SUI is trading at $3.48, gaining +1.70% over 24 hours, with smaller gains of +0.10% hourly and +0.87% weekly. The price is stable at the range of $3.40-3.60, having consolidated following a robust July increase.

Futures market activity remains strong, with volume at $5.08 billion, up +1.17%, reflecting continued liquidity and interest from traders. Open interest has, however, fallen to $1.89 billion, showing light profit-taking and cautious repositioning.

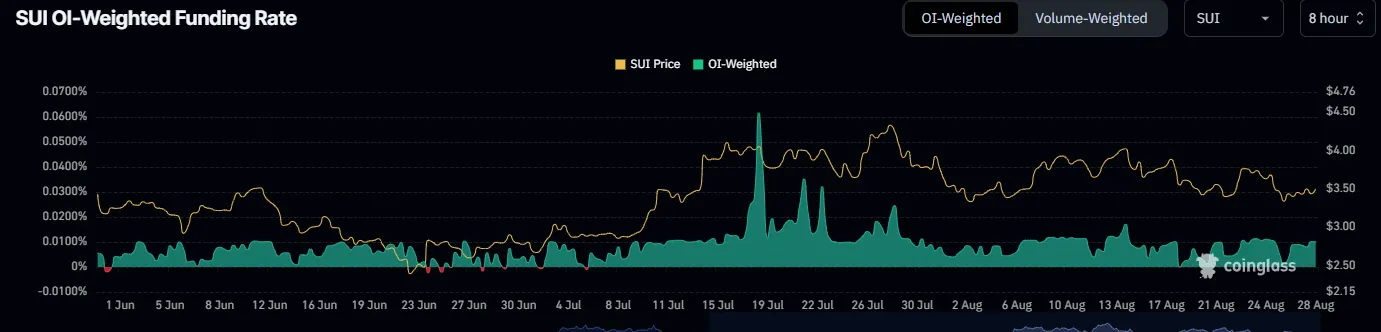

Funding Rate : Source : Coinglass

Coinglass funding rate data verify that sentiment remains bullish, with OI-weighted rates positive, largely within 0.0100% to 0.0300%. Short spikes in mid-July crossed 0.0500, which corresponds to SUI increasing to above $4.0 before the present decline.

The altcoin has become a top blockchain to generate stablecoins, surpassing the performance of ecosystems such as Solana and Ethereum. The average stablecoin APY on Sui is 8.55%, versus 4.73% on Solana and 5.76% on Ethereum.

Bluefin has the highest-yielding platform of all ecosystems at 10.23% APY on USDC and 11.02% on USDT. Other protocols such as Navi and Suilend provide 8.55%8.94% APY on USDC and 5.57%7.01% on USDT.

https://x.com/Torero_Romero/status/1961012484736704534

Comparatively, Ethereum Fluid offers 8.77% on USDC and 7.97% on USDT, which remains below the highest offers of the altcoin. Even more established platforms such as AAVE and Compound have even lower yields, with a range of 3.81%-5.26% in both stablecoins.

Such stable yields always make the altcoin a top choice among stablecoin investors looking to earn risk-adjusted returns. Capital inflow into Sui-native protocols keeps increasing as the yields are still appealing.

