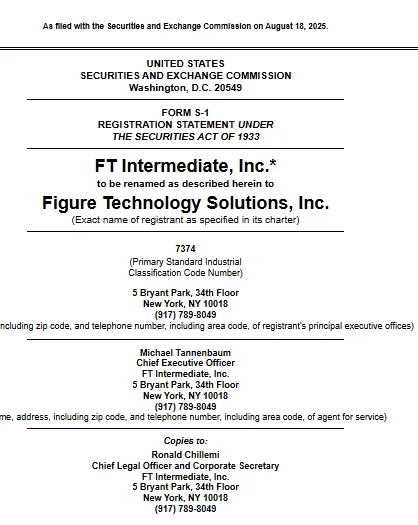

A blockchain-based consumer lending platform run by Figure Technologies IPO filing with the SEC on Monday, which might raise $400 million. The business intends to change its name in line with the offering, although it filed as FT Intermediate.

Source : SEC website

Figure Technologies IPO filing aims for a $3.3b valuation and plans to raise $400m through 20million shares at $22-$25 (expected)

The offering's primary underwriters are BofA Securities, Jefferies, and Goldman Sachs. The companywill be listed under the "FIGR" symbol on the Nasdaq. The money raised from the offering will be used for general cost.The final share price is not disclosed yet.

Source: Wu Blockchain

Figure Technologies IPO filing, stating H1 sales of $191M, up 22.4% YoY, and a profit of $29M, as compared to H1 2024's $13M loss. Since its founding, the company has grown capital-efficiently and achieved strong profitability. As of June 30, 2025, the company had an accumulated deficit and total stockholders' equity of $404 million. Its revenue surged 22.4% to $191 million in the six months.

"Blockchain can do more than disrupt existing markets. By taking historically illiquid assets – such as loans – and putting these assets and their performance history on-chain, blockchain can bring liquidity to markets that have never had such," Cagney said in papers.

The blockchain-lending platform, which was co-founded in 2018 by internet entrepreneur Mike Cagney, facilitates trading, lending, and investing in sectors including digital assets and consumer credit.To date, the organization has created over $16 billion in home equity with its more than 160 partners. The New York-based company and some of its existing stockholders will sell shares in the offering. In 2021, the company raised $200M in a funding round at a $3.2B valuation.

More and more cryptocurrency players are trying to get into public marketplaces this year. Gemini, the cryptocurrency exchange run by the Winklevoss twins, went public in New York last week. Figure Technologies IPO filing is estimated to raise around in between $400M-$500M. The company is joining a growing list of crypto players looking to tap public markets this year.

Figure Technologies IPO filing will be a test of whether blockchain lending can win out over traditional finance giants and crypto-native players. With a stable revenue foundation, demonstrated profitability, and solid valuation, Figure is standing out as a legitimate fintech contender. Its Nasdaq listing later this year will show if investors are willing to support blockchain lending as a mainstream financial product.

Sheetal Jain is a seasoned crypto journalist, content strategist, and news writer with over three years of experience in the cryptocurrency industry. With a strong grasp of financial markets, she specializes in delivering exclusive news, in-depth research articles and expertly optimized on-page SEO content. As a Crypto Blog Writer at CoinGabbar, Sheetal meticulously analyzes blockchain technologies, cryptocurrency trends and the overall market landscape. Her ability to craft well-researched, insightful content, combined with her expertise in market analysis, positions her as a trusted voice in the crypto space.