Galaxy Digital, a well-known crypto and digital asset company. It has officially started trading on the Nasdaq Stock Exchange. The shares of this company opened at $23.50 on May 16, this marks a major achievement for the organisation after a lengthy and complicated procedure of getting listed in the US.

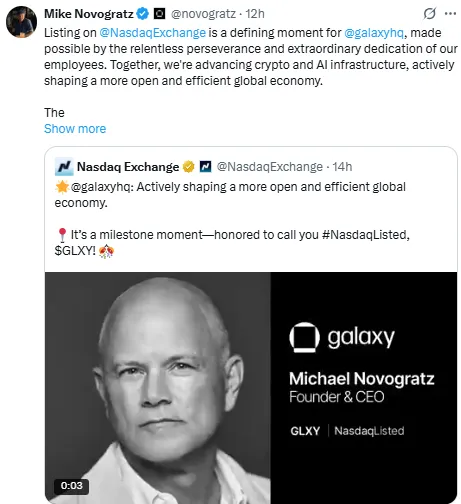

The CEO of Galaxy Digital, Mike Novogratz, called the listing process “unfair and infuriating,” pointing out the strict regulations. It made this difficult for crypto organisations to turn into public companies in the United States. Till now, it is was only listed on a Canadian exchange. Even after the challenges, the company finally secured a U.S. listing successfully. This is a step which is considered a positive signal for the crypto’s future in the country by many industry experts.

On the same day trading began, the Galaxy Digital stock went up by 0.76% in a day. The management also shared that they are working with the U.S. SEC to tokenize the company’s shares. This means they want to convert the stock into blockchain-based tokens. It can be used in decentralized finance (DeFi) applications like lending or borrowing platforms.

This move would allow company's shares to be traded more conveniently and probably reach more investors around the world. Tokenized stocks could also become part of a massive trend where conventional financial products are brought onto the blockchain.

Galaxy Digital is not the only one focusing on the concept of tokenization. The company stated that it wants to tokenize several kinds of assets, including stocks, bonds, and ETFs. This is part of a bigger trend in cryptocurrency named as real-world asset tokenization (RWA).

Although still a small part of the market, tokenized assets are getting popular. Other big corporations like Robinhood, are also diving deep in the idea. Robinhood may develop a blockchain that allows people in Europe to trade tokenized United States stocks.

At a recent SEC roundtable on May 12, chair Paul Atkins compared asset tokenization to the way music transformed from analog to digital. He stated that type of change assisted the economy of the U.S. prosper, and tokenization might do the same.

The Nasdaq debut of the Galaxy Digital comes as more crypto companies are aiming for U.S. public listings. Companies like Gemini, Circle, Kraken, and Metaplanet are all actively working or considering entering the United States market. On May 14, trading platform eToro successfully completed its own U.S. listing.

Financial Snapshot

As per the organisation’s website, it currently has about $7 billion of assets. In the first quarter of 2025, the organisation bore a loss of $295 million.

This new interest wave materializes at a moment when the political climate in the U.S. seems to be heating up towards crypto. President Donald Trump has been cultivating warmer relationships with the industry, urging additional crypto businesses to venture into the U.S.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.