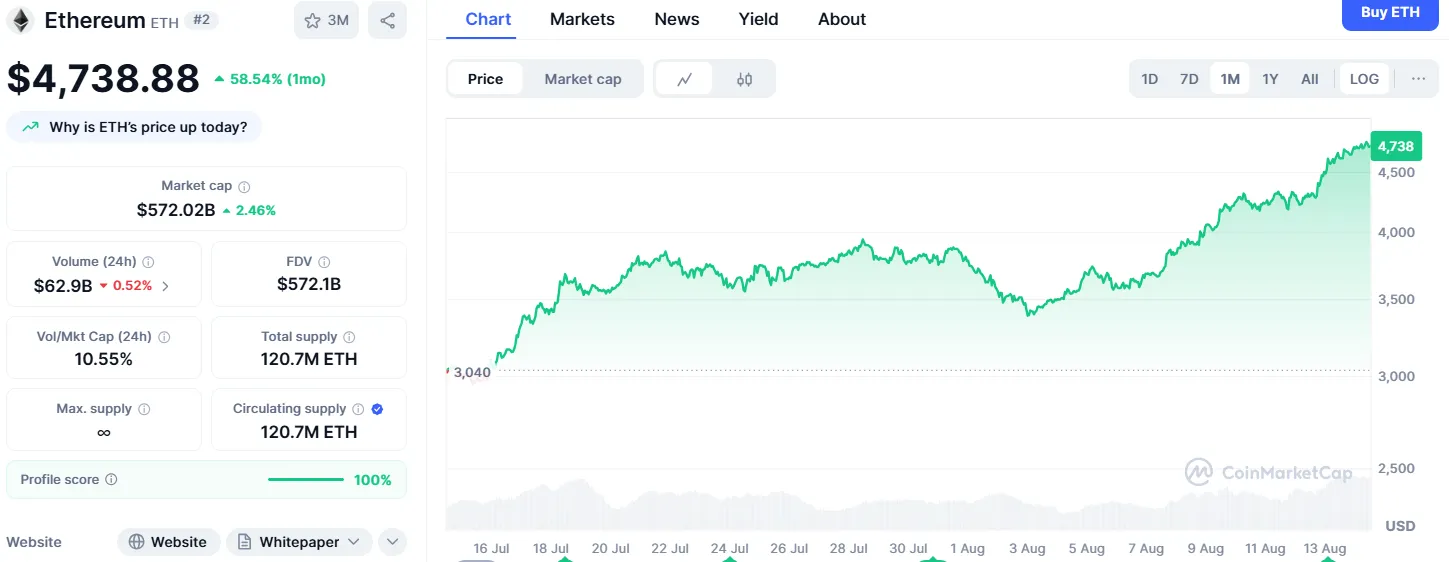

The ecosystem gained momentum mainly from April when corporate giants started buying it. The layer-1 token saw a fresh high and is trading today at $4,738 with $572B market capital. The token has surged massively with 58% in the past 30 days for the first time in four years.

Source: CoinMarketCap

Crypto analysts have been speculating for a long time that ETH will reach its 4K ATH target soon. In the last seven days the coin price surged above its all time high targeted price of $4k with above 28% of increase which is boozing the market. The way the coin is growing rapidly, it can be expected that Ether will be the new boss in the crypto market. As the coin is showing the biggest macro trade and everybody is leaving their path from Bitcoin to Ethereum.

