Something big is brewing between the U.S. and Europe— and it’s not just talk anymore. If no trade deal is reached by August 1st, the European Union plans to impose a jaw-dropping 30% tariff on $117 billion worth of American exports.

As a crypto analyst tracking global tensions closely, I can tell you this: the impact of these Europe Tariffs On US Goods could shake more than just trade charts.

The Union just fired back—and it’s no bluff. As Bloomberg and The Kobeissi Letter confirmed, the EU is preparing to impose 30% tariffs on $117 billion worth of U.S. goods if no trade deal is struck by August 1st.

Source: X

This sudden announcement follows President Donald Trump’s threat to tax most European exports to the U.S. at the same steep rate.

While some in Washington might have expected diplomatic hesitation, Europe’s rapid response suggests something deeper is unfolding.

The plan involves activating an already-approved €21 billion list of tariff, now merged with a previously proposed €72 billion extension. The goal? Deliver a sharp, proportional hit targeting core American industries — aviation, automobiles, and iconic consumer brands.

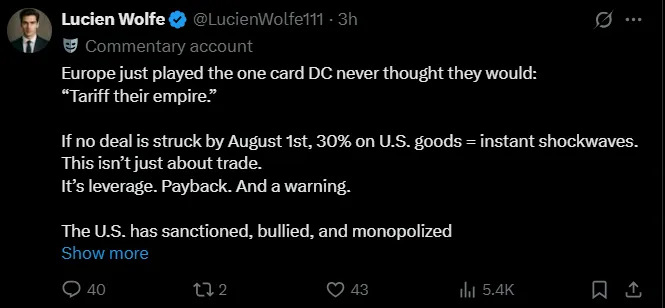

Crypto commentator Lucien Wolfe nailed the emotional temperature of the moment when he posted:

“Tariff their empire… this isn’t about trade. It’s leverage. It’s retaliation.”

As a crypto analyst who’s studied macroeconomic shocks for years, I can say this move changes the tone globally. It’s not just tit-for-tat—it’s Europe stepping out of Washington’s shadow.

The European Commission plans to tax goods that matter politically and economically. Products reportedly affected include:

Boeing aircraft (already under global scrutiny)

American-made cars (targeting Detroit directly)

Bourbon whiskey (a cultural symbol in U.S. exports)

By mirroring Trump’s strategy, the EU is aiming not just at goods—but at influence.

EU officials have clarified: these tariffs go live only if the U.S. imposes its own rate after August 1st. It’s a strategic red line.

Notably, Trump recently cut lower-rate tariff deals with Japan and the Philippines—avoiding full-blown friction. But the same leniency hasn’t extended to Europe. That silence is growing louder by the day.

Germany is even signaling support for deploying the Anti-Coercion Instrument (ACI) — a powerful mechanism that could reshape EU trade defense.

For traders and analysts alike, this developing tension presents both risks and opportunities.

Boeing ($BA), Ford ($F), Brown-Forman ($BF.B) may react sharply.

Euro/USD volatility is already increasing — a critical forex pair to monitor.

Crypto could attract attention if the dollar weakens or markets seek alternate hedges.

The Europe Tariffs On US Goods story is no longer just policy talk. It’s a countdown. And if August 1st passes without compromise, the next financial shock might not come from the Fed or inflation—it could come from Brussels.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.