Ethereum price surge today isn’t just another spike in a bull market—something far more strategic is happening behind the scenes.

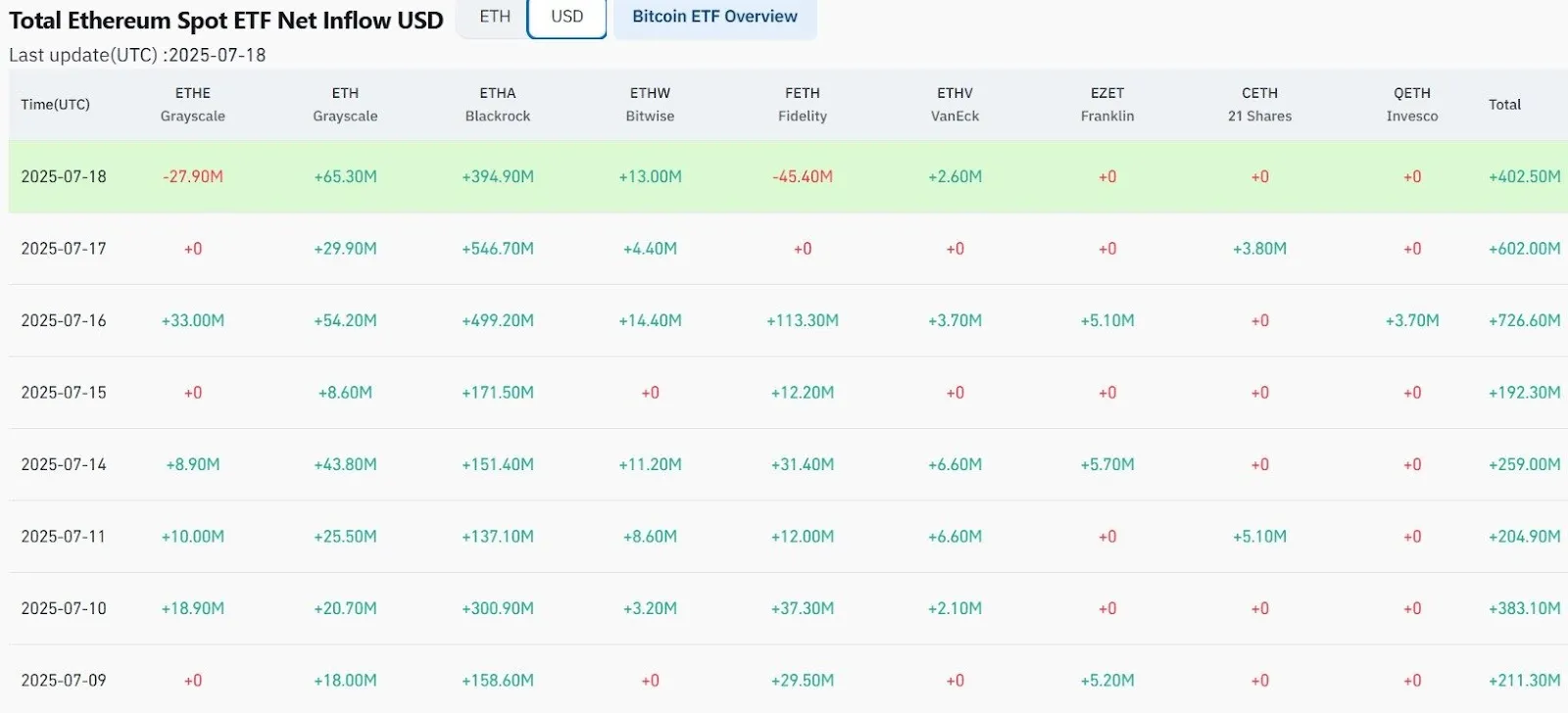

Over the last 48 hours, this altcoins has done what Bitcoin couldn’t: outpace it in ETF inflows. But why are institutions suddenly shifting billions toward this altcoin, and what does it signal for the market next?

In the latest Ethereum news today, this rare flip has crypto analysts buzzing, ETH ETF products have now recorded more inflows than Bitcoin for two straight days. This historic shift signals not just a bullish wave — but a Wall Street reallocation toward the altcoin season.

At the heart of this move? The GENIUS Act, passed earlier, which offers clear legal guidelines and framework for stablecoin and staking infrastructure—and institutions are acting fast.

On July 21, the token touched $3,800—the first time since December 2024. It is now up 52% in July alone and trading at $3,796.98 with a market cap of $458.45 billion, according to CoinMarketCap. Volume? Surging 46.88% in 24 hours, now sitting at $44.53B.

Source: CoinMarketCap

As far as my analysis being a cryptocurrency expert, the bigger signal isn’t price—it’s positioning.

