This shining asset just hit a brand-new all-time high, and it's making investors think twice. People are now asking—can $BTC be the next big thing to explode? In this article, we’ll look at how both the assets are moving in the market. You’ll also see if BTC has a real chance of breaking its own record soon.

The golden asset has hit an all-time high according to TradingView chat, crossing $3,329 per ounce. It’s not just a small bump—this is a historic move.

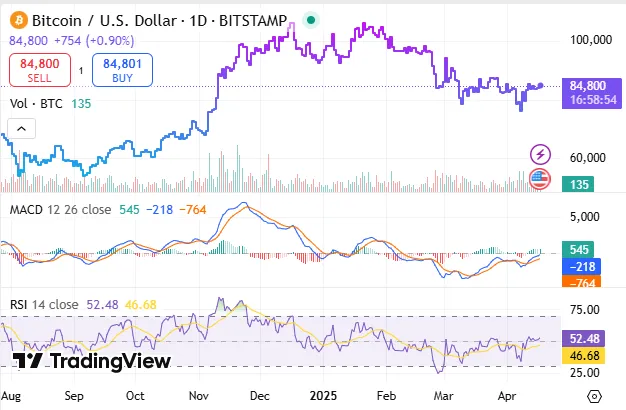

Source: TradingView

It is trading above all major moving averages (20, 50, 100, 200), which means the uptrend is very strong. Every dip so far has been bought up, showing continued interest and strength in this real treasure.

As investors rush toward safe-haven assets, another major digital asset might be getting ready to move.

All signs are now pointing toward BTC as the next in line for a major breakout. Could it really follow the safe heaven's path? Let’s break it down using the latest gold and Bitcoin price analysis.

According to TradingView , $BTC price is currently trading around $84,800, not far below its all-time high of $109,114.88. While it hasn’t exploded yet, this stability is a bullish sign that it is building strength.

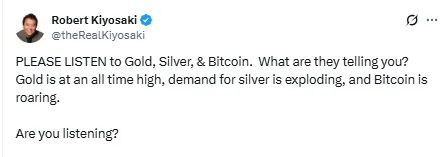

Source: X

$BTC Technical Indicators:

MACD: Bullish crossover – momentum turning positive

RSI: 52 – still has room to rise before becoming overbought

Support Levels: $81,000 and $76,500

Resistance Zones: $88,500, $92,000, then $100,000

This brings back the long-standing debate on both the valuable resources and how they behave during macro uncertainty.

Unlike this shinig metal, $BTC hasn’t made headlines yet—but the setup is quietly forming. ETF inflows are increasing, whales are accumulating, and volume is rising. The question now is, will the cryptocurrnecy go up?

When this timeless asset price rallies this hard, it usually means something bigger is going on.

According to some of the big crypto analysts, a major reason behind it reaching an all-time high can be Trump’s new tariff implementation on various countries, resulting in market instability.

People are losing trust in traditional markets. Inflation, war, and weak currencies are pushing investors into safer assets—and the rea treasure is leading the way. While gold soars, silver demand is exploding, and king of crypto is quietly heating up behind the scenes.

Even financial author Robert Kiyosaki’s Bitcoin gold prediction posted on X:

“Please listen to Gold, Silver & Bitcoin. What are they telling you?

shining asset is at an all-time high, demand for silver is exploding, and $BTC is roaring.”

Source: Robert Kiyosaki X

When someone like Kiyosaki speaks, it’s not just hype—it’s a warning to pay attention.

This ATH rally is more than just a record—it’s a signal. It shows that markets are searching for scarce, independent, value-holding assets. The gold and Bitcoin correlation is becoming clearer—when one rallies, the other tends to follow.

This largest cryptocurrnecy checks every box:

Fixed supply

Rising demand

Institutional adoption

Massive upside potential

If real asset is already flying, then the digital asset might be getting ready to take off.

We could be just days away from seeing BTC break into new territory—and this time, the world is watching.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.