What if Wall Street is quietly preparing for Ethereum $10K prediction to come true—and no one’s paying attention? In a stunning move, BitMine Immersion just announced its stock options will trade on the NYSE starting July 23.

But that’s not even the big story. The real shocker? Firm wants to acquire 5% of all of this tokens in circulation. This BitMine news is making waves across the crypto world.

In a bold strategic shift, BitMine Immersion (NYSE: BMNR) just announced that its stock options will begin trading on the New York Stock Exchange from July 23.

Source: Wu Blockchain

But the bigger headline? The company has openly stated its plan to acquire 5% of this token—a move that signals long-term conviction and is sending shockwaves through crypto circles.

According to the company, this decision aims to enhance liquidity and investor exposure. But beneath that, it's clear: Company’s Ethereum strategy points to growing institutional confidence in cryptocurrency.

This story instantly connects to the MicroStrategy Bitcoin strategy, in which Michael Saylor's firm began purchasing BTC in huge amounts and impacted the entire market. Now, firm seems to be attempting a similar playbook with this coin, signaling a new wave of corporate conviction.

The parallel is striking: a public firm buying large amounts of a top crypto asset, going public with its intention, and using stock market instruments to build investor trust. This is the reason MicroStrategy BitMine immersion is so powerful.

If company captures 5% of supply, it could restrict liquidity and trigger the next bull run 2025. As a crypto analyst, I take this as an opportunity to consider a potential signal of deep institutional accumulation that might take place shortly before a major breakout later this year.

Currently, price stands around $3,620.50, down 2.8% in 24 hours. Trading volume dropped to $38.3B—hinting at post-rally exhaustion. So, why is ETH falling today even though the overall market mood is positive?

Looking at the ETH price analysis:

The RSI is at 77.30, which means it is currently overbought and could take a break or move sideways for a bit.

The MACD shows that momentum is slowing down, so while this token is still climbing, it’s doing so more slowly. That doesn’t mean the rally is over—just that it might take a short break before making its next big move, especially if a fresh trigger comes in."

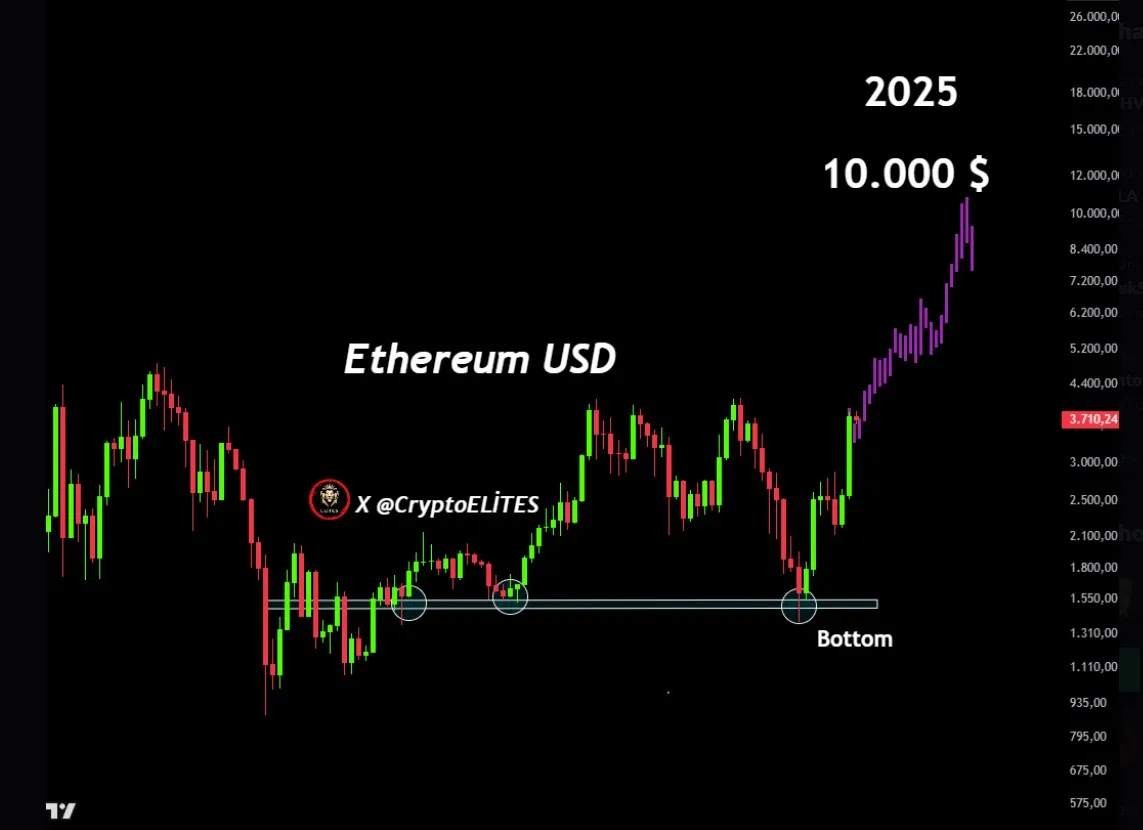

A lot of traders are now wondering—can it really hit $10K by 2025? According to CryptoELITES’ bold Ethereum $10K prediction, the right conditions could make it happen sooner than expected.

Let’s break it down:

Short-Term ETH Price Target (Q3 2025): $3,400–$3,900

Mid-Term Price Target (Q4 2025): $4,500–$6,000 (Layer-2 boom + ETF buzz)

Long-Term: Ethereum price prediction $10K possible by end of 2025 with macro tailwinds, network upgrades, and ongoing burn.

If the BitMine Ethereum strategy plays out, it could tighten supply—and that alone might justify a $10K ETH price target in this bull cycle.

Whether you’ve been waiting for a sign to re-enter the market or a long-term holder, this Bitmine news of NYSE trading is hard to ignore. A public firm setting sights on 5% of currency feels like the early days of BTC’s rise—only this time, Ethereum $10K prediction is in the spotlight.

For now, ETH price analysis points to short-term consolidation. But with institutions stepping in, the move may just be the smart money signal to watch.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.