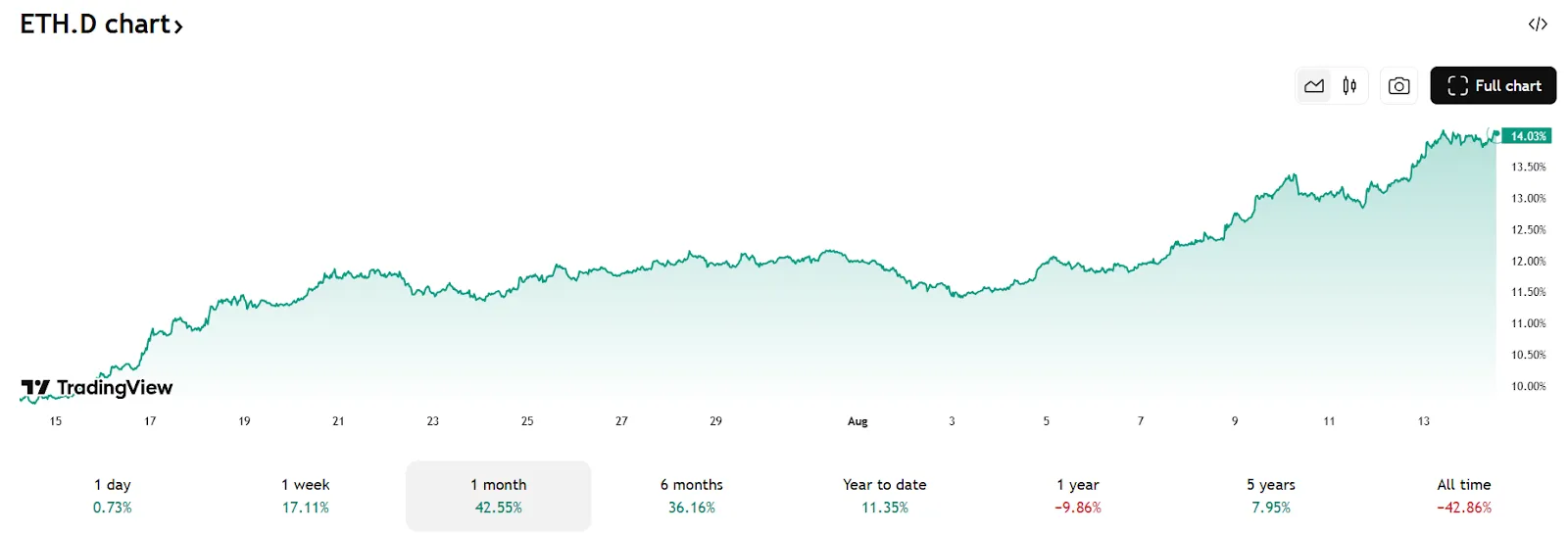

The market dominance of the token is gaining day by day with the biggest macro trade. According to the trading view Chart shows the remarkable monthly dominance surge of 42%.

Source: Trading View

Over the past week, Ethereum has had an outstanding performance, jumping nearly 17% of dominance. Some might think it's all just hype, but the chart displays Ethereum's dominance over the whole crypto market.

BitMine has $5.5 billion worth of ETH completing its biggest macro trade. The world’s largest Ethereum treasury company, BitMine Immersion Technologies, has targeted a huge $20 billion raise to increase its treasury. BitMine is becoming ETH's biggest macro trade of the decade, with a long-term target of $704,000.

The firm has aggressively accumulated 1.2 million ETH since the beginning of July, and its treasury is now worth almost $5.5 billion. Meanwhile, company stock (BMNR) has skyrocketed 1,300% over the same period.

If ETH fails to clear the $4,780 resistance, it could start a downside correction.Analysts predict that there is a chance that the coin could dip below $4600 due to correction.

An upside break above the $4,950 resistance might call for more gains in the coming sessions. If this happens, Ether could rise toward the $5,000 resistance zone and could create history by reaching its new ATH of above $7500 by the end of this year.

Standard Chartered raised ETH price targets to $7,500 by year-end and $25,000 by 2028 as institutional demand drives ETH near record highs. He thinks Standard Chartered's year-end price forecast for Ether is low.

Source: X

So what is the year end price prediction of the coin by Tom Lee? Tom Lee called it "one of the biggest macro trades of the next decade." He thinks that the token has shown a consistent level of surge from past months and the way financial institutions are demanding the forecast would be higher than expected.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.