Is the Ethereum price surge of almost 20% today just the beginning of a larger rally? What's the next ETH price prediction everyone's buzzing about?

It is taking center stage once again, blasting around 20% in less than 24 hours to trade at approximately $2,219 as per CoinMarketCap. This 20% surge has rekindled tremendous bullish sentiment in the crypto universe, energized by whale purchases, an pectra upgrade, and aggressive high-leverage play by traders.

Here's what's propelling the coin upward—and where it might be going next.

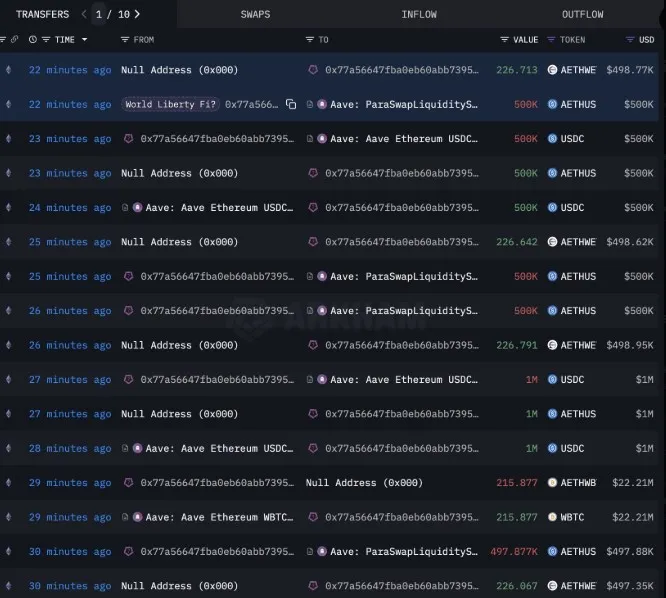

1. Ethereum Whale Buying 1,587 $ETH Today: Trump-Linked Wallet Fuels the Rally

Source: Lookonchain Data

The ETH price surge went into overdrive courtesy of some serious whale action. A wallet suspected to be affiliated with Trump's World Liberty purchased 1,587 ETH (~$3.5M) and 9.7 WBTC (~$1M) in a high-risk move, Lookonchain reports.

The Pectra update, which has been live since May 7, is one of the major drivers fueling the rally. The huge update reduces Layer-2 fees by 40%, increases the validator limit to 2,048 tokens, and allows users to pay gas fees using ERC-20 tokens.

Source: X

These developments charged this token's scalability, taking its real-world asset (RWA) value to $6.6B—a 32.8% monthly increase.

As a crypto analyst keenly observing the latest market developments, my observation is that the FOMC meeting's announcement of keeping the rates unchanged has been greatly affecting the price rally. So let's breakdown Ethereum FOMC rally price prediction now.

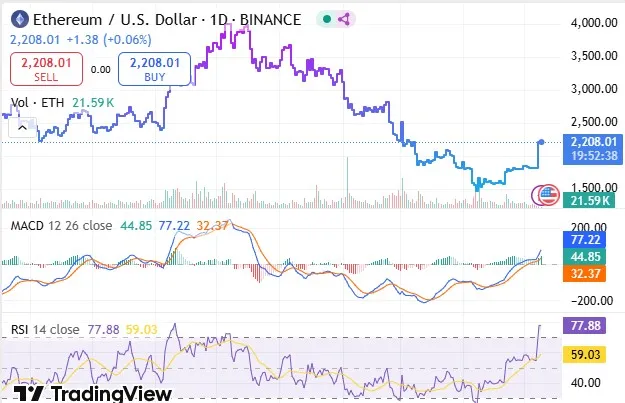

Source: TradingView

Technically, the TradingView chart shows that Ethereum is looking strong, but traders should stay careful. The MACD is showing good buying strength—the MACD line (77.22) is much higher than the signal line (32.37), and the chart also confirms that buying pressure is growing. At the same time, the RSI stands at 77.88, which drives this coin into the overbought range.

Key levels to watch:

Support: ~$2,050

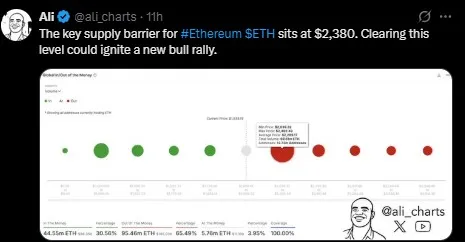

Resistance: ~$2,380 (highlighted by Ali Charts as a key "supply wall").

As per one well-known crypto analyst Ali Martinez, The $2,380 resistance level is a break-or-make level—many traders can sell here in order to break even, causing selling pressure. But if it breaks through, a new bull run towards $2,600–$2,750 might spark quickly.

Source: Ali Charts

This top cryptocurrency is sitting at the crossroads of whale buying, technical upgrades, and bullish momentum, where will it go from here?

Short-Term (1–2 weeks): It may soon retest the $2,380 resistance. Expect possible dips to $2,050–$2,100 if overbought signals trigger a cool-down.

Mid-Term (1–3 months): A confirmed breakout above $2,380 could send this coin skyrocketing to $2,600–$2,750.

Long-Term (6+ months): With positive macro drivers its price could aim for $3,200–$3,500. On the flip side, downside risks include a fall back to $1,800 if market sentiment shifts bearish.

Why ETH is going up is concluded comprehensively, and the explosive ethereum price surge action is due to a perfect storm of whale purchases, high-stakes trading, and a successful network upgrade.

The battleground of choice? $2,380. A breakout there can unleash its next great bull wave. In the meantime, do your own research and watch this coin closely—be prepared for opportunity and for volatility.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.