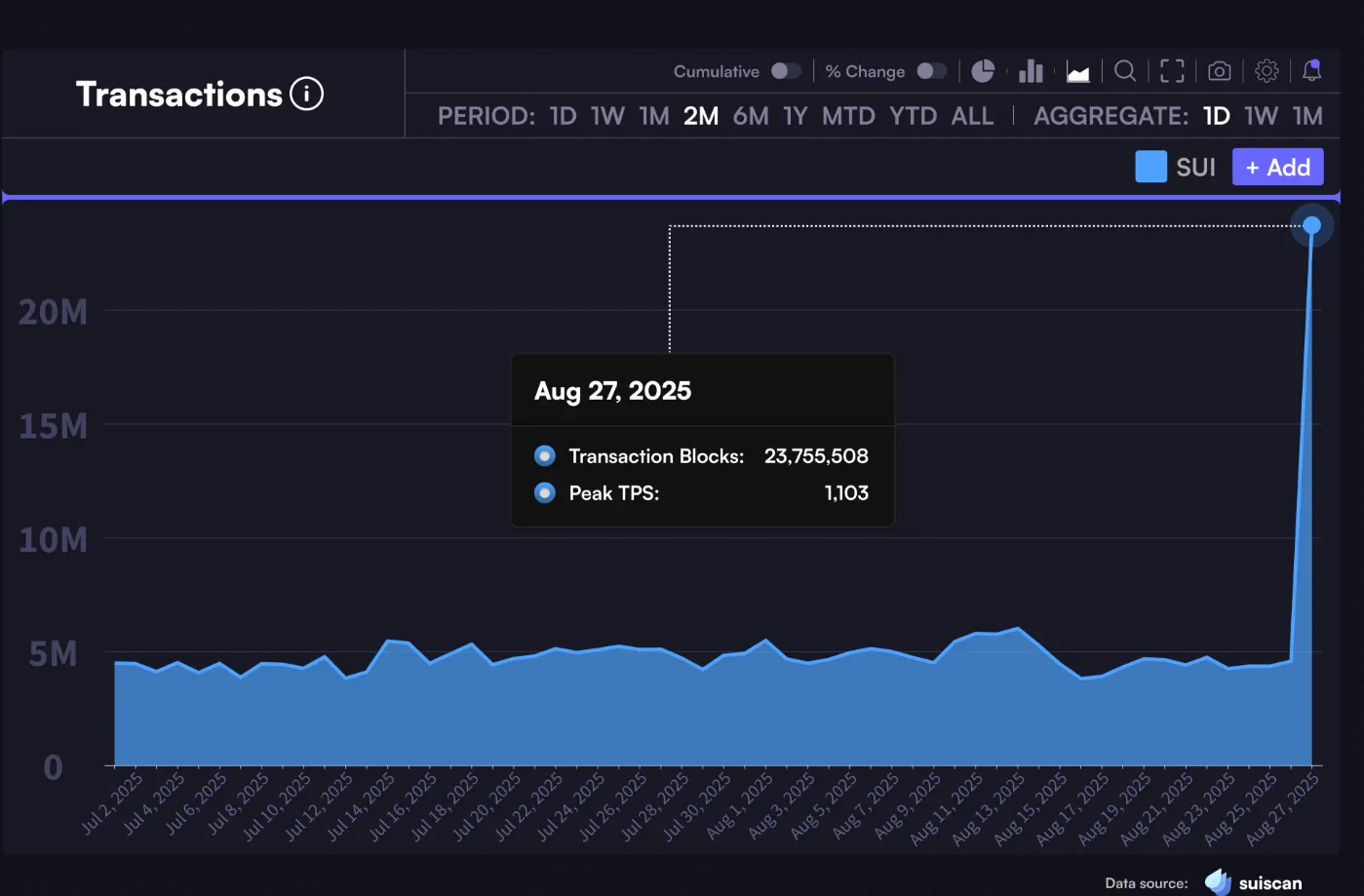

Moreover, Sui registered a new on-chain usage peak on August 27, 2025, with 23,755,508 transaction blocks processed in a single day. The network was able to support large-scale traffic with a peak throughput of 1,103 TPS.

Transactions : Source : X

The main catalyst of this surge was the Dig A Hole community project, which added 19.5 million transactions by itself. The spike did not disrupt the network in any way, which confirms the scalability of the Move-based architecture.

Daily transactions prior to this event ranged between 4–6 million, making the surge a significant deviation and stress test. The incident verified the chain performance under the peak demand, which enhanced its technical reputation.

In the meantime, the crypto's native order book DeepBook recorded highs, with $457.23 million weekly volume and $105.18 million 24-hour trading volume. These numbers are the highest performance of the platform.

https://x.com/DeepBookonSui/status/1960425905538654618

DeepBook volume charts indicate a steep late-August increase in activity in both weekly and daily volumes. This represents an increasing number of traders and underpins the liquidity power of the Sui ecosystem as it expands.

Traditional finance involvement in crypto has been increasing, with Grayscale and VanEck providing exposure to the asset. This move increases institutional credibility and justifies the attractiveness of SUI as a long-term investment.

The Sui network is still growing in adoption, with more than 45 million users holding wallets, with integrations with Phantom, Backpack, and zkLogin. This increase highlights increasing retail and developer participation.

Therefore, the altcoin is structurally bullish, trading within a symmetrical triangle for over a year, which signals re-accumulation. Analysts expect this pattern to resolve higher, driven by rising on-chain usage and market support.

Crypto analyst Alex Clay is much more optimistic, with price targets of $8.07, $9.558, and $12.2875, depending on technical and fundamental strength. Strong TVL, stablecoin inflow, and platform utility support his long-term view.

Source : X

Real-world use cases such as xMoney, Mastercard payments, and GameFi and tokenization applications are also advantageous to the Sui ecosystem. All these developments are strengthening the momentum of the altcoin as it enters the second market cycle.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.