Grayscale Research has released its latest quarterly update , offering a sector-wise breakdown of the crypto market as (Q3),2025 begins.

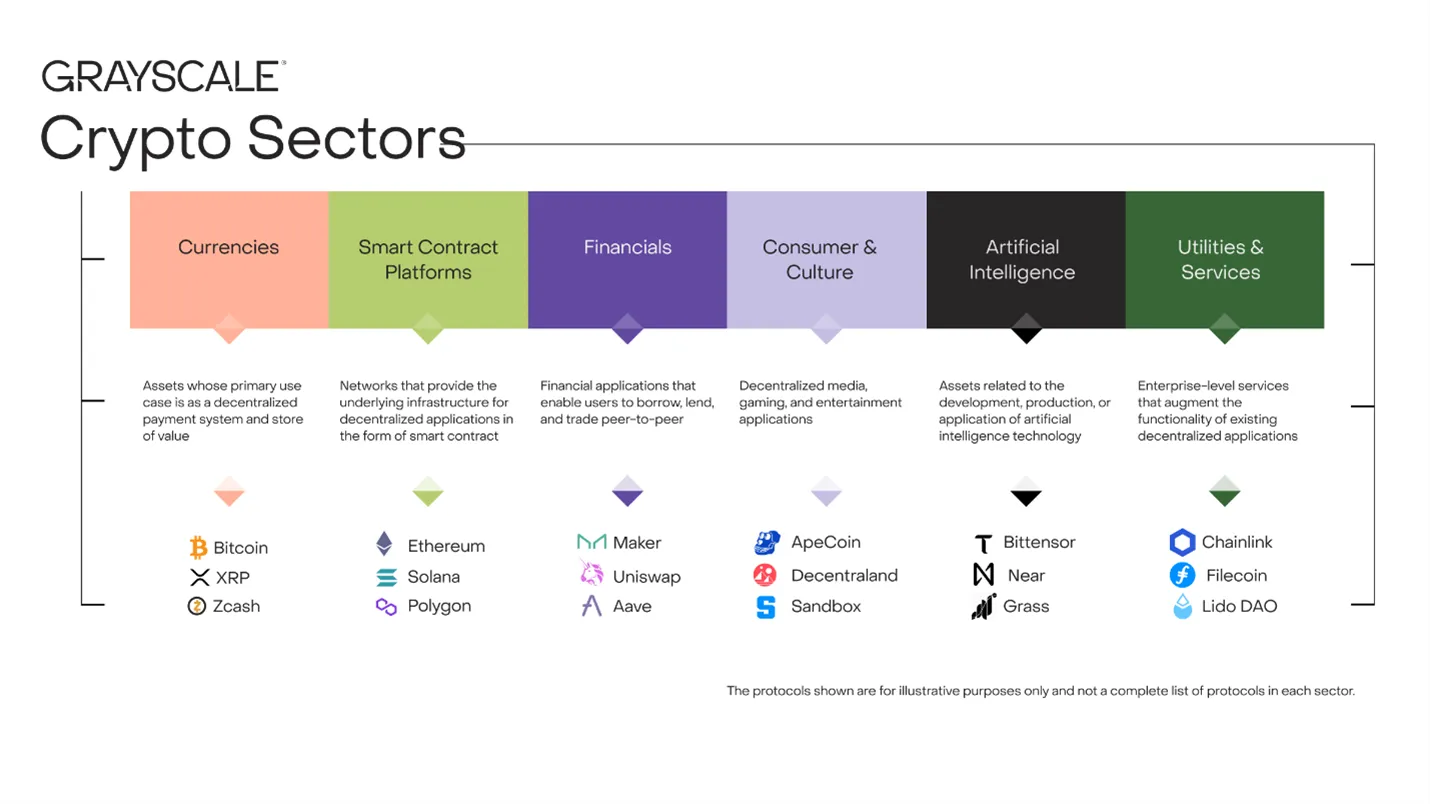

Developed in partnership with FTSE/Russell, Grayscale Crypto Sectors Framework groups over 260 digital assets into six key categories, Adding and making it easier to track market trends, performance, and emerging themes across the $3 trillion crypto market.

Source: Twitter

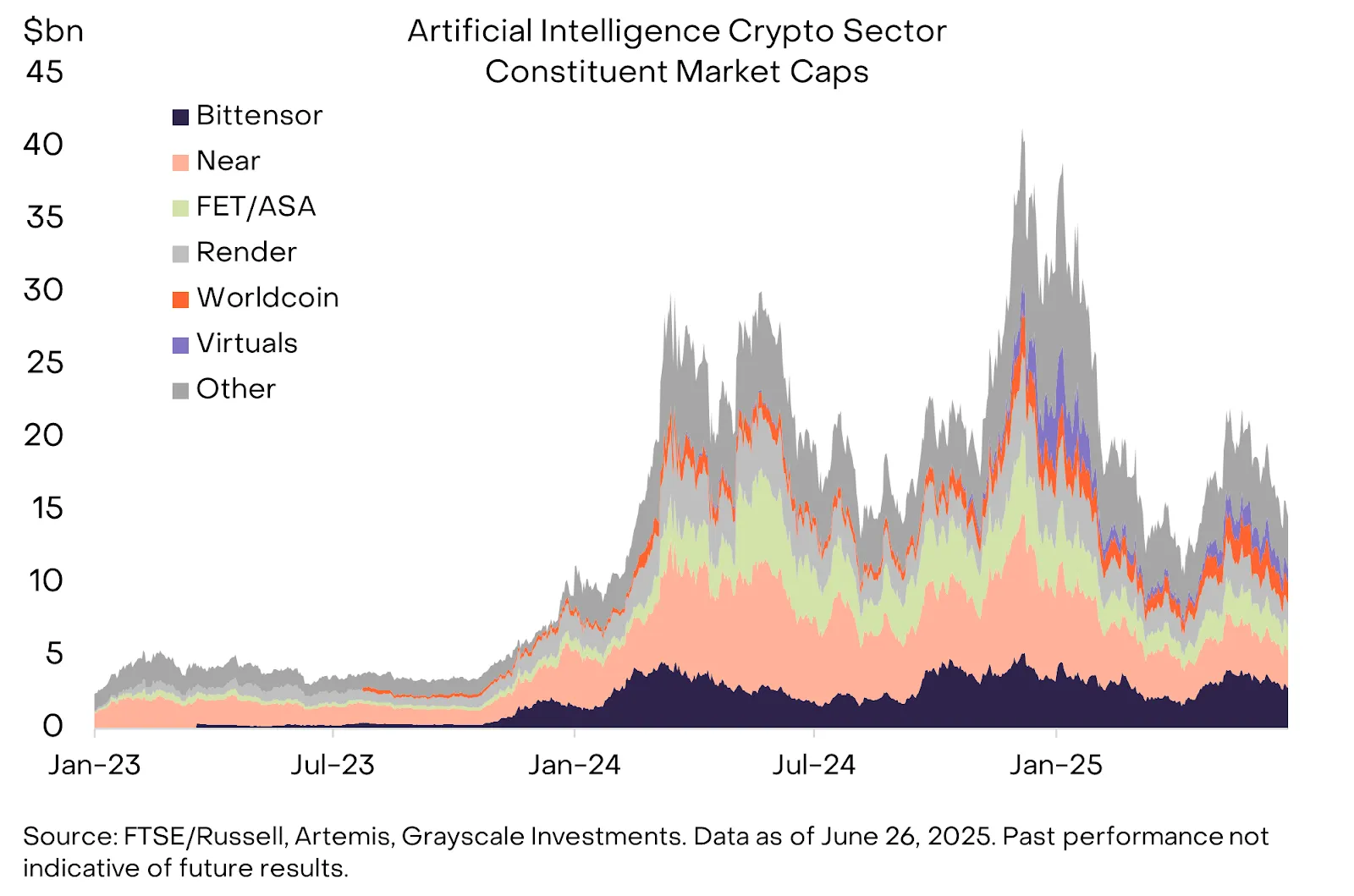

According to the reorts of Grayscale their is a major development this quarter is the official addition of the Artificial Intelligence Crypto Sector, now comprising 24 AI focused tokens, with a combined market cap of $15 billion- a steep jump from $5 billion in 2023.,reports by Grayscale.

The top asset in this category is Bittensor, which enables decentralised development and training of AI models.

The AI sector posted a 10% gain in Q2 signaling growing interest in projects that merge blockchain with artificial intelligence.

Source: Grayscale

According to the Greyscale Second Quarter (Q2) report of 2025, brought both progress and instability. While Bitcoin’s 30% rally lifted the Currencies Crypto Sector, overall crypto market performance remained flat due to global economic and political headwinds- including military conflict in the Middle East and shifting trade policies.

Other sectors, like Financials and AI show moderate gains. In contrast, the Consumer and Culture and Utilities and Services sectors underperformed, largely due to cooling in utility-driven tokens.

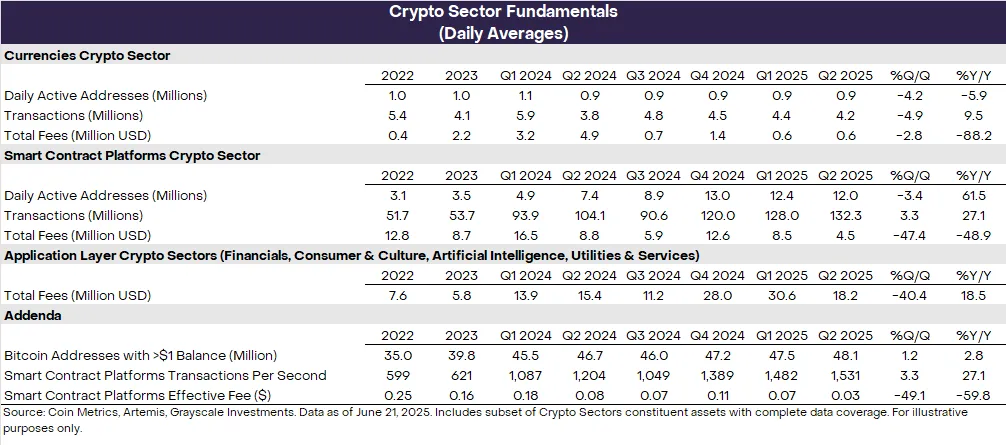

Accordingly by Grayscale, Usage of Blockchain is growing continuously. Smart contract platforms processed over 130 million transactions last quarter– equivalent to 1,500 transactions per second.

By researchers of Grayscale, the average transaction fees dropped to $0.03 reflecting tower trading activity in previously hot segments like Solana-based memecoins.

Source: Grayscale

Despite the drop in fees, application-layer activity still brings in around $5 to $10 billion annually, suggesting healthy long-term engagement.

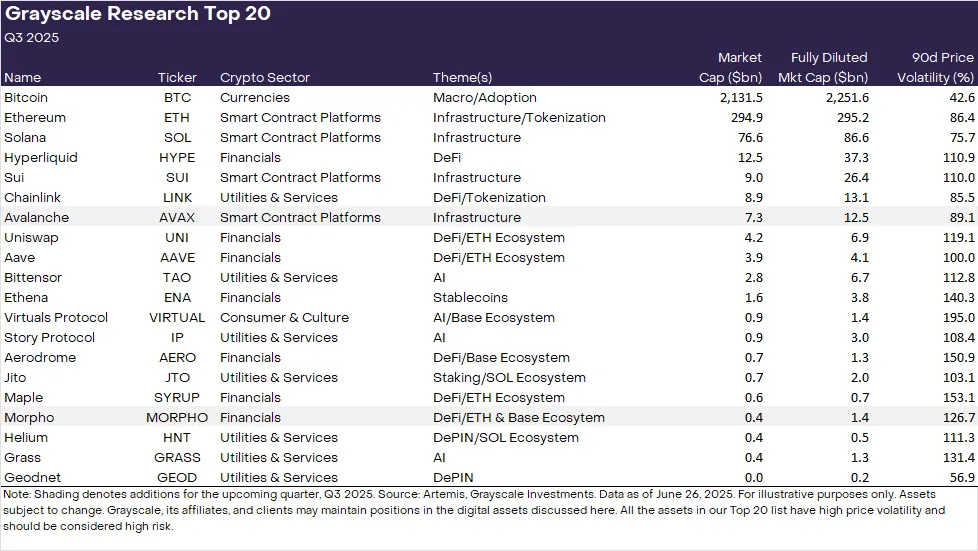

Grayscale updated Top 20 digital assets list aims to highlight the most promising projects each quarter.

Avalanche (AVAX): A smarter contract platform that’s gaining traction. Avalanche has seen a rise in transactions and user engagement, possibly linked to new partnerships in gaming, including the popular MapleSTory ecosystem.

Morpho (MORPHO): A decentralized lending protocol built on Ethereum and Base, Morpho now manages over $4 Billion in Total Value Locked (TVL) and is the second largest lending platform in Decentralized finances.

With the recent launch of Morpho V2, the project is now targeting integration with traditional financial institutions.

The two very well known two projects– Lido Dao (LDO) and Optimism (OP)-- were dropped from the Top 20 this quarter, despite remaining vital parts of the Ethereum ecosystem.

Lido Dao (LDO) could face increased competition if news US regulations favor centralized staking via ETFs or other custodial services.

Optimism (OP) powers major 2 layer networks like Coinbase’s Base and Uniswap’s new chain, but the Op token hasn’t clouded its short-term upside.

Both projects are still seen as strategically important long-term, but Grayscale is opting for stronger near-term, momentum plays.

Greyscale reiterates that all assets in its top 20 list are high-risk, high-volatility investments.

Smart contracts exposure for regulatory developments, and evolving macroeconomics conditions continue to pose challenges for the sector.

Still, innovation is alive and well-particularly in areas like AI, DeFi and smart contract platforms.

For investors with a high risk appetite, keeping up with these sector trends may offer valuable insights for the quarter ahead.

Bitcoin is benefiting from renewed demand as a hedge against bankruptcy and Global uncertainty. With inflation still sticky and the traditional market facing pressure, investors are turning to BTC as a store of value.

The newly formalized Artificial intelligence Crypto Sector is riding both technological buzz and actual adoption. AI -related tokens are gaining legitimacy and market cap- led by projects like Bittensoir which are building decentralized AI infrastructure.

Decentralized Finance is back in focus for the platforms like Morpho, which used to offer efficient vans customizable on-chain lending solutions, are drawing attention for their strong fundamentals.

Smart contracts platforms usage Still Climbing, like Avalanche have seen organic transaction growth- possibly driven by new gaming platforms and stablecoin activity by Greyscale.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.