An Ethereum whale just woke up after nearly a decade of inactivity, and it's turning heads across the crypto industry. Around six hours ago, this early ICO participant moved all 1,140 ETH, now worth about $2.88 million, out of two Genesis wallets as reported by the Lookonchain. Back in 2015, the total cost of that ETH was just $353. Which makes a percentage increase of almost 81,500%.

Source: Lookonchain

But this isn’t just a one-off event. It’s part of a broader trend that’s starting to look like something much bigger.

This movement mirrors recent Bitcoin activity. On July 4, a mysterious wallet holding 10,000 BTC, worth over $1 billion, was activated after being untouched since 2011.

Just a day later, on July 5, eight more dormant Bitcoin wallets came alive, holding over 80,000 BTC valued at $8.7 billion. Here the BTC was around $1.09 billion. These actions sparked hype around BTC: Why now? Is this a sign of something major unfolding?

It looks like Ethereum whales are now following the same path. After watching these sudden Bitcoin awakenings, the altcoin holders from the early days may be positioning themselves ahead of a potential market surge.

It’s not just individual whales making moves. Big names in traditional finance are diving in as well.

BlackRock

BlackRock, the world's largest asset manager, reportedly added over $750 million worth of ETH in June alone. It now holds 1.753 million ETH, about 1.5% of the entire supply of this digital asset.

Even more striking, BlackRock managed to quietly accumulate 175 million dollars worth of this crypto within a span of one year. That kind of conviction doesn't go unnoticed in financial space.

Bit Digital

Adding to the buzz, Nasdaq-listed Bit Digital has shifted its treasury to focus on this altcoin. After raising $172 million in an IPO, the company used the funds to purchase ETH and even sold off 280 BTC to further its strategy for this altcoin. Bit Digital now holds more than 100,603 ETH.

These moves aren't likely random. Whales waking up after 10 years, and institutions aggressively accumulating this digital currency, are raising the same question across the crypto community: Is something big about to happen?

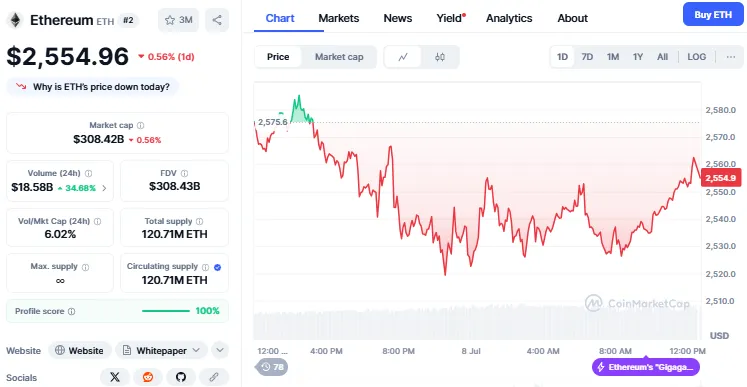

Currently the altcoin is trading at $2,555 with a decrease of 0.56% in a day. Trading volume has increased by 18%. This depicts that as of now, this has not impacted the price, but it is worth watching how the price moves.

Source: CoinMarketCap

Many analysts believe Ethereum could be heading for a major price breakout. Some whales may be positioning themselves to ride the next wave up or preparing to take profits at the expected all-time high.

Ethereum hasn’t yet crossed its previous record of around $4,800, of November 2021, but with growing institutional demand and reduced supply due to staking and deflationary tokenomics, it might not be long before new highs are reached.

The timing of these whale activities, alongside big institutional buys, is hard to ignore. It could be a coordinated move to generate buzz, similar to what happened with Bitcoin. Or it could be a real market signal that Ethereum’s next big chapter is about to begin.

What’s certain is this: Ethereum whales are not sleeping anymore, and that alone is worth paying attention to.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.