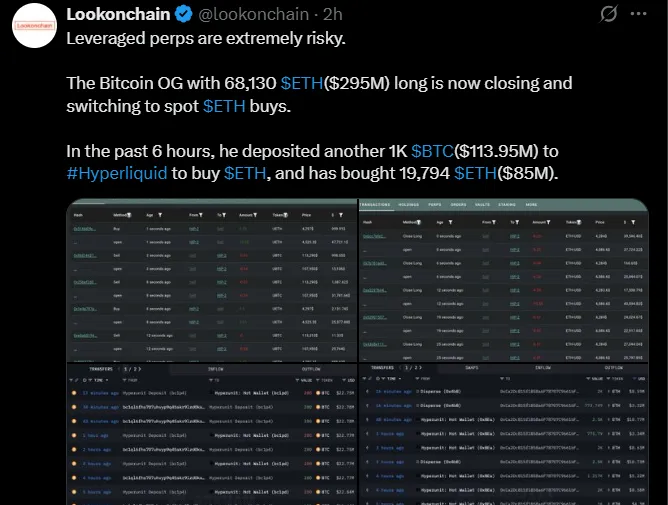

One Altcoin currency is suddenly at the center of market drama. According to Lookonchain ETH whale buying data, a legendary Bitcoin OG holding 68,130 ETH ($295M) has closed leveraged longs and switched to spot $ETH buys.

Within six hours, he even sent 1,000 BTC ($113.95M) to Hyperliquid, converting it into 19,794 altcoin tokens ($85M).

This isn’t just another shuffle of coins, it comes right before the U.S. Fed’s September rate cut decision, which many believe could be the trigger for pre-rate cut rally. The spotlight on Ethereum Whale Buying is stronger than ever.

Bitcoin OG Switch: Closed risky leveraged positions and built a safer, longer-term spot ETH stack, which shows confidence in the asset outperforming $BTC.

The U.S. Government Buy: They have Accumulated 332,460 tokens ($281M), which results in a strong backing ahead of potential price rise.

BlackRock Sells Big: Offloaded 63,280 altcoins ($271.9M), it could be a shakeout before a breakout, or smart profit-taking ahead of volatility.

All of these activities in the last 24 hours adds to the mixed narrative of institutional moves in crypto news today.

Bitcoin price is trading at $113,386. Weak RSI at 42 for now, but sellers are in control. It may risk slipping to $110K.

According to the Tradiview price chart data, second largest cryptocurrency price increased, currently sitting at $4,296. Healthy RSI at 57 represents a strong demand near $4,200, and it is also ready to break $4,400 resistance.

Side by side, altcoin looks resilient while $BTC looks exhausted. The charts echo what this whale buying has been signaling: the next big play may belong to the the altcoin's market.

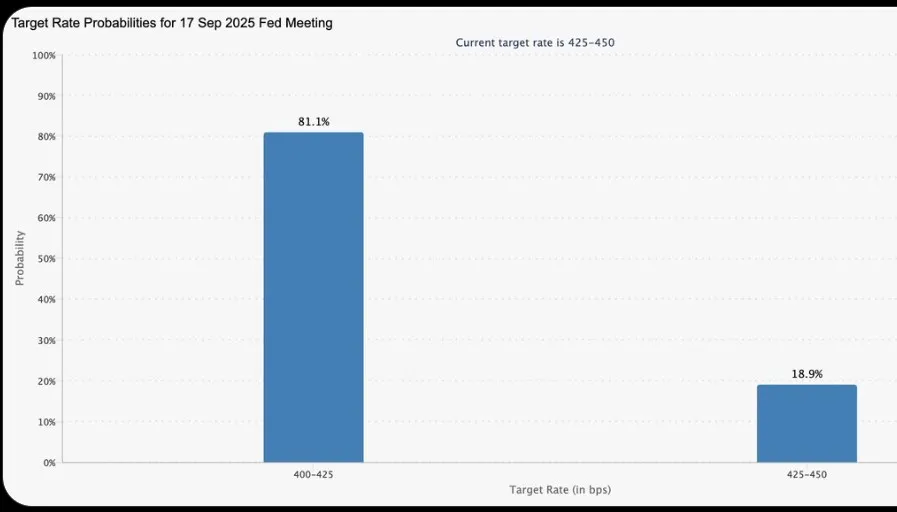

Crypto analyst Carl Moon highlighted an 81.1% chance of a Fed rate cut in September. His bold advice:

“BUY ANY ALTCOIN NOW… SELL IN DECEMBER.”

At the same time, its futures trading volume has surpassed Bitcoin’s. This isn’t just another number — it’s proof that traders and institutions are shifting focus. Analysts are linking this surge directly to Ethereum $5000 prediction levels.

Let’s piece this together:

A Bitcoin OG closes leverage and stacks spot $ETH.

The U.S. government quietly accumulates hundreds of thousands of this assets.

BlackRock sells, perhaps to reset the board.

Analysts scream “altcoin season” before the Fed rate cut September decision.

Charts show our current asset is stronger than BTC.

This isn’t random noise. This is Ethereum Whale Buying turning into orchestration — a coordinated buildup before $ETH price prediction breaking its all time high come true.

Whether it’s a pre-rate cut rally or just big players playing profit games, one thing is certain: This whale news is the loudest signal in the market right now and the next move could redefine its role against Bitcoin.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.