Bitcoin Rally Next? 2020 Pattern Repeats After Gold and Silver Peak

After a long period of sharp increases in price, gold and silver are now finally trending slower. On the other hand, Bitcoin has recently demonstrated renewed strength above $89,000 with the crypto market cap crossing $3 Trillion market cap. This has sparked an important question in the minds of investors: "is Bitcoin Rally Next?"

Source: X (formerly Twitter)

In answering this question, it would be necessary to consider both the charts and the larger market cycle.

Silver’s Explosive Rally

Silver recently touched a historical high of around $83.75 per ounce, thanks to the shortages emerging along with the growing demands in the solar, ev, and AI industries. At silver all time high, the total market value of the metal exceeded $4.8 trillion, exceeding global companies.

But looking at the Tradingiew XAUGSD chart, the cooling trend is more apparent. Prices corrected close to 10% intraday before settling in the $77-$80 range. RSI readings came down from overbought to the mid-40s, indicating that the momentum is slowing down rather than failing.

Source: TradingView

The MACD is flattening, and the volume is normalized. This is indicative of a consolidation of the extreme levels, and it is not crashing.

Another experienced investor, Robert Kiyosaki, has also warned of a FOMO phase of this metal asset, urging investors to wait.

Gold Is Consolidating After Record Levels

Gold shows a similar pattern. After trading near $4,550, gold has moved sideways with mild pullbacks. RSI remains near 50–56, a neutral zone that usually reflects balance between buyers and sellers.

There is no clear breakdown on the gold chart. Instead, price action suggests consolidation after a strong rally. Historically, this behavior often appears near cycle pauses rather than trend reversals.

Bitcoin Chart Signals Fresh Momentum

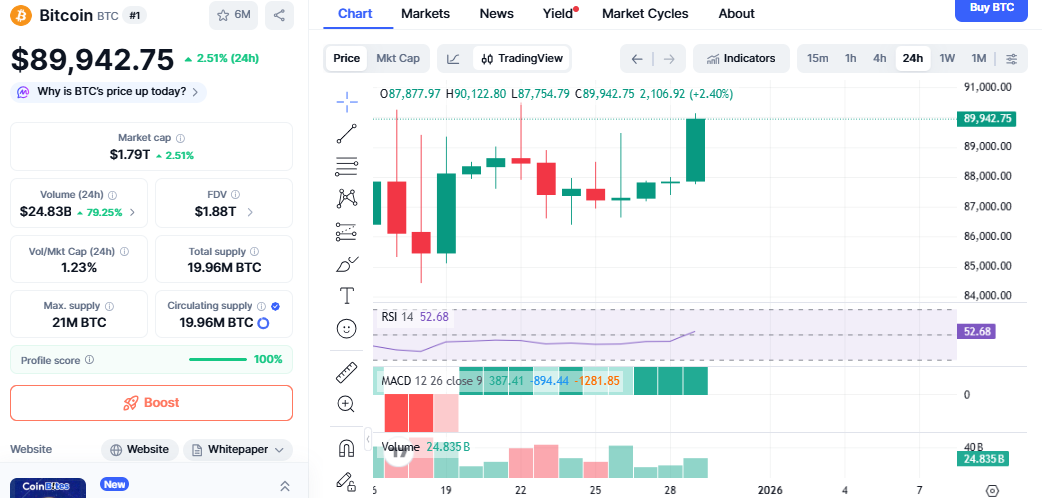

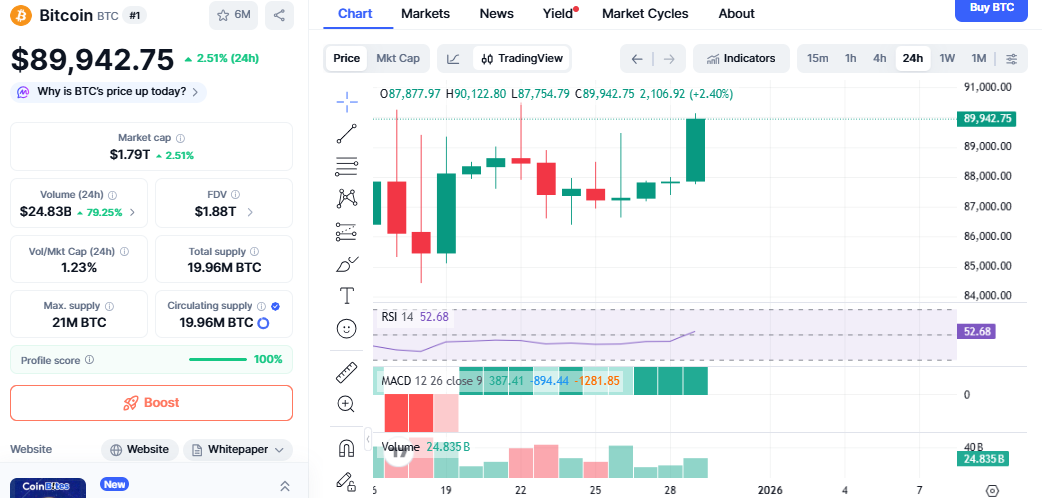

While metals cool, Crypto is heating up. As per the Coinmarketcap, Bitcoin price today is near $89,000–$90,000, up around 2.5% in 24 hours. Market cap stands near $1.79 trillion, with 24-hour volume jumping over 79% to $24.8 billion.

Source: CoinMarketCap

Technical indicators support strength:

RSI near 52–53, showing room for upside

MACD flipped positive for the first time in days

Price cleared key resistance at $88,000

A major driver was a short squeeze. Over $102 million in crypto shorts were liquidated in hours, including $23M+ in BTC shorts, forcing bearish traders to buy back BTC.

This price action strongly supports the Bitcoin Rally Next narrative.

Historical Pattern Points to Rotation, Not Weakness

This setup closely mirrors mid-2020. After the March 2020 crash:

Gold rose from $1,450 to $2,075

Silver jumped from $12 to $29

BTC stayed flat around $9,000–$12,000 for months

Only after gold and silver peaked did BTC explode, rising from $12,000 to $64,800, while total crypto market cap expanded nearly 8x.

Today, a similar structure is forming. Gold and silver moved first. The digital asset lagged. Now metals are pausing, and Bitcoin is breaking out.

Liquidity, Structure, and the Bitcoin Setup

Unlike 2020, The crypto asset now has more catalysts:

Ongoing FED liquidity injections

Expected rate cuts

Improved crypto regulation clarity

Spot ETFs and institutional access

Reduced exchange inflows (down ~54% vs early December)

Whale data shows over 270,000 BTC withdrawn from exchanges in 30 days, tightening supply.

If it holds above $88,000 and closes strong into year-end, BTC Rally Next becomes more than speculation, it becomes a structural trend.

Conclusion

Gold and silver often move before other markets, and this usually signals a shift, not danger. Their recent drop, along with BTC staying strong, suggests money may already be moving into crypto. Even though prices are still volatile, the data shows buying activity is building rather than investors selling off.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing.