Have big investors started trusting ETH again? As the market slowed down and prices pulled back, one large Ethereum holder made a bold move. Instead of selling, the whale borrowed money and bought more of this digital currency, adding fuel to the growing story of Ethereum Whale Accumulation.

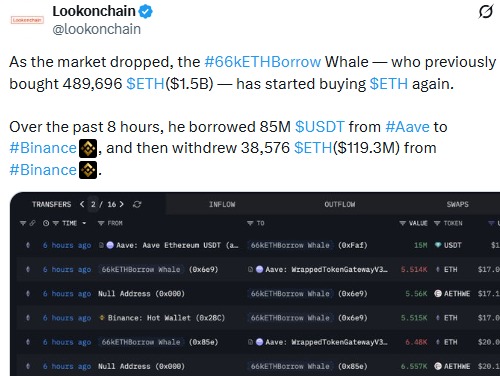

According to Lookonchain data, the wallet known as the “66K ETH Borrowed Whale” borrowed $85 million USDT from Aave. The funds were sent to Binance, and soon after, the address withdrew 38,576 coins, worth about $119 million.

This buy happened when the 2nd best cryptocurrency's price dropped from around $3,300 to near $3,090. Instead of waiting, the big investor used the dip as a buying chance. This move clearly adds to ongoing Ethereum Whale move.

Source: X (formerly Twitter)

This is not a new player. Earlier this year, when the cryptocurrency was trading above $4,000, the same investor borrowed heavily using ETH as collateral. As prices fell, the strategy changed. Instead of exiting, the wallet started buying more.

On November 22, the wallet bought 114,684 coins in just two days. Before the latest purchase, it already held 489,696 tokens. Now, total holdings stand at 528,624 tokens, valued near $1.63 billion.

The wallet currently has $647.7 million in debt on Aave, with a liquidation price close to $1,594, which is far below today’s price.

To small traders, borrowing during a dip may look risky. However, in the case of big investors, this action can be a strategy. They can borrow stablecoins in order to raise their balance without selling their tokens.

Such an Ethereum Whale Accumulation can normally depict a level of confidence in a particular goal, such as an increased value in the future. The above does not have a direct impact on ensuring a gain in price but can affect a stable market environment.

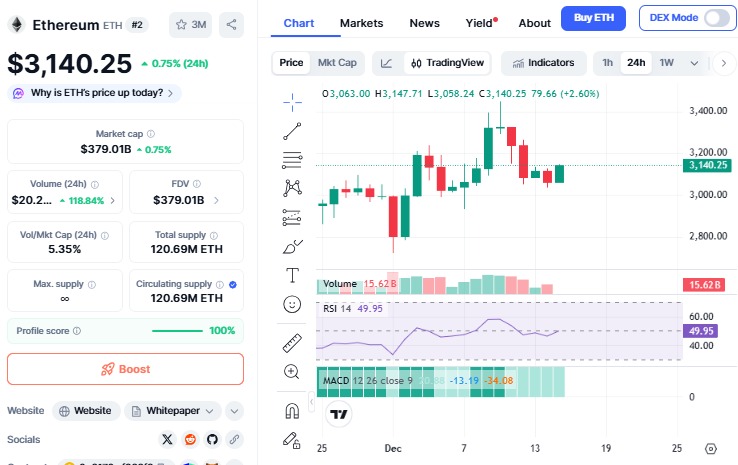

The current price of the currency is $3,140. It is up 0.77% in a day. This is a slightly better performance than the whole crypto market. The net outflows in daily ETH ETF are $19.41 million as per Sosovalue.

Source: CMC

Technical Indicators

It is trading above the 30-day average at $3,036.

RSI at 46.28 depicts neutral momentum with no overbought pressure.

The MACD is at +23.39 signals early bullish strength.

Momentum indicators are mixed, featuring neither strong buyers nor strong sellers.

Below is the short-term ETH price prediction:

Bullish Case: If support at $3,100 is maintained, it may attempt to increase towards $3,250.

Bearish Case: If selling pressure rises, a re-test of support at $3,030 might happen.

This accumulation is emerging as an important market indicator with big investors continuing to accumulate during a quiet market.

Although no less risk remains, such huge investment trends imply confidence in crypto’s strength in the future.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.