Perpetual open interest (OI) jumped from $18B to $28B in just seven days. That’s billions in new leveraged bets, largely driven by institutional desks, according to DEX platform Storm Trade.

Crypto analysts aren’t just watching inflows, they’re watching the charts. A widely shared ETH/USD monthly chart shows a break of structure (BOS) in early 2025.

ETH Key Levels at a Glance:

Resistance Zone: $3,800–$4,000 — It hasn’t broken this since 2021.

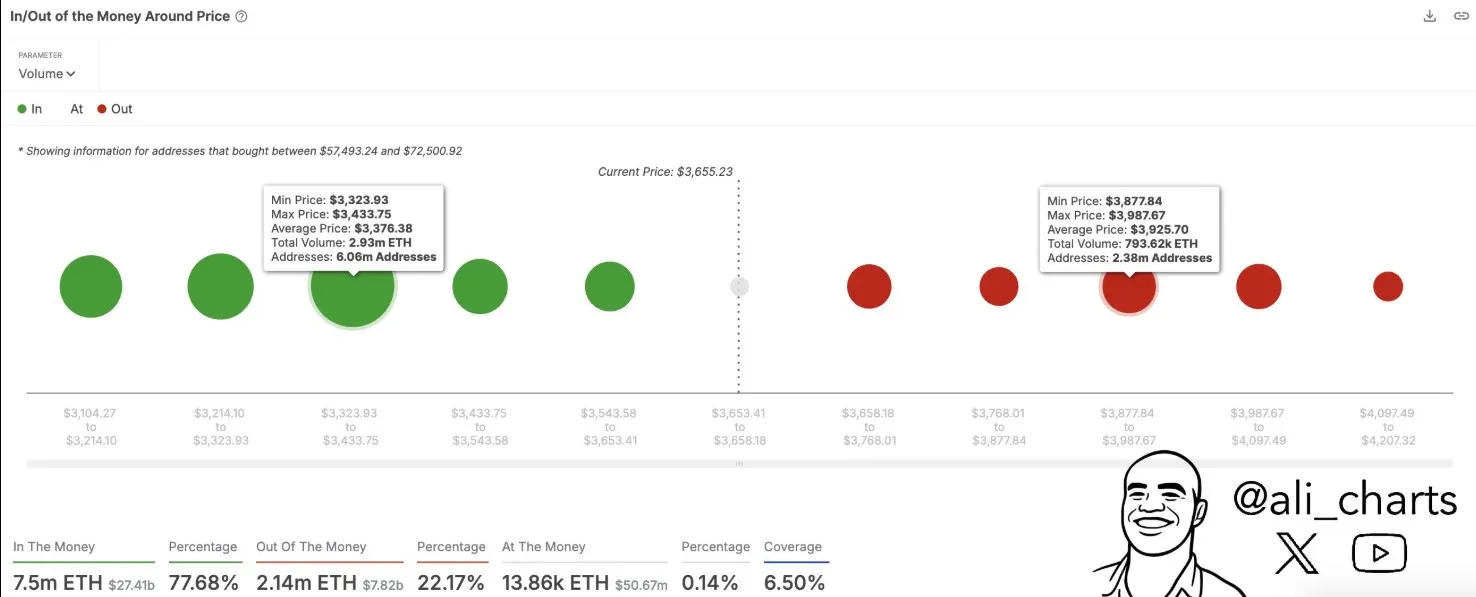

Support Zone: $3,323–$3,433 — Over 6M wallets bought here = strong support as per Crypto analyst Ali Charts.

Source: Ali Charts

Resistance Cluster: $3,877–$3,987 — Held by 2.38M wallets = potential selling pressure.

Breakout Signal: Clearing $3,987 could lead to a fast move higher.

Unlike previous price surges driven by hype or halving cycles, this wave has regulatory teeth and ETF muscle behind it. According to Coingabbar's analysts, Ethereum ETF inflows from BlackRock’s ETHA product are already exceeding early-stage expectations.

The GENIUS Act further fuels momentum by making this altcoin staking infrastructure more accessible to institutions. This is why many believe the altcoin season isn’t upcoming—it’s already unfolding.

Top analysts have shared short-term bull run price predictions of $4,000–$4,200, while mid-term targets stretch as far as $5,600 if macro momentum and ETF flows hold.

Breakout confirmation will come from daily closes above $4,000, turning resistance into support. With on-chain support and ETF liquidity in place, it may soon retest its $ETH new ATH near $4,878—or even surpass it.

The narrative has flipped: Ethereum price surge today is not a one-off event. With price signals strength, ETF inflows building, and institutional reallocation underway, it is leading a quiet but powerful transformation in market structure.

The next 72 hours could decide if ETH cements its breakout—or triggers the biggest wave of profit-taking since its 2021 peak.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.