Alphabet Inc. has now become the biggest shareholder in Bitcoin mining company Tera-Wulf (WULF) after putting more money into an AI project. With this partnership it gets a 14% stake in the company through warrants connected to a lease agreement with Fluidstack. This update is drawing attention in the Terawulf Google finance story.

Source: X

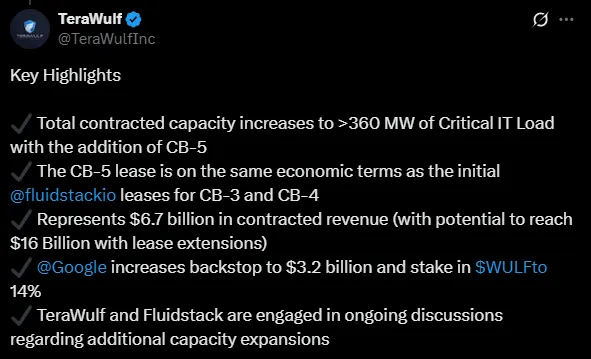

WULF has signed a 10-year lease deal with Fluidstack for its Lake Mariner data center in New York. To support this, Alphabet Inc. is giving a $3.2 billion guaranteed support.

In exchange, the tech giant got the right to buy over 73 million shares, which makes it the biggest shareholder in the organisation. The company’s strategy head, Kerri Langlais, said this shows strong trust in firm's zero carbon projects. The updates have already drawn a lot of attention in Terawulf Google finance news.

Source: X

Tera-Wulf has decided to keep its current Bitcoin mining operations but will not make them bigger. Instead, putting more focus on AI and high-performance computing (HPC). This change comes after the Bitcoin halving in April 2024, which reduced mining rewards to 3.125 BTC per block. Because of this cut, mining has become less profitable, pushing new opportunities in AI and HPC.

Tera-Wulf expects its deal with Fluidstack to bring in $6.7 billion, which could grow to $16 billion with lease extensions. Analysts following TeraWulf Google finance see this transition as key to long term profitability.

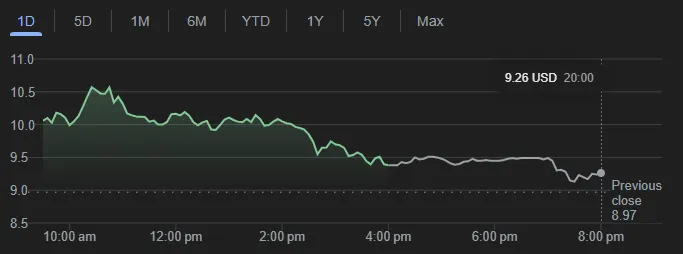

Investors react positively to this deal. On Monday, WULF stock first went up 17% to $10.57 from $8.97. But by the end of the day, it dropped back to $9.38.

Even with ups and downs, WULF shares have jumped over 72% in just five days after the deal was announced. This strong rally has been a key focus in TeraWulf Google finance news, showing investors confidence on partnership.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.