According to the data for SoSo Value, Ethereum ETFs have hit its all time high weekly inflow of $2.85. This massive surge has created waves in the world of cryptocurrency and also boosted the confidence of the ETH audience as well as news investors who see a strong green signal before investing.

Earlier, it set a weekly inflow record of $2.18 billion with a total net asset value of $18.37 billion when coin was trading around $3,551.59. And this time, ETH went even further, breaking its own record and pushing inflows to a new high.

Currently, according to the data of CoinMarketCap the coin is trading at $4,256.36 (at the time of writing) and today running low by 4.66%. This might be due to Fed rate cuts and rising geopolitical tensions added more uncertainty to the market.

Investors should stay positive as Ethereum ETFs inflows keep rising, and the current price dip looks temporary.

As per the last updated record of SoSo value on August 15, the Total net asset value of Ethereum ETFs is $28.15 billion which is 5.34% of its market cap and the Cumulative sum net Influx of $12.67B.

Apart from this the Total value traded by Ethereum ETFs is $3.4 billion with a daily sum net outflow of $59.34 million.

As of August 15, Blackrock (ETHA) has shown a daily sum net influx of $338.09m and cumulative net influx of $12.16B, whereas Grayscale(ETHE) and Fidelity (FETH) is showing an outflow of $101.74, and $272.23M.

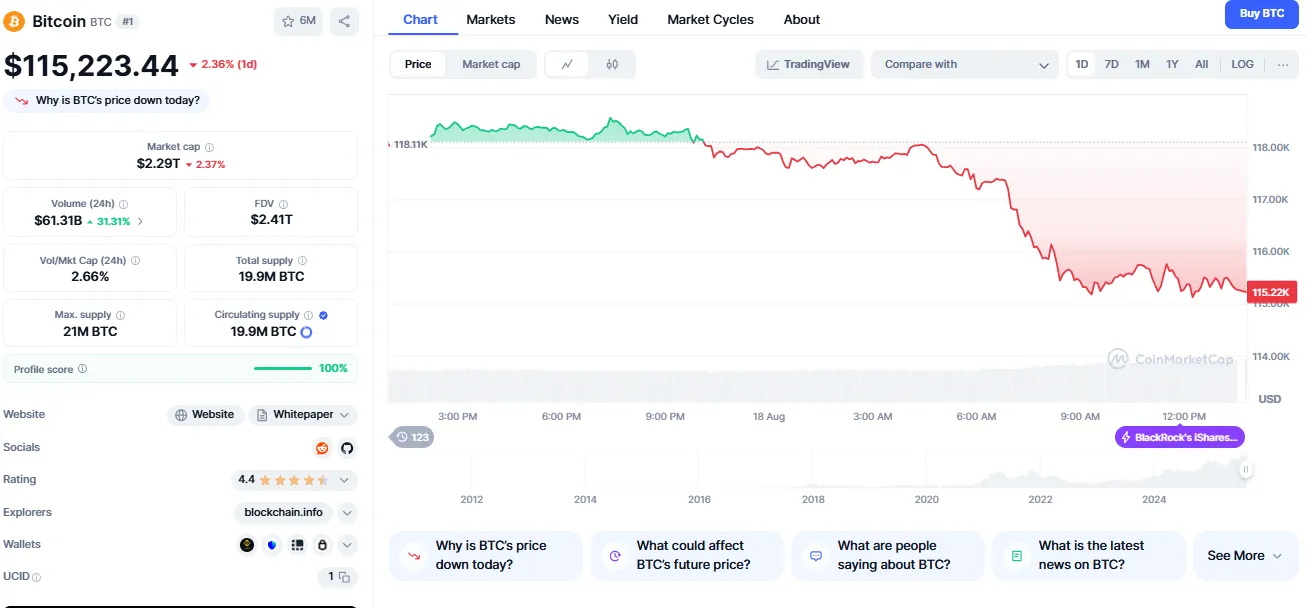

Bitcoin has made its all time high by gaining its price to $124k on August 14 and currently it is trading at $115,223.40 and running low today by 2.36%, according to the data of CoinMarketCap.

It might be a reason that as big Bitcoin holders moved a huge amount of BTC to exchanges that hints they might sell which is putting downward pressure on the price.

At the same time geopolitical risks could also be a reason for the lowering price of Bitcoin.

Source: X

But if you compare the BTC ETF inflow whose weekly total ETF inflow is $547.82 million which is little high if compared with the previous week which was $246.75M.

The total net asset value of $151.98B which is 6.54% of BTC market cap and the total value traded by BTC is $3.28B, Cumulative total net inflow of $54.97B. The daily total Bitcoin ETF in flow is $14.13million.

Source: SoSo Value

Although the BTC ETFs are not showing as positive signals like Ethereum ETFs inflow.

Many big investors like BitMine and Sharplink are buying ETH aggressively and boosting their treasuries. Whereas recently World Liberty Financial which is a DeFi project linked to the Trump family, has invested $18.6 million in the coin which shows that it is slowly leading the market.

ETH just set a new benchmark, giving investors a positive signal, while Bitcoin’s $3.38B weekly ETF inflow record in 2024 still stands unbroken, keeping investors' confidence steady.

ETH's new record boosts investor confidence, while Bitcoin’s old ETF inflow record keeps the market cautious.

Akanksha is a dedicated crypto content writer with a strong enthusiasm for blockchain technology and digital innovation. With a growing footprint in the Web3 space, she specializes in turning intricate crypto topics into clear, engaging narratives that resonate with readers across all experience levels. Whether it's Bitcoin, emerging altcoins, DeFi platforms, or NFT trends, Akanksha delivers timely and insightful content that helps audiences stay informed in the ever-evolving crypto market. Her analytical approach, combined with a passion for decentralized finance, allows her to craft informative pieces that empower both new and experienced investors. Akanksha firmly believes in the transformative power of blockchain to reshape global systems and drive financial inclusion.