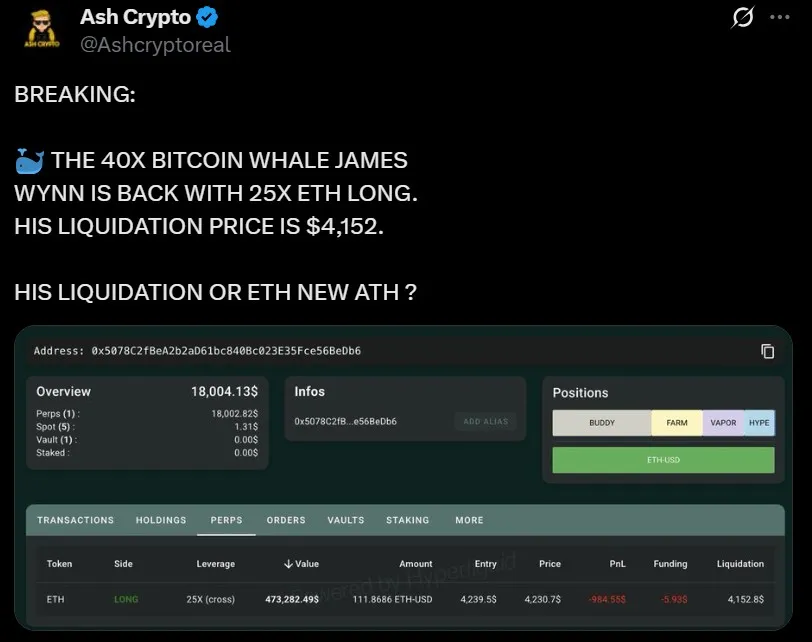

The crypto market is buzzing with the fresh news of Ethereum whale buying after James Wynn, one of the most followed whales, entered a 25X long position on $ETH with a liquidation price at $4,152.

According to the Ash Crypto latest X post, this bold move has divided the community: will ETH price secure a new all-time high (ATH), or is James Wynn Ethereum leverage risking liquidation if the market pulls back?

At the time of writing, price trades at $4,289, slightly lower after peaking near $4,800. On the technical side:

According to the TradingView Binance chart analysis, RSI is at 59, showing neutral-to-bullish momentum but cooling from earlier highs.

MACD has turned weak, signaling caution in the short term.

Candlesticks suggest the token is forming lower highs and lows, a sign of correction.

Key levels to track after this latest Ethereum whale news are: $4,200 and $4,000 as support, while resistance stands at $4,350 and $4,500. A break above $4,800 could push prices toward new highs.

Well-known analyst Merlijn The Trader explained that the altcoin is following the Wyckoff cycle — accumulation, shakeout, and now distribution.

During the dip, weak investors sold, but strong holders stayed in. After looking at the chart, Merlijn believes USDT price is entering its Phase 3 lift-off, with upside targets around $5,200–$5,500 if momentum continues.

This insight is now dominating the latest ETH news platforms worldwide fueling what will be the next value target.

Short-term: ETH prediction today could remain in the $4,000–$4,500 range. If $4,200 fails, a test of $3,900 is possible.

Mid-term: Altcoin could rally toward $5,200–$5,500 if support holds.

Longer-term: The token has potential to target $6,800–$8,500, keeping it one of the strongest digital assets on the market.

For anyone following this news today, the overall sentiment remains cautiously optimistic after this full price analysis.

The big question for traders is simple: will Wynn’s massive position succeed, or will the the investor face liquidation if the token dips further? Right now, the token is about 12% down from its all-time high.

Being a crypto analyst, who’s been tracking the token's updates from a long time, I believe Ethereum whale buying amid volatility often creates strong support zones, which could be a bullish sign for the weeks ahead.

James Wynn’s bold leverage bet has put Ethereum whale buying in the spotlight. If support levels hold, ETH price today could make another push toward $5,000+, validating the bullish outlook.

But if $4,000 breaks, liquidation becomes a real threat. For now, the market sees Wynn’s move as both a warning and an opportunity.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.