In a major classification of the Federal Reserve’s stance on digital assets, Fed Chair Powell has stated that US Bank are permitted to engage with digital currency companies- as long as they maintain proper risk management and consumer protection protocols.

Talking before the House Financial Service Committee on June 24 as part of his semiannual monetary policy report, Powelll reiterated that the Fed does not oppose crypto-related activities by bank, provided they follow established guidelines.

Source: X

Digital Currency is not banned

Banks can get involved by their own responsibilities

Regulators should want innovation, but with their guardrails.

The Chair of the Federal Reserve's recent statements feels like it is a very big win for the users. But is it real clarity or just another carefully worded signal?

Yes, the Fed is removing the “reputational risks” and opening the windows for the bank that they work with the firms.

But there is still no definite timeline or the detailed rulebook.

Banks are allowed to engage, but only if they “manage risk” a phrase open to interpretation.

Powell’s updated stance is a wake-up call for traditional banks. With the Fed no longer blocking partnerships, now have the green light to explore services like custody, payments and settlements.

For some of them. It’s a chance to innovate and stay competitive. For others, it’s added pressure that they can no longer ignore the virtual currencies space while fintechs and digital-first firms move ahead.

In easiest terms we can say that Fed has given the permission to the Banks that they are free to play on their own way of managing risks.

The Fed has financially flipped the switch. Powell’s latest statement gave traditional banks the go-ahead to partners with the firms- as long as they follow the Rules.

By accepting the vague “reputational risks” excuse, regulators have cleared the path for legit collaborations. Can now offer services like virtual currency's custody, payments and settlements without fear of unclear pushbacks.

Compliance must be strong with their policies and including existing regulatory standards like Anti-Money Laundering (AML) and know-your-customer (KYC ) and data privacy rules still fully apply.

Every banks need a well defined internal process for approving, monitoring and reporting activities

Just because this is becoming more accepted doesn’t mean the legal; grey areas are gone.

Is this the Firm is licensed or not?

Are the products legally allowed in all jurisdictions served?

Are smart contracts and custody structures legally sound?

Powell noted that Fed staff will be retrained and aligned with other agencies like the FDIC and OCC to ensure a consistent approach. That means banks should be proactive: Stay in touch with regulators, document decisions, and seek clarity where needed.

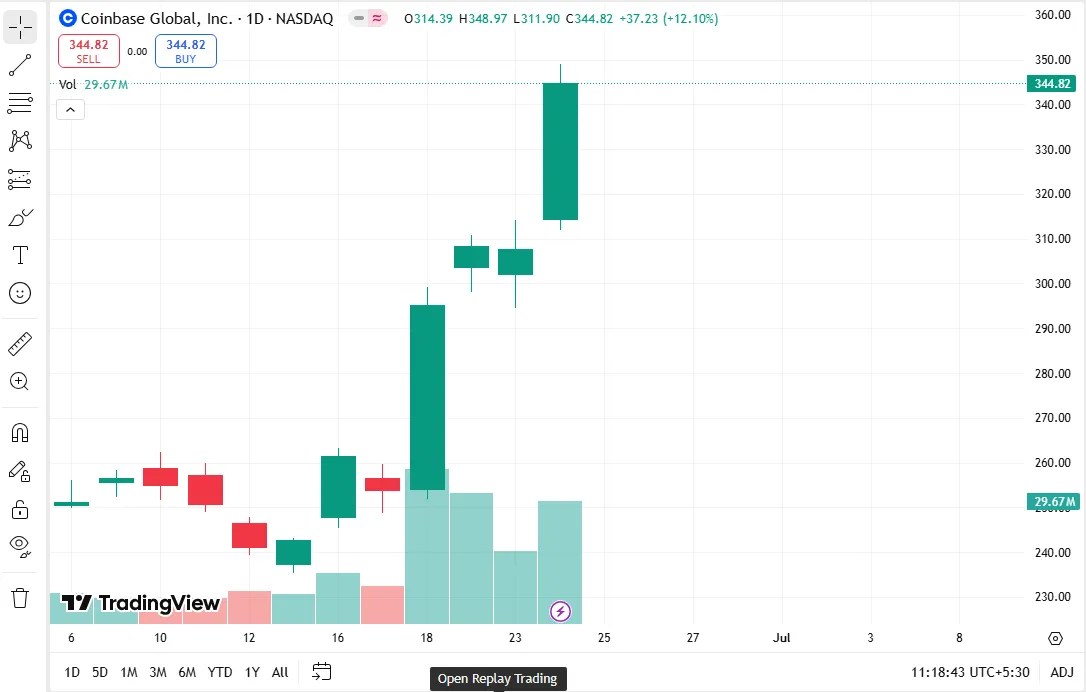

Source: Trading View

Stocks Like Coinbase also jumped, with Wall Street seeing it as a step towards real adoption. Banks and fintechs got a confidence bump.

The Federal Reserve is signalling a more open approach to crypto, encouraging “responsible innovation” and making it easier for the banks to work with digital assets firms.

This means Crypto firms could gain better access to loans, payments and banking support.

Banks can explore crypto services - but must have strong risk controls in place.

Mona Porwal is an experienced crypto writer with two years in blockchain and digital currencies. She simplifies complex topics, making crypto easy for everyone to understand. Whether it’s Bitcoin, altcoins, NFTs, or DeFi, Mona explains the latest trends in a clear and concise way. She stays updated on market news, price movements, and emerging developments to provide valuable insights. Her articles help both beginners and experienced investors navigate the ever-evolving crypto space. Mona strongly believes in blockchain’s future and its impact on global finance.