In a move that stunned the crypto world, BitMine Immersion Technologies has officially confirmed that its ETH holdings have surpassed $1 billion, just seven days after closing a $250 million private placement.

Now investors are bullish on whether ETH reach $10K target now. With 300,657 tokens on its balance sheet, BitMine Ethereum holdings Outpacing event is drawing strong comparisons to MicroStrategy’s Bitcoin playbook—but this time, this second largest cryptocurrency is the focus.

In the latest Ethereum news today, CEO Jonathan Bates called the move “a signal of conviction in token’s long-term value.” Their bold goal? Acquiring and staking 5% of the coin’s total supply.

BitMine Ethereum treasury strategy has caught the attention of institutional investors, many of whom are now watching closely and asking, “Will it go up from here, or is a correction next?”

According to AI analyst account Alva, “BitMine isn’t just stacking ETH—they’re announcing to Wall Street that the asset is ready for prime time.”

Source: Wu Blockchain X

This statement came after Wu blockchain X Account confirmed the news in its latest post. Such a shift in narrative—from a developer chain to a treasury-grade asset—would likely change corporate crypto strategies.

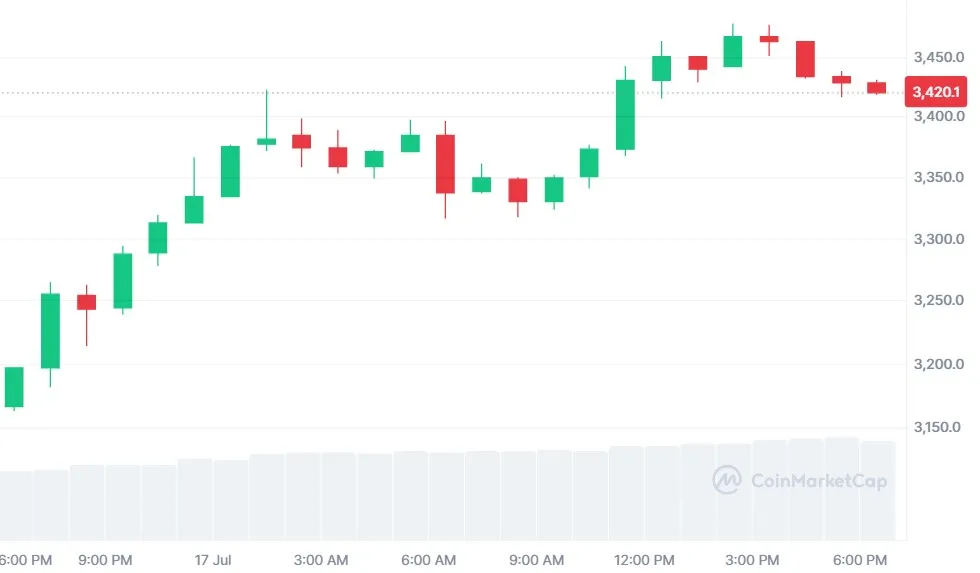

Following the announcement, altcoin’s price surged 7.5%, breaking above $3,400 for the first time in five months. Trading volume exploded over 42%, with bullish momentum clearly building while fueling debate on why it is going up today?

Technical indicators are painting a clear breakout: MACD has turned positive, RSI signals oversold conditions, and open interest in its futures keeps rising. A new trend may just be starting.

While sentiment is bullish, not everyone agrees on the short-term path. The token first retest the $2,800 to $3,000 support range before targeting the $3,800 to $4,200 zone.

This TradingView chart shows a clear breakout: the price has surged above the upper Bollinger Band with rising momentum, suggesting strong bullish pressure for Ethereum price prediction breakout. Analysts also believe that it could reach $6K soon, with the long-term Ethereum price prediction going as high as $10,000.

Bitmine Ethereum Holdings move may be the beginning of a broader trend. If other companies follow suit, the price surge could see a supply squeeze that pushes value to unprecedented levels.

With long-term projections floating around $6,000 to $10,000, the answer to: Will ETH reach 10,000 is quite clear. As demand increases and supply tightens through staking, token’s next leg up could be sooner than expected. The market is closely watching the momentum carefully, so to stay ahead of this supercycle, always do your own research and track the latest news to avoid high risk in the cryptocurrency market.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.