Something strange is happening this quarter—Ethereum is outperforming Bitcoin in ways that cannot be ignored.

After years of being considered the second runner-up, it is now stepping up in Q3 2025 and creating dramatic changes in trader sentiment, and has brought one major question to the forefront: is this the official start of Altseason 2025?

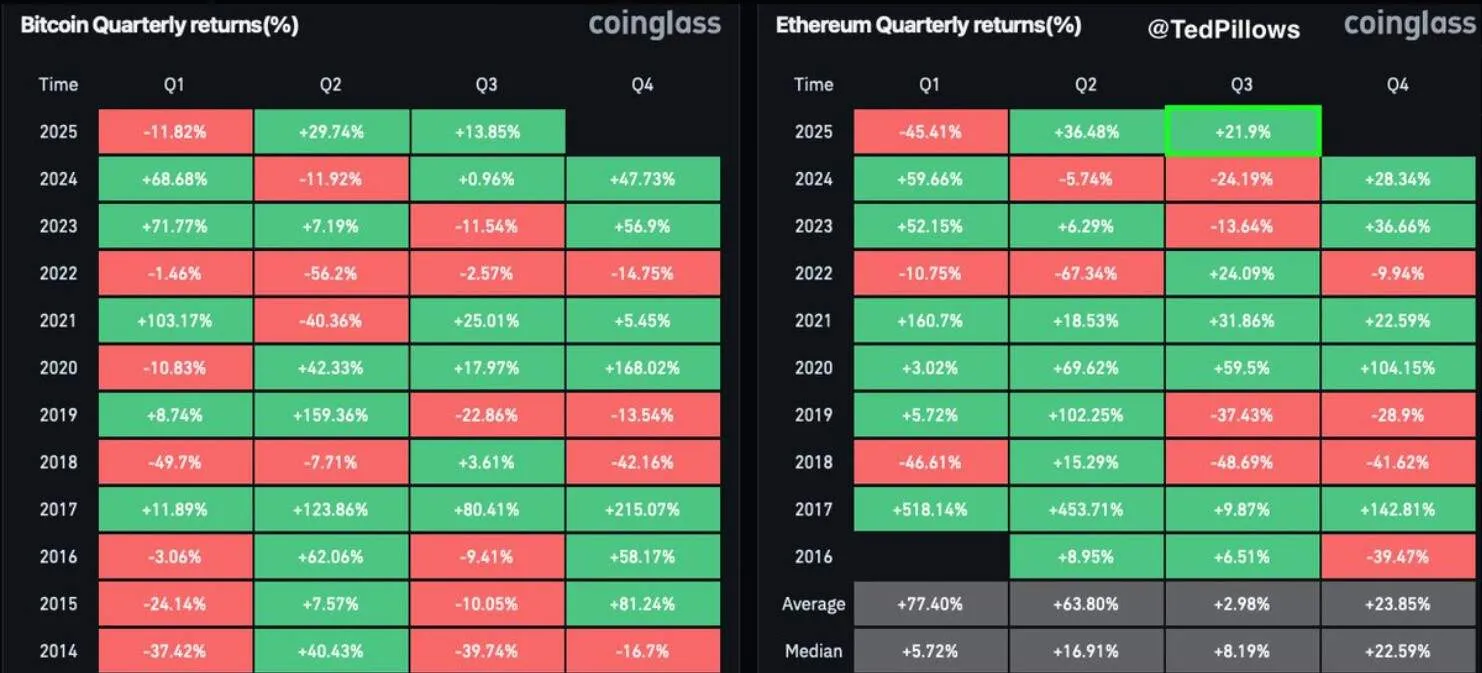

So far in Q3, it has delivered a +21.9% return, compared to BTC's +13.85%, according to data from the Coinglass chart. This isn’t just a temporary flip. Historically, this cryptocurrency tends to outperform in Q3—and this time, it's doing so with real strength in market structure.

Crypto analyst and OKX partner Ted Pillows shared a bold chart on X last week, stating:

“$ETH is currently outperforming $BTC in Q3. Altseason loading.”

And the data agrees. With worl's largest cryptocurrency cooling after a strong first half of 2025, all eyes are now on $ETH.

Ethereum price outlook Today : Technical indicators are flashing green. On the daily chart of TradingView, The token’s RSI is nearing 74—typically a sign of overbought conditions—but there's no bearish divergence in sight. The MACD line continues to show bullish momentum, confirming that buyers are still in control.

It is also trading comfortably above the $3,000 psychological level, a zone that many traders see as the new battleground for long-term support.

In contrast, Bitcoin's RSI and MACD are showing signs of cooling. After briefly touching a high near $123,000, BTC has pulled back toward the $117,000 range, where it now faces some resistance.

A chart that’s gaining massive traction comes from trader Merlijn, who believes this currency is now mimicking another token's legendary 2020 breakout.

Here’s what the data shows:

83% correction in the bear cycle

Followed by a 342% rally

Then a steep 63% drop

After which, Bitcoin surged over 1,100%

If this roadmap holds, it suggests that the asset may be gearing up for one of the biggest rallies of this bull market—possibly leading a massive Ethereum altcoin rally.

This is why traders are starting to treat ETH not just as another coin, but as the leading indicator of where the entire crypto sector may go next.

There’s always been a rhythm to crypto markets: Bitcoin rallies first, then $ETH takes the lead, and finally, altcoins explode.

But this time, the token may have jumped the queue. Coingabbar Analysts are calling it early: the altcoin season today might be starting with this token, not BTC.

For long-term investors, this performance isn't just a number—it’s a potential shift in the balance of power. If the coin continues its current trajectory, it may bring renewed attention to the broader altcoin market.

For active traders, the ETH vs BTC chart is becoming a go-to tool for identifying strength and momentum.

Key Takeaways:

Ethereum vs Bitcoin Q3 data shows ETH clearly leading

MACD and RSI for ETH support continued upside momentum

BTC remains stable, but the current coin is gathering steam

Ted Pillows and Merlijn both point to ETH as a market leader

Signals of altcoin season 2025 are building fast

If Bitcoin holds the floor—and Ethereum pushes higher—we may look back at Q3 2025 as the quarter altseason truly began.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

2 months ago